The social media phenomenon was a child of the Great Bull Market and appears to be in terminal decline as the Great Bear Market gathers pace. The problems being faced by Facebook (NASDAQ:META), Snap and many others are now coming to light with Musk’s buy-out of Twitter as he cuts a savage 50% of the workforce overnight.

Like the others, company revenues are collapsing as advertisers abandon the site. It is losing $4 million a day. And morale in the workforce has plunged.

So did Musk buy at the top? Indeed yes, unless he can perform another turn-around miracle (a la Tesla). Unfortunately for him, there are no massive government subsidies available to cushion the blow as there were with his EV venture.

For me, the point is this: Musk has exhibited the classic mistake of a man who risked all and won big with his Tesla venture. Naturally, he was lauded and must have felt on top of the financial world. Then, basic human hubristic psychology kicked in and he felt he could do no wrong in his next venture totally unrelated to the EV business.

But can lightning strike twice? Very rare.

Of course, being ‘the richest person in the world’ (at least on paper) allows him to treat Twitter somewhat as a plaything but even he must be concerned at losing $4 million a day. He has his fellow investors to think about and any friction between them could turn nasty – and he could fall off his perch at the top of the world pretty quickly.

With the social media leader Meta/Facebook shares crashing a whopping 78% off its September 2021 ATH (making a new $90 low last week), his Twitter buy was certainly highly contrarian!

I consider the Twitter buy-out as the last hurrah for the social media trend as it leads the bear market lower. In fact, the tech sector has been leading the charge lower since the decades-long bull market terminated last year. It has much farther to fall.

Will the Fed pivot?

That was the burning desire of the bulls on Wednesday as the Fed reported on its deliberations. The implication is that if the Fed is seen as easing up on its hawkish tone, buyers would rush back into shares as many are seen as ‘cheap’.

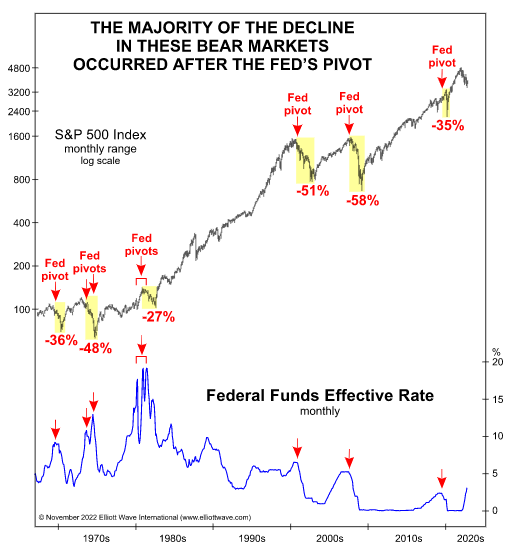

But what does history tell us about the stock market reaction to previous Fed pivots? It seems obvious that stocks should rally every time the Fed pivots (lowers policy rates), right? Then take a look at this chart

Yes, after each pivot, stocks fell hard.

Does that surprise you? If you are a rare individual like me believe that the market makes the news, it shouldn’t. So my message to the bulls: Be careful what you wish for. I would definitely consider the next Fed pivot as a good reason to sell.

Last week we were treated to the Fed following the market 75bps higher and Friday’s Non Farms jobs data that surprised few with high job creation (flagged by an earlier jobs report). But the Dow, as the most nervous and jumpy of the US indexes, jerked around mightily. But odds still favour a downside resolution as it starts wave 3/3.

But if there is more life in the rally near term above the Fib 76% retrace then it could approach the wave 2 high at 32,600 (latest 32,350) and possibly exceed it. I offer this as a realistic option because late last week, the commodities surged lead by the energies (that rocketed the FTSE 100) and the PMs.

On the negative side is the Nasdaq performance which remains exceptionally weak (see above). As I have long maintained, this index is leading the charge lower and it is my preferred market to trade from the short side.

But when we see sharp declines we will confirm the wave 3/3 is under way.

Will oil reach $200 or even $300?

Last week, I laid out my case for a vigorous rally phase in NatGas which is being played out in style (but with high volatility). VIP Traders Club members are already following my similar campaign in Crude Oil – and yesterday it surged by $4.

If my roadmap is correct, we have started a massive fifth wave up that will take it well above the old wave 3 high at $127 (latest $92). Sound preposterous? Then consider this scenario:

There is little question OPEC has the upper hand in energy pricing and the market’s reaction to its latest production cut was to rally, Having tested the market’s reaction to its cuts, let’s say that for whatever reason they decide – or are forced – to cut production some more. Remember, development of oilfields has been ‘discouraged’ by Western governments in favour of ‘green’. There are few sources of new production lined up and existing fields are wearing out.

With the USA’s Strategic Reserve almost tapped out as Biden has just ordered a halt to outflow, even a small production cut now could have outsized bullish price implications. Spot markets are very tight.

And what exquisite timing with COP 27 starting this week! No amount of bluster from the world ‘leaders’ about demanding to move away from fossil could possibly make the slightest difference. Even Saint Greta is not attending ‘it’s just a forum for white middle aged men to showboat their green credentials’.

Note this: It has taken 27 of these COPs and trillions in subsidies to achieve a 1% drop in the fraction of the global energy demand taken by fossil from 83% to 82%. What a deal!

Incidentally, Greta is now 19 and seems to be moving away from her youthful eco idealism and into another idealism of urging us to destroy capitalism (which was the original aim of the eco movement 40 or so years ago). She needn’t bother – that may well be accomplished anyway in the coming depression and Great Bear Market.

Communism and fascism always flourish in depressions. Capitalists are always hated (or worse).

So with further OPEC production cuts, the old $127 high could easily be exceeded and my old price target above $200 achieved.

Imagine the huge impact on the global economy – who could afford fuel with diesel above £3/litre or even £4 or £5.

With economies screeching to a halt, share markets would further collapse (except for energies) with tech continuing to lead the way.

I have started these energy campaigns for VIP Traders Club members.

The tropicals are getting hotter!

The markets in Sugar, Cocoa and Coffee have been cooling under pressure as production has been ample to satisfy demand. And traders have viewed Western economies heading for a recession with demand falling. But last week they sprang to life especially yesterday as the dollar slumped.

But these markets have a long history of tracing out huge waves between major highs and lows – with massive profit potential if you can hang on during the inevitable violent corrections.

In particular, I believe Coffee offers tremendous potential here. It is a commodity that is inelastic (demand is not sensitive to the consumer price).

The daily chart shows RSI (Relative Strength Index) has dipped well below the ‘oversold’ 30 mark where previously that dip marked a major low. Note the gorgeous tramlines with accurate PPP in 2021 (not marked) and the recent low touching the lower tramline.

and here is Cocoa

It has been ranging in a tight range for some months but now moving to the sharp end of the wedge.

and Sugar:

Sugar has also been trading in narrow range. But all three I see as poised for major breakouts as the US dollar has started weakening.

Has the dollar bull finally been stopped?

We had a strong US jobs data yesterday which should have supported the dollar (higher interest rates to come?) but guess what? Yes, it slumped by 2 handles. The MSM headline writers had their knickers in a royal twist trying to rationalise that action.

But here is a very viable option

I have the 28 September high now as my wave 5 final wave up and the waves down are starting a major wave 3/3. IF this is correct, I expect huge declines ahead with a break of my trendline confirming.

Previously, I had another new high to come, but now that appears doubtful.

And if that scenario is correct, commodities will roar northwards. Hmm.

Movies are set to get much much darker

Movie themes mirror social mood and hence stock markets. And now they are getting a lot darker. I am no fan, but I see today that the directors of the very successful Avengers franchine predict that movies as we know them are over. They will become AI action interactive offerings and young people will not want to view them in a cinema. The most successful ones will be horror movies.

That will repeat the huge success of the Frankenstein themed movies of the 1930s in the middle of the Great Depression. As stock markets improved in 1934, movie-goers shunned horror films and they flopped. They wanted Fred Astaire and Ginger Rogers feel-good escapism and not being frightened to death.

So look out for even more horrific movies to confirm the bear is still in charge.