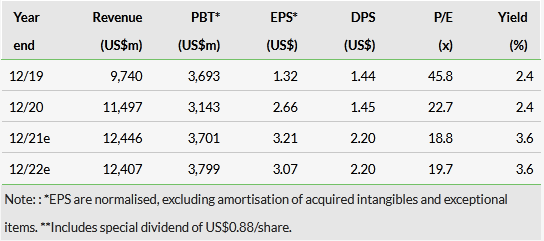

Newmont’s financial results for Q221 materially exceeded our expectations for the third quarter in succession, driven by a 3.8% (or US$111m) positive variance in revenues (of which 2.4% could be attributed to the gold price) and a 2.8% (US$61m) further positive variance in the form of lower costs. Of the 12 mines over which Newmont exerts management control, four outperformed (financially) relative to our prior expectations, two performed in line and six underperformed, although not, on occasion, without commendable management efforts to mitigate negative outcomes in the face of unscheduled challenges (eg the need to put Tanami into care and maintenance for two weeks, at short notice, after a case of COVID-19 was detected there). In the wake of its results, coupled with increases to our estimates for Q3 and Q420, we have upgraded our forecasts for adjusted net EPS for Newmont (NYSE:NEM) for FY21 by 18.4%.

Share Price Performance

Results follow Ahafo North approval

Newmont’s results follow its board’s sanctioning of the development of the Ahafo North project in Ghana earlier in July. The project will add 275–325koz pa to production at an all-in sustaining cost of US$600–700/oz for the first five years of production (CY24–28) at a capital cost of US$750–850m. Construction is scheduled to be completed in H223 and commercial production in early FY24.

Cost pressures

In addition to its financial results, Newmont also reported some signs of modest cost pressure within the industry. While these are expected to have little or no effect on Newmont’s performance for the remainder of FY21, we have now built a 5% increase in (nominal) costs into our financial models for all of its mines from FY22.

Valuation: 19.3% premium to share price

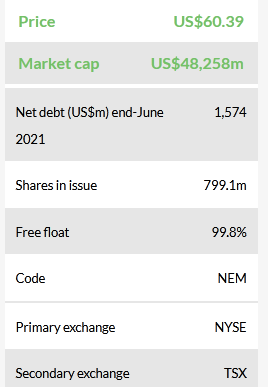

Despite increasing our basic adjusted EPS forecast for FY21 by 18.4%, our FY21 valuation of Newmont remains broadly unchanged at US$72.05/share (vs US$72.92/share previously), as the increase has coincided with a general de-rating of the gold mining sector in FY21, coupled with a decrease in inflation expectations in the wider US economy that has therefore resulted in increased implied (real) hurdle rates (see Exhibits 5 and 7). This valuation puts Newmont on a premium rating relative to its peers, but may be justified by the company’s size, track record and the fact that almost all of its operations are in top-tier jurisdictions. However, it remains cheap relative to historical valuation measures, which continue to imply a share price close to US$100/share.

Click on the PDF below to read the full report: