Record’s assets under management equivalent (AUME) has continued to grow in Q122 with net inflows including the launch of the new Record Emerging Market Sustainable Finance Fund. This is the first of several new product initiatives to be realised and will contribute to diversification of revenues. The group is also continuing to focus on modernisation and succession to support future growth.

Q122 trading update

Share price performance

AUME increases with revenue diversification

At end-June Record's (LON:RECL) AUME stood at $84.5bn, an increase of 5% compared with end-March (in sterling terms to £61.2bn, also an increase of 5%). There was a net inflow of $1.8bn (2%), split evenly between passive hedging and currency for return. The latter included the Record Emerging Market Sustainable Finance Fund, which launched at end-June at a size of approximately $0.75bn. The fund is important as it is a first step in the group’s strategy to create new products in collaboration with clients to grow and diversify revenue. It also provides an entry point to sustainable investment as an area for development and commands a significantly higher fee margin than existing products. Changes in exchange rates and market levels together with scaling of volatility targeting mandates resulted in a positive movement in AUME of $2.6bn (3%). The client count was reduced to 87 from 89 as two legacy funds with negligible AUME were closed in the quarter. Average fee rates were broadly stable and no performance fees were earned in the period.

Further estimate increase

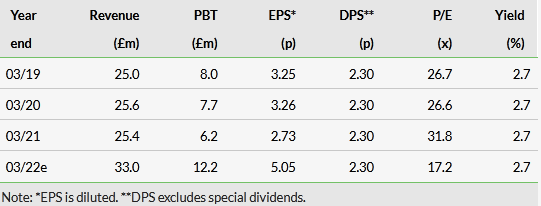

Following the increase in AUME in Q122, we have again raised our estimates for FY22. An increase of 3% in our revenue assumption results in a 6% increase in diluted earnings per share (see Exhibit 3 for further details). As with previous estimates, we do not allow for further unannounced prospective fund flows or potential performance fees.

Valuation

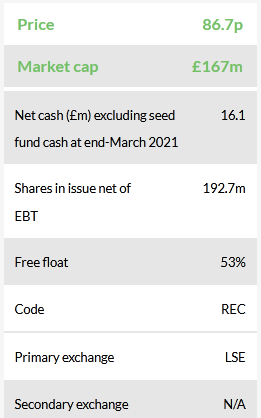

On our revised estimate, the shares trade on a prospective P/E of 17x, a premium to the average for a selection of UK asset managers (Exhibit 2). Supporting this are the recent upward trend in AUME, the potential for further new product development and possible crystallisation of performance fees over time.

Click on the Pdf to read the full report