The Treasury market is nervous about a repeat of the August hawkish Fed pushback.

Market participants await nervously Powell’s speech this evening after the October CPI report sent bond yields lower and riskier asset prices higher. Even if the surprise slowdown in inflation is good news, it is only the first in a long series of conditions the Fed needs to see before it pauses its hiking cycle. Longer-term, the direction of travel is indeed towards lower inflation and an end to this tightening cycle but we expect the Fed to take Fed Funds rates some 100bp higher than currently, just under 5%, before this is the case.

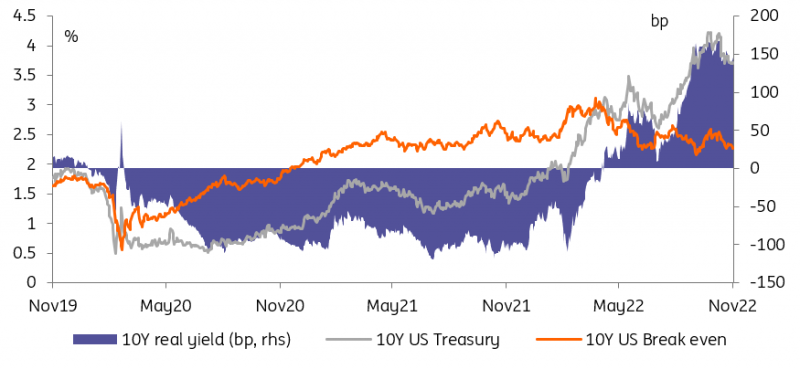

There is just over two months to go before the last hike in this cycle in our view. In the meantime, the Fed will be wary of markets undoing some of the painstakingly-delivered tightening of financial conditions. There is a precedent. In June to August of this year, 10-Y Treasuries rallied 90bp peak to trough, helped by a lower-than-expected inflation report. This prompted a strong pushback from Fed officials in August, culminating in Powell’s Jackson Hole speech. Treasuries went on to sell.

Closer to the end of this cycle, but the 5Y is most at risk of cheapening today.

Where this phase is different is that the Fed is having a harder time delivering its hawkish message as it signaled in no uncertain terms that the pace of hikes will soon reduce from 75bp to 50bp per meeting. There is still one employment and one inflation report before the December 14th meeting, but the burden of the proof is on those calling for another 75bp hike. Still, the 50bp drop in nominal 10Y Treasury yields, and 26bp in real yields, is a headache for the Fed. So is the aggressive flattening of the term structure, meaning that even if markets continue to expect the Fed to deliver hikes, the effect of these hikes do not feed through to longer borrowing costs. With Treasury yields over 100bp below where we expect the Fed funds rate to peak, we think the market is vulnerable to a sell-off around Powell’s speech.

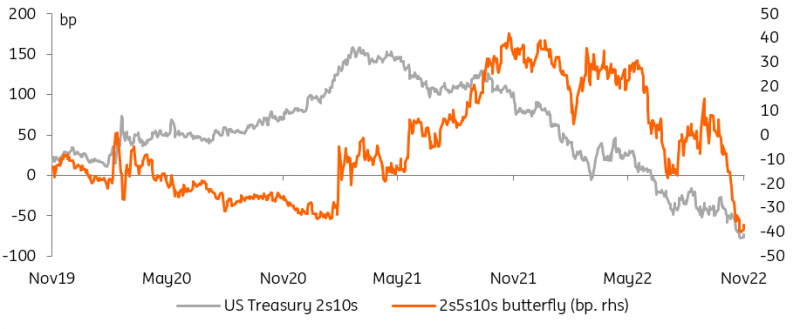

Curve flattening is an inevitable effect of markets seeing the end of the Fed’s cycle, but we think this makes the sectors that rallied the most into today’s speech most at risk of a retracement. Rather counter-intuitively, this should mean a re-steepening of the 2s10s slope on the Treasury curve. If Powell is successful in delivering his hawkish message, the 5Y point on the curve should retrace its recent outperformance, which will be visible in a richening of the 2s5s10s butterfly.