After outperforming the broad equity market for the better part of the last decade, Information Technology (IT) investments have been among the worst-performing equities in 2022. This has left many investors wondering if they should adjust their portfolio strategy. Most people appreciate how technology is rapidly changing our world, but it can be difficult to understand how to invest in the sector. In this article, Fisher Investments UK will look at the basics of the IT sector and help you understand different investment options within this category.

Information Technology Sector Basics

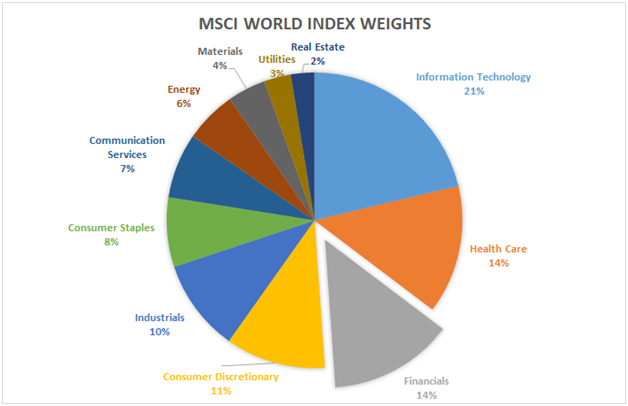

As technology has become increasingly important to society, it comes as no surprise to Fisher Investments UK that its importance in the investing world has also increased. As Figure 1 shows, the IT sector today is the largest part of the MSCI World Index – a widely used representation of the global equity market – by a healthy margin. It’s also worth noting the IT sector was even larger before the Global Industry Classification Standard (GICS) re-categorised some companies from a number of sectors, including IT, into the Communications sector in 2018, but more on that another day.

Figure 1: Equity Sector Weights

Source: Factset. MSCI World Index Sector Weights. As of 25/10/2022

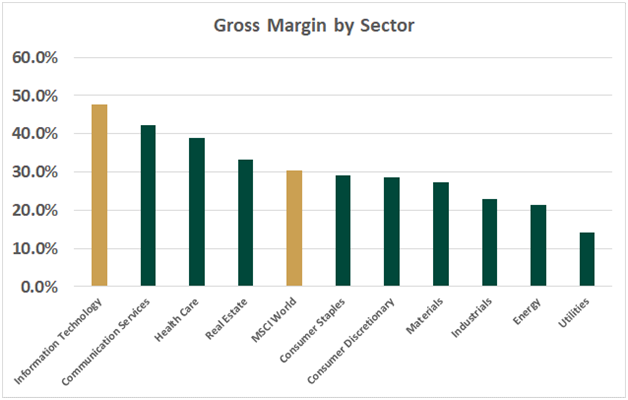

Companies in the IT sector tend to have wide profit margins on average, but can vary dramatically depending on the business model. For example, early stage tech companies can grow rapidly but usually at the expense of profits. As IT companies mature, their growth can decelerate whilst profitability improves. Because IT companies tend to invest heavily in future growth, which has a negative impact on net profits, investors tend to look at gross profit margins – revenue less the cost of goods – as a better indicator of the health of the current business. As Figure 2 shows, the IT sector has higher gross margins than any other sector.

Figure 2: MSCI World Sector Gross Margins

Source: Factset. MSCI World Index. Sector Gross Margin ex-Financials. As of 30/9/2022

Companies in the IT space also tend to have more flexibility with their balance sheets relative to other sectors. Because technology is a rapidly evolving and fast-growing space, it often attracts early-stage investors like venture capital funds and angel investors. As such, IT companies often raise capital by issuing equity instead of borrowing money from banks. This dynamic means IT companies don’t usually deal with some of the debt-related issues other industries can face.

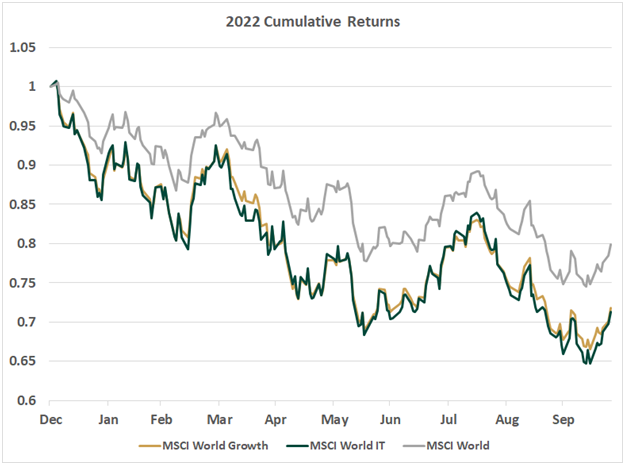

Fisher Investments UK understands that having fast growth rates, high margins, lower debt burdens and the ability to reinvest profits for the future are qualities that classify much of the IT sector as “growth” companies. On the other hand, “value” companies usually have slower growth rates, return more profits to shareholders and rely more heavily on debt financing. Value-oriented IT companies certainly exist, but its more common for IT companies to represent the growth category of the market. As Figure 3 shows, the MSCI World Growth Index and IT have tracked each other very closely this year.

Figure 3: IT and Growth Track Each Other

Source: Factset. MSCI World, MSCI World Growth and MSCI Information Technology Index Total Return. 31/12/2021-25/10/2022. As of 26/10/2022

The Rise of Software

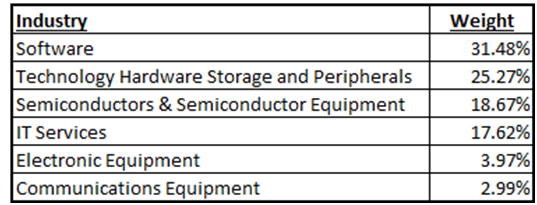

The meaning of the word “technology” in the context of investing has evolved over time. For example, some of the first “technology” investments in modern stock market history were telegraphs and wired telephones – a far cry from what many consider cutting edge technology today, such as subatomic manufacturing or artificial intelligence. But one of the largest transitions over recent decades has been the shift from technology hardware (computers, mobile phones, etc.) to software applications. In the 1980s, there were virtually no meaningful software companies represented in broad equity benchmarks – such as the MSCI World. However, Figure 4 shows that software companies represent the biggest portion of IT equity space today.

Figure 4: MSCI World Information Technology Industries

Source: Factset. MSCI World Information Technology Industry Weights. As of 25/10/2022

One reason software is such a significant portion of the equity market is because of the types of business models in the industry. Each is different, but software companies boast some of the highest profit margins in the global equity market. At the end of the third quarter, the MSCI World Software Index had ~56% gross margins[i] – materially higher than the MSCI World and even the MSCI World IT indices.

Fisher Investments UK knows that many companies in the software space have shifted from providing perpetual licences for their products to establishing recurring revenue streams. Said differently, many companies now require an ongoing paid subscription to use their products and services. Investors have rewarded companies that have successfully made this transition because it provides enhanced visibility into future revenues and profits. Software providers can rely on a more predictable income stream, but it also benefits software customers, who get access to the latest updates and features without having to buy a new licence.

Hardware Still an Important Piece

Whilst software and services industries have steadily expanded, hardware continues to make up about half of the IT sector. The level of technology ranges in this space. Some companies make basic components that are the building blocks of technology we use every day. Others make some of the most advanced technological components in the world. It’s important to understand what each company does, who their customers are and how changes in the economy can influence their business. For example, a recession may cause consumers to pull back spending on high-end smartphones, but it may not necessarily deter a wireless provider from continuing to build out critical communications infrastructure.

The hardware landscape has evolved dramatically over time. It’s easy to forget that the computing power of the devices in our pockets is many times greater than the room-sized computers of just a few decades ago. It’s an area that requires constant innovation. Consider semiconductors—a critical component to many of the technologies Fisher Investments UK sees today. There are only a handful of companies in the world capable of making the most advanced chips that power everything from personal computers (PC’s) and mobile phones to supercomputers and self-driving cars. These companies constantly aim to make their chips smaller, more powerful and more energy efficient. Innovation is expensive, but rewards companies who stay on the forefront. Conversely, there are countless examples of companies that have failed because they didn’t adapt to new technologies.

How has the IT sector performed?

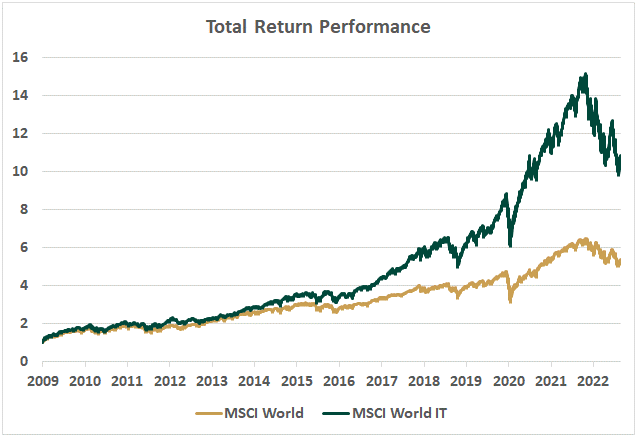

As with any performance-related question, the appropriate answer should be “over what timeframe?” IT investments have been among the best-performing assets since markets bottomed in the aftermath of the Great Financial Crisis in 2009, as Figure 5 shows.

Figure 5: IT Performance Since 2009

Source: Factset. MSCI World and MSCI World Information Technology Index Total Return. 9/3/2009-25/10/2022. As of 26/10/2022

However, the story has been much different in 2022, as IT is one of the worst performing sectors this year[i]. Why have IT equities been hit so hard? There are many theories, but the financial media regularly attribute this year’s underperformance to a combination of IT’s previously high valuations – the price you pay for an equity – and alleged sensitivity to rising interest rates.

However, Fisher Investment’s UK research has found no long-term evidence to suggest such connections exist, even if these relationships happen to coincide over shorter periods like this year. IT equities have performed well in periods of rising interest rates in the past and in periods where investors suggested valuations were “too high.” It’s possible IT equities have been hit hard simply because they had performed so well leading into the recent market peak. Regardless of the reason, IT equities have been disproportionately impacted this year.

Should Investors Adjust Their IT Exposure?

Fisher Investments UK thinks investors should always maintain a well-diversified portfolio aligned with their long-term individual goals and financial circumstances. Changes to portfolios should be made based on forward-looking views rather than on recent performance. If you are thinking of adjusting your exposure to IT, we think you should consider the following questions first:

- What is your outlook for equities? Recall, IT is a significant portion of the broader market.

- Do you think growth equities will perform better than value equities?

- Do you think the US market, which hosts most of the biggest IT equities, will perform well?

- Do you prefer high-margin companies in today’s environment?

- Which parts of IT do you think will do better? Hardware or Software?

By answering these questions, you can improve the chances you are making an informed decision in your portfolio positioning.

Disclaimer:

This document constitutes the general views of Fisher Investments UK and should not be regarded as personalised investment or tax advice or a reflection of client performance. No assurances are made that Fisher Investments UK will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Nothing herein is intended to be a recommendation or forecast of market conditions. Rather, it is intended to illustrate a point. Current and future markets may differ significantly from those illustrated here. In addition, no assurances are made regarding the accuracy of any assumptions made in any illustrations herein. Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square (NYSE:SQ), Canary Wharf, London, E14 5AX, United Kingdom. Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

[i] Source: FactSet. MSCI World Information Technology / Software Index. Gross Margins. As of 30/9/2022.