Did you hear that rattle? That loud noise was the same one as before – cans being punted down the road. And that screech of squealing tyres was the sound of U-turns being performed by the government.

So the laudable small government, low tax, high growth positive vision offered to us by Truss/Kwarteng as they came into office a month ago has been well and truly smothered at birth and we are back to the bigger government, higher taxes and negative growth agenda wrenched back by the ‘blob’ of the establishment.

And the brutal way in which a positive message from leaders has been crushed tells you all you need to know about the current state of social mood – it is dark and getting darker.

That has now killed any chance that a more ‘conservative’ administration can emerge from the Tories. All political parties are now fully aligned to socialism – and more of it to come. The command and control instinct of politicians nurtured during the Covid lockdowns is alive and well.

With debt levels for consumers and many companies sky-high, there was no other real course to keep the show on the road for a little longer in the face of rapidly escalating interest rates. There is no going back to the low-rates expansion of the recent past. Deflation of credit lies directly ahead – and falling asset prices.

And there is a growing chance we will have a general election soon – with the tax-and-spend Labour party almost certainly producing a landslide victory. All they have to do is not say anything controversial and not mess up. If so, the state will certainly grow larger, taxes will rise. And all of this in the face of a looming depression.

That victory is a pretty safe prediction since parties in power during harder economic times (measured by a falling stock market) always lose power to those offering a more palatable vision. The populace always blame the incumbents for all of their ills often with anger.

So now the nation’s economy and finances are well and truly doomed to sink even deeper into a depression that will manifest next year (if not sooner).

I find it astonishing that the whole uproar has been focussed on just corporation tax. Where did that come from? A normally under the radar tax on companies has suddenly assumed monumental importance even for citizens who are never likely to pay it. And with the increase from a ‘reasonable’ 19% to 25% of profits (an astonishing 32% increase), I am quite sure that will make many companies re-think any expansion plans they may have had.

Higher taxes are always an impediment to growth. In an expansion phase, that is not such a problem but now we are facing a depression and these higher taxes will hasten its arrival.

Corporation tax makes up about 10% of UK revenues and I am quite sure that figure will fall when the higher rate is imposed (at least in nominal terms). A reverse Laffer Curve Effect!

But at least there appears to be some agreement on the necessity of big spending cuts to come – and fast. But good luck with that. I see one of the sectors in the firing line is support reduction for Net Zero. If so, this will bring forward its demise (long predicted here). But with major vested interests in the wind/solar farms industry, any cuts will likely prove to be illusory. More likely will be cuts to support for the low-hanging fruit of hydrogen and other ‘renewables’.

Incidentally, I mentioned last time that we will see more faces super-glued to pavements – and such an event occurred right on cue with Stop Oil protesters chucking tomato soup – and then gluing themselves to the wall – at the famous ‘Sunflowers’ painting hanging in the National Gallery (since cleaned). I am wondering at the symbolism here with crude oil, tomatoes and sunflowers? Hmm.

Mayhem in the markets

And the turmoil in our politics was well matched by that in the markets. Not only here in the UK but matched in US markets. So why should market mayhem be almost universal last week? Did the chaos in the UK influence US markets? That is a very remote possibility. More likely is the idea that the markets, driven as they are by social mood reacted to changes in unison.

Nowhere is this more evident than the strong coupling of all global financial markets – Stocks, Bonds, Precious Metals and Currencies ex-Japan (against the dollar) are moving more or less in synch with high accuracy. When they go up, they go up together (and very vice versa).

In bullish times, that rarely happened. The inverse stocks/bonds relationship generally held. But in a strong bear market such as this, all assets move lockstep together.

Last week saw the most brutal rapid swings in sterling and gilts. Here is the sterling chart

The Black Monday plunge to 1.03 is my wave 3 and wave 4 rallied 13% in only one week, fell back to 1.10, bounced to last week’s 1.14 high and is now heading lower in a wave 3 of 5 down.

Here is the FTSE 100

At the 6800 close it is lying right on my major support zone which it has been testing since April 2021 (it briefly spiked below on Thursday post-US CPI). A strong move below it next week would confirm the wave 3 of 3 thesis.

Stocks entered extreme whipsaw territory last week

I have been tracking the twists and turns in the US markets very well at least since the ATHs a few months ago and last week was no exception. On Thursday morning – hours before the hot CPI data was revealed – I advised members to take some profit on their short index positions just before the Dow initially fell and then roared northwards by 1,000 pips or so in a screaming rally.

Most MSM pundits were at a loss to explain the rally – but not here. I happened to suggest its likelihood hours before the data hit.

This was one of the ‘short sharp counter-trend rallies’ I have been warning to expect in a strong bear market. And that prudent move enabled short positions to be reset at a higher level – with great profits in the bank This is the bear market leader Nasdaq and the chart I issued to members Thursday morning

This was my alternate option based on wave count and strong mom div. Also, I sensed a decent bounce was highly likely since I knew the market was heavily short going into the CPI and any recovery would produce a mother of short squeezes. This is the result

It may not be the biggest mother but it did shake out a lot of weak shorts and produced a three up to the Fib 62% retrace of recent wave 1 (a common rally target). And that was the ideal place to reset shorts.

With that weak hands shakeout, odds are now high next week will see major declines to confirm to my wave 3/3/3 thesis. Let’s see.

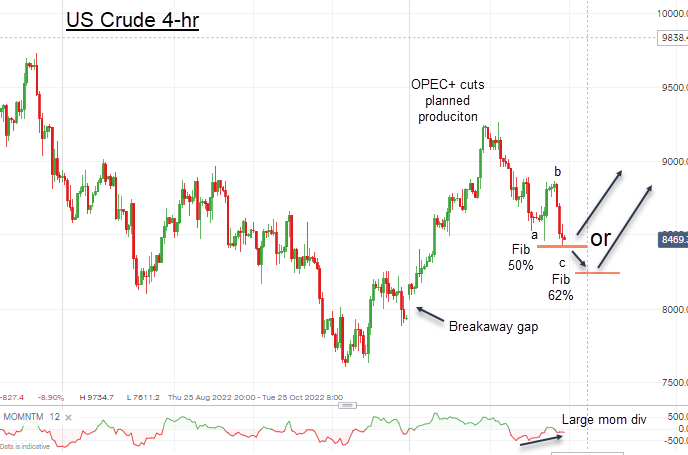

The Oil Wars continue raging fiercely

As stated last week, it’s Biden vs OPEC+ and the score then was Biden 0 – OPEC+ 1. With the OPEC+ move to cut production substantially, prices initially rallied but then ran into a brick wall. It seems oil traders are taking seriously the prospect of a sharply reducing demand as global economies slow – and as the US is releasing massive outflows from its Strategic Reserves by orders from Biden in his life-or-death effort to win the mid-terms next month by keeping gas prices in check.

So now the scare is even at 1 – 1. Shall we go for a shoot-out on penalties?

Not so fast – prices are still above the line-in-the-sand $80 OPEC+ floor and the charts are suggesting a turnaround should be close by.

The market should turn up from around here or after another dip to the $82 region. If the latter, it would accompany a very hard decline in stocks next week (oil would be viewed as an asset!), But if so, I can see huge buying emerge as it would be hitting the OPEC+ floor zone that would be strongly defended by them.

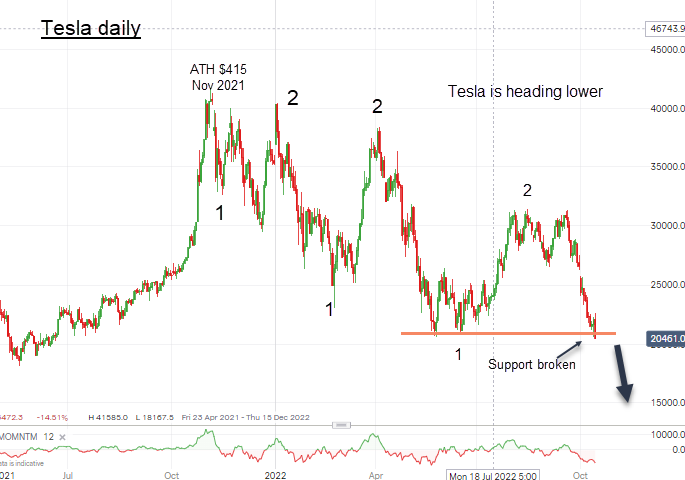

Tesla has just broken major support

I have been using Tesla (and Bitcoin) as my litmus tests of the state of general investor sentiment for the last few years. And Tesla has just made a significant break of major support and is heading lower to levels barely imaginable by EV fans.

Now at around $200, they have more than halved since their ATH was set last November just as the Nasdaq made its ATH – and have last week moved below the pink support area.

One thought – once, charging an EV was a lot cheaper than the fossil fuel equivalent of filling a tank – and a tailwind for purchasing an EV, despite the much higher EV purchase price. But with the massive increase in consumer electricity unit charges around the world, that is no longer the case. In fact, EV ‘fill-ups’ often cost more than fossil – and as gas/petrol prices in the US ease, the difference is stark and is bound to put many potential EV switchers off.

And the high EV purchase prices are only getting higher (batteries costing more from higher cost raw materials) and in the new era of ‘cutting back’ retrenchment, EV sales growth is very likely to fall – perhaps hard. There is growing doubt that some makers could be forced to leave the business.

So will the Tesla become the new ‘DeLorian’ as another example of a ground-breaking car that hit the skids (without the gull wings). Will a rare example, years from now, be featured in a re-make of a Back to the Future movie? And is it really almost 40 years since that was released? I must be getting old!