yesterday, the VIX index was up slightly, and 10-day realized volatility began to rise from its depressed levels, as the S&P 500 moved by 60 basis points instead of its usual 25 bps. With a Jobs report on Friday, a CPI report next week, a FOMC meeting coming up, and a BOJ meeting, volatility will likely continue rising.

The VIX 1-day rose somewhat intraday, though not as much as expected given Powell’s speech. Still, with an important Jobs report on Friday, it’s likely to continue climbing through today. Reaching 20 remains possible, as this has been the level that the VIX 1-day has reached in previous instances.

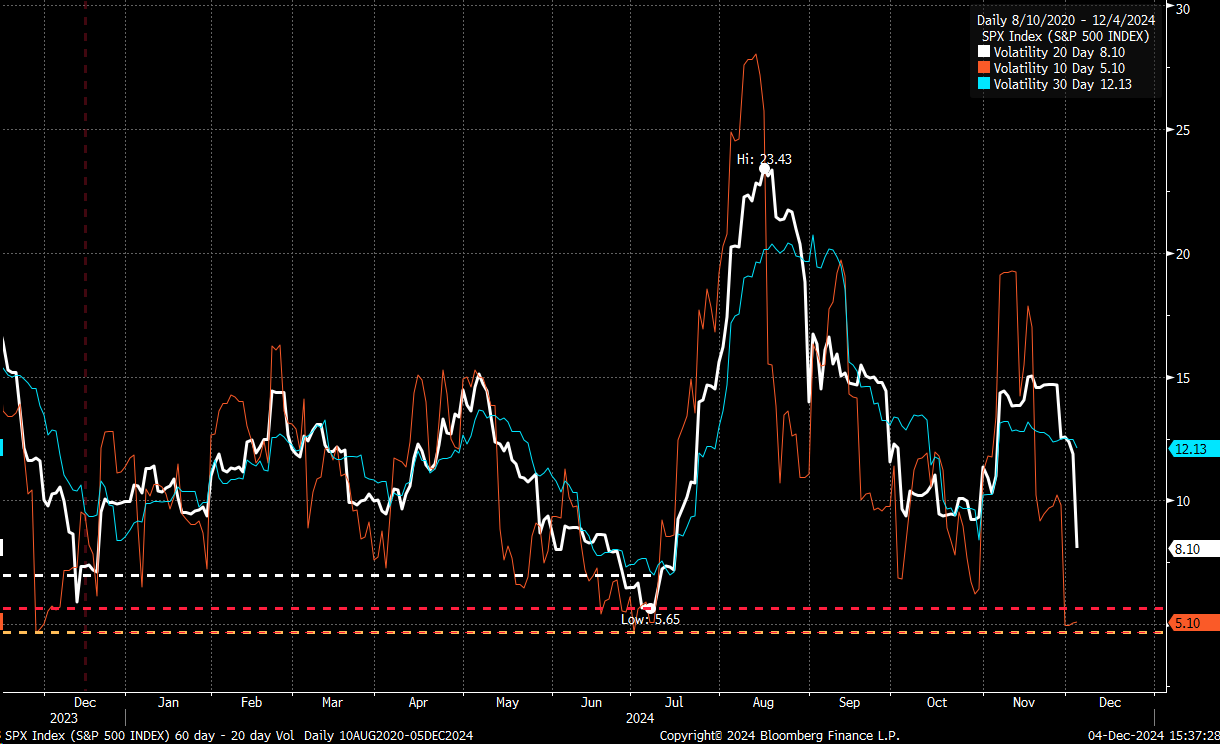

Meanwhile, the 10-day realized volatility increased slightly, while the 20-day realized volatility fell sharply, converging with the 10-day realized volatility level.

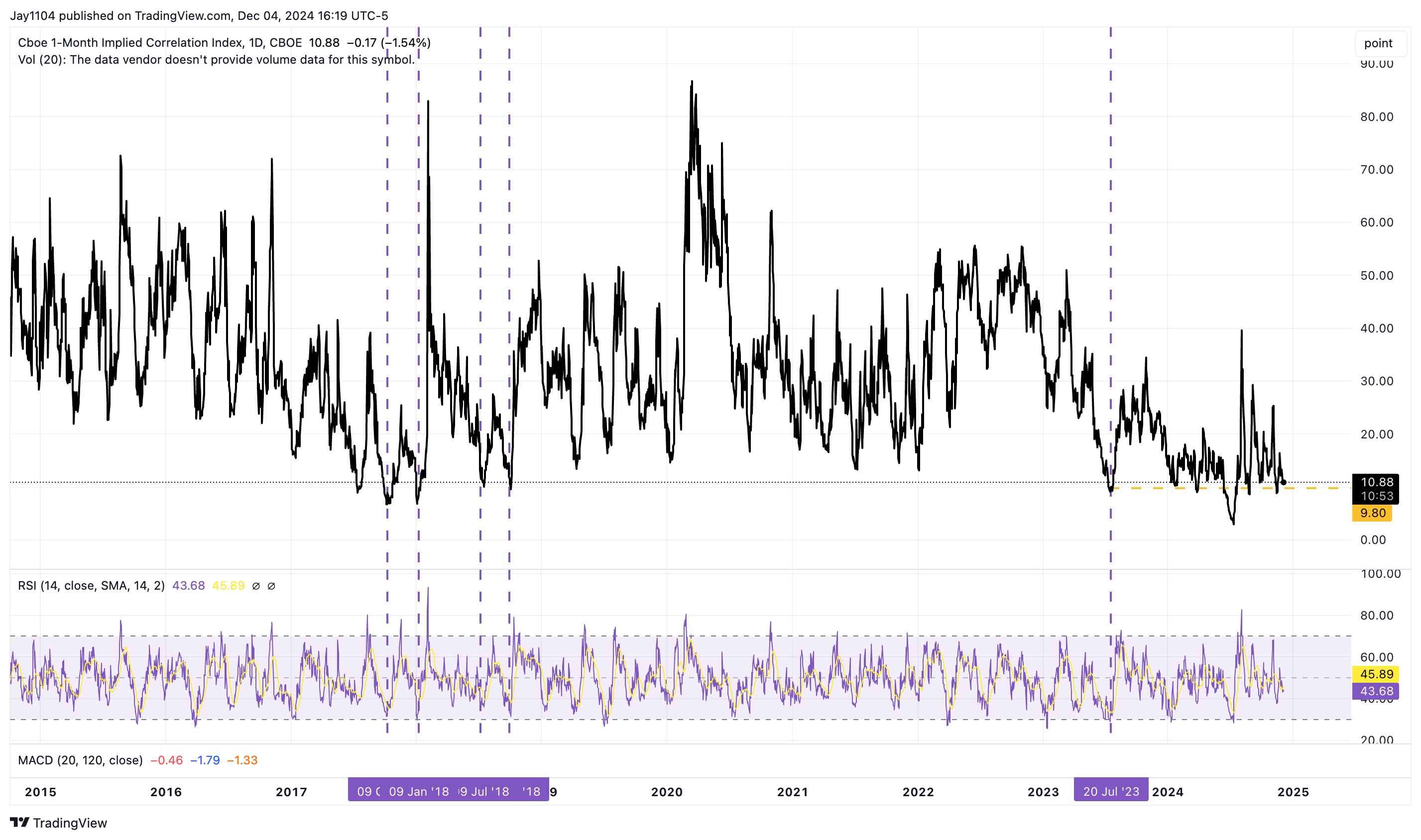

The one-month implied correlation index closed below 11 yesterday, and while it could go lower, historically, this has been very rare.

In the meantime, HY credit spreads continue to contract, with the CDX high yield index falling and being at the very low end of the historical range.

There appears to be a significant strain on liquidity in the overall market structure. The spread between the first-month generic BTIC on Adjusted Interest Rate S&P 500 Total Return Index Futures and the second-month generic contracts has been widening recently. Essentially, this widening spread indicates deteriorating liquidity conditions and increasing costs for maintaining near-term futures positions compared to longer-dated contracts.

You are seeing these strains everywhere, as noted by the USD Swap spread for 10-year SOFR, which has fallen to some historically low levels.

It is the same issue in Europe, based on the Euro 10-year swap spread.

Something isn’t right in this market at the moment. While the exact cause isn’t clear, rising funding costs and unusual spread movements suggest a potential squeeze causing market distortions. This could be related to year-end positioning or contracting balance sheets at the Fed and ECB, with liquidity not being as plentiful as commonly believed.

Markets can undoubtedly continue to squeeze, and this dynamic may be partially responsible for rising stock prices and declining implied volatility. However, the duration of these conditions remains uncertain.

Adding to these concerns is the Yen carry trade situation, particularly if the BOJ decides to adjust rates in December, which could cause conditions to deteriorate further. It seems prudent to watch how these market conditions evolve.

In fact, we have recently seen the 5-year USD/JPY currency swap spreads rising, as the market may be beginning to prepare for the BOJ potentially raising rates in the future and lower rates in the U.S. This dynamic could make the yen carry trade less favorable.