Mixed results for Wall Street yesterday

On Thursday, at the end of the market session, we had the following results:

S&P 500 closed slightly negative -0.09%, as well as Dow Jones, which has lost -0.56% but the technological Nasdaq, closed in green with a gain of +0.13%.

Yesterday, Wall Street saw a decline after the previous stock rally driven by the speech of Jerome Powell, the Federal Reserve Chairman, who said that there will be a slow in the pace of the interest rate hikes in December.

Investors are focused on today’s Bureau of Labor Statistics data release, which will include the average hourly earnings, non-farm employment change, and unemployment rate.

The data will be released today at 13:30 GMT and markets will react accordingly.

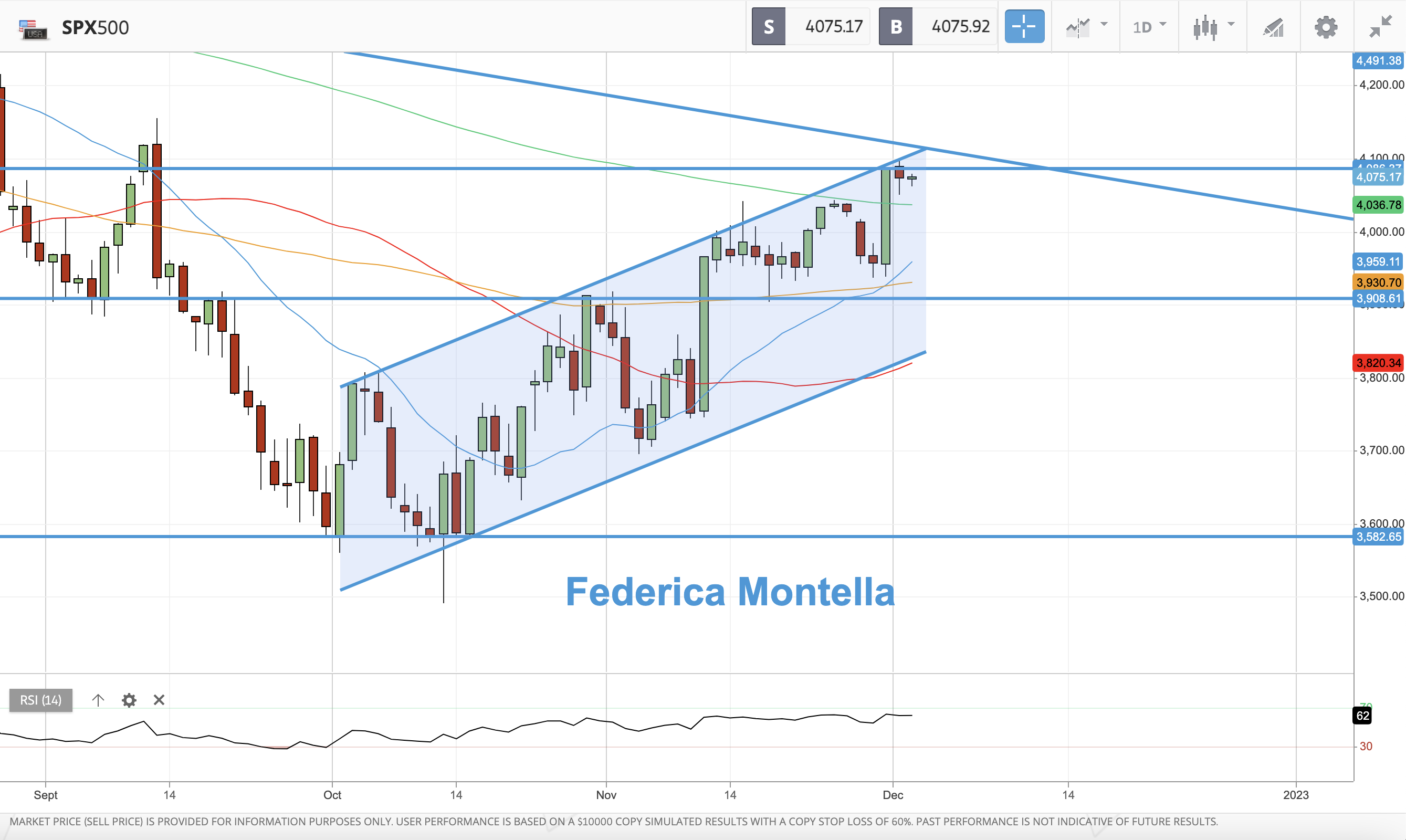

S&P 500 Technical Analysis - Daily Chart

The S&P 500 price has broken the 200-day MA (green moving average) on Wednesday, following the Federal reserve's chairman's speech about a soft landing.

This breakout is a very bullish signal.

Yesterday we saw an apparent retest of the 200-day moving average as support, which should confirm that a new bullish trend is started.

If the index price can remain above this key level for some time, we should see higher prices in the upcoming days.

However, for that to happen, the S&P price has to break also above 2 major resistance levels: the horizontal line and the trendline at around 4100.

If the price gets rejected at resistance, the potential support levels are the 200-day MA, then the 21-day MA (blue moving average) and then the horizontal support line at around 3900.

The RSI moved higher to 62, indicating a Bullish trend.

Is there going to be enough buying power to push stocks higher and break out above resistance levels, leading to a longer rally?

Or is the index price going to be rejected and generate another drop in price as it happened a few months ago from August to October?

We will find out in the upcoming days.

Fear & Greed Index

The market sentiment is at 65 in the "Greed" mode following the level of 69 registered yesterday.

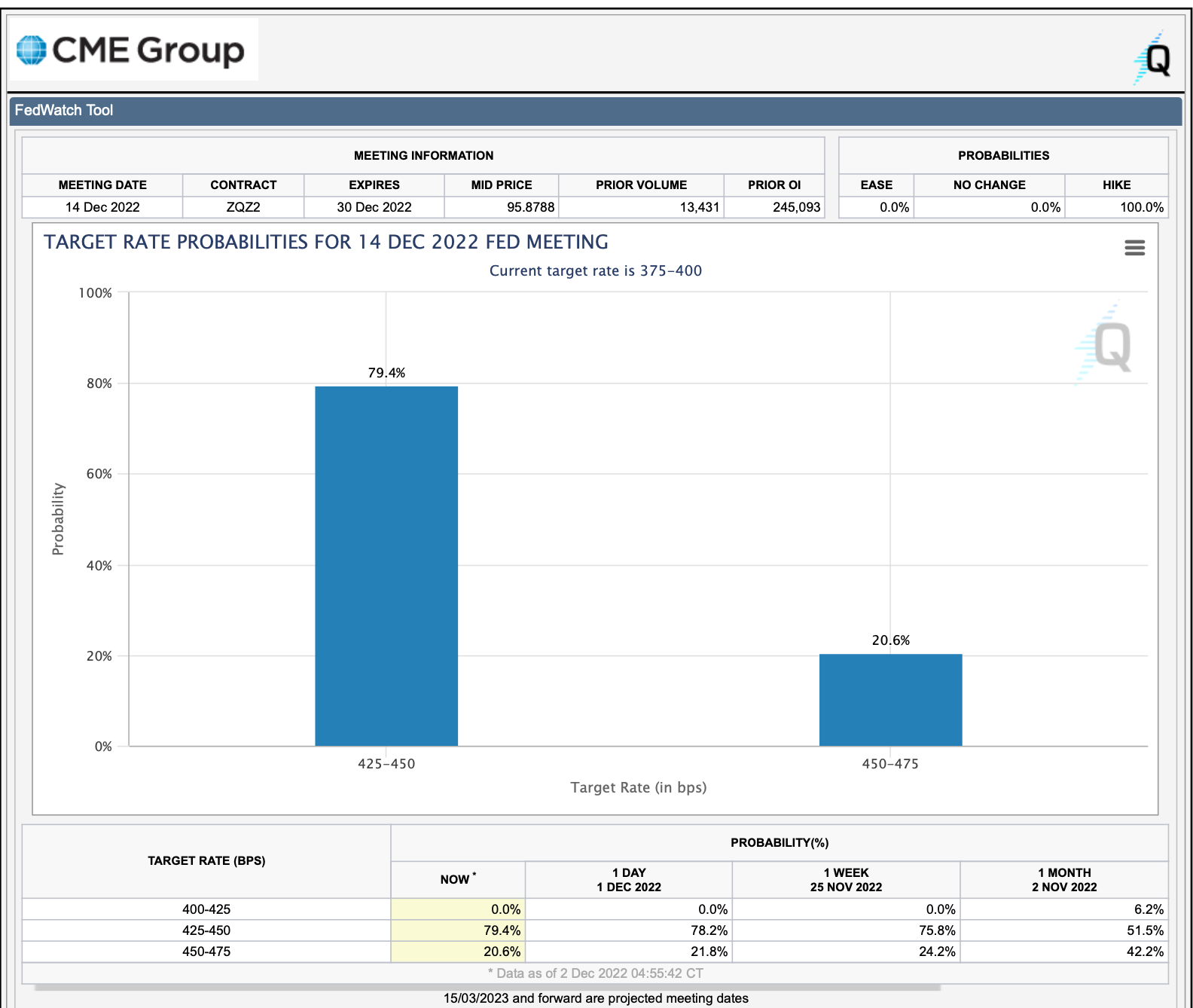

FedWatch Tool - FED rates probabilities

79.4% of investors are expecting the FED to increase the interest rates by 0.50% in the next meeting.

The remaining 20.6% are expecting a 0.75% rate increase.

The data show us that the number of investors expecting an increase of 0.50% is getting higher.

No other options are considered at this stage.

The next FED meeting is on 14 December 2022.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is the bull market back? Technical levels to watch

Published 02/12/2022, 11:54

Updated 28/07/2023, 11:55

Is the bull market back? Technical levels to watch

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.