Natural Gas Futures opened the week with a gap-up, buoyed by expectations of colder weather driving demand. However, despite this promising start, selling pressure has dominated, leaving the market on edge. Traders are grappling with whether potential supply stability and higher January demand for natural gas will be enough to counter persistent bearish momentum.

Colder weather forecasts have sparked concerns about increased storage withdrawals, but uncertainty continues to weigh heavily on the market. This mix of fundamentals and technical indicators sets the stage for volatile price action, keeping traders on high alert for short- and long-term opportunities. Let’s break down the technical picture to better understand what might come next.

Short-Term Technical Insights

On the 4-hour chart, natural gas futures opened with a bullish gap but struggled to sustain upward momentum. Selling pressure has pushed prices lower, even as a bullish crossover—marked by the 9-day moving average (DMA) climbing above the 20- and 50-DMAs—offered a glimmer of hope. Despite this, the 50 DMA at $3.186 has acted as a firm resistance level, preventing a sustained rally.

Should prices break below the 20 DMA at $3.124, the next significant support lies at the 200 DMA. The outcome of this week’s inventory report, scheduled for Thursday, could prove pivotal in determining whether bearish momentum accelerates or a rebound materializes.

Daily Chart Analysis

Zooming out to the daily timeframe, natural gas futures remain under heavy selling pressure. The bullish opening gap quickly gave way to a bearish candlestick pattern, signaling market hesitation.

The downward cross of the 9 DMA below the 20 DMA reinforces the bearish outlook, suggesting continued volatility in the near term. Much will hinge on today’s closing level, as it could set the tone for price action heading into the rest of the week.

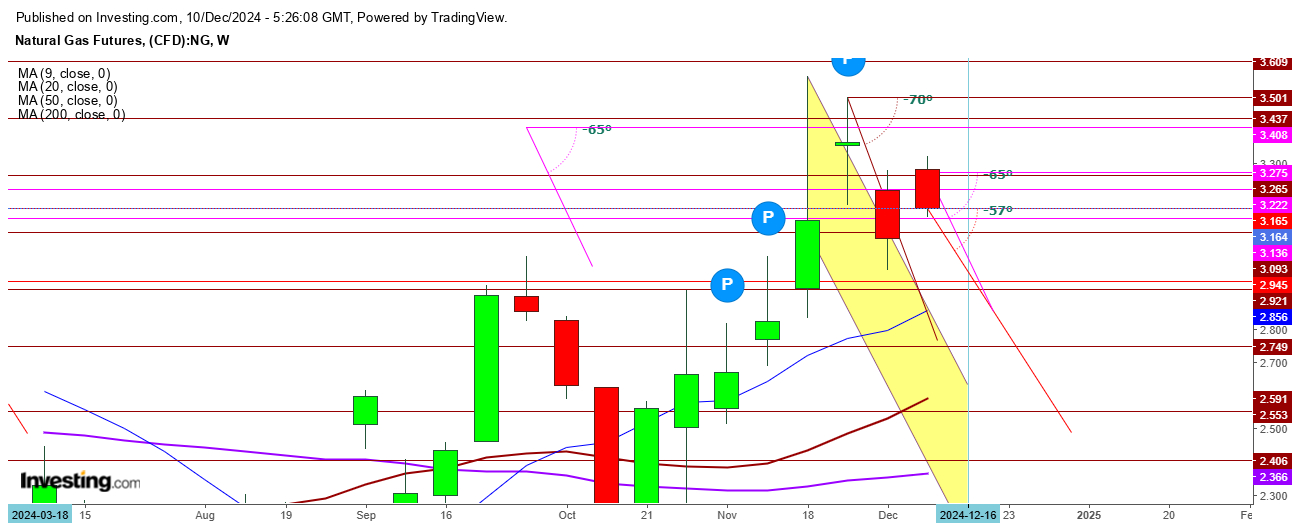

Weekly Outlook

On the weekly chart, natural gas futures face significant resistance at $3.276. If prices fail to hold above the critical support level of $3.093, further downside could be on the horizon.

A breakdown below $2.921 could trigger a gap-down opening next week, amplifying uncertainty and keeping the market on edge.

Final Thoughts

Natural gas futures are poised for a volatile week, with traders balancing the bullish influence of colder weather expectations against bearish technical signals. Thursday’s inventory data and today’s closing price will be key determinants of the next directional move.

Disclaimer: All the readers are requested to take any position in natural gas at their own risk as this analysis is purely based upon the observations. The author of this analysis does not hold any position in natural gas.