Wall Street went up yesterday

Wednesday has been a positive day for the US stock market.

All three major US indexes closed in profit.

The S&P 500 finished at +1.42%, the Nasdaq ended the trading session at +1.79% and the Dow Jones closed at +1.00%.

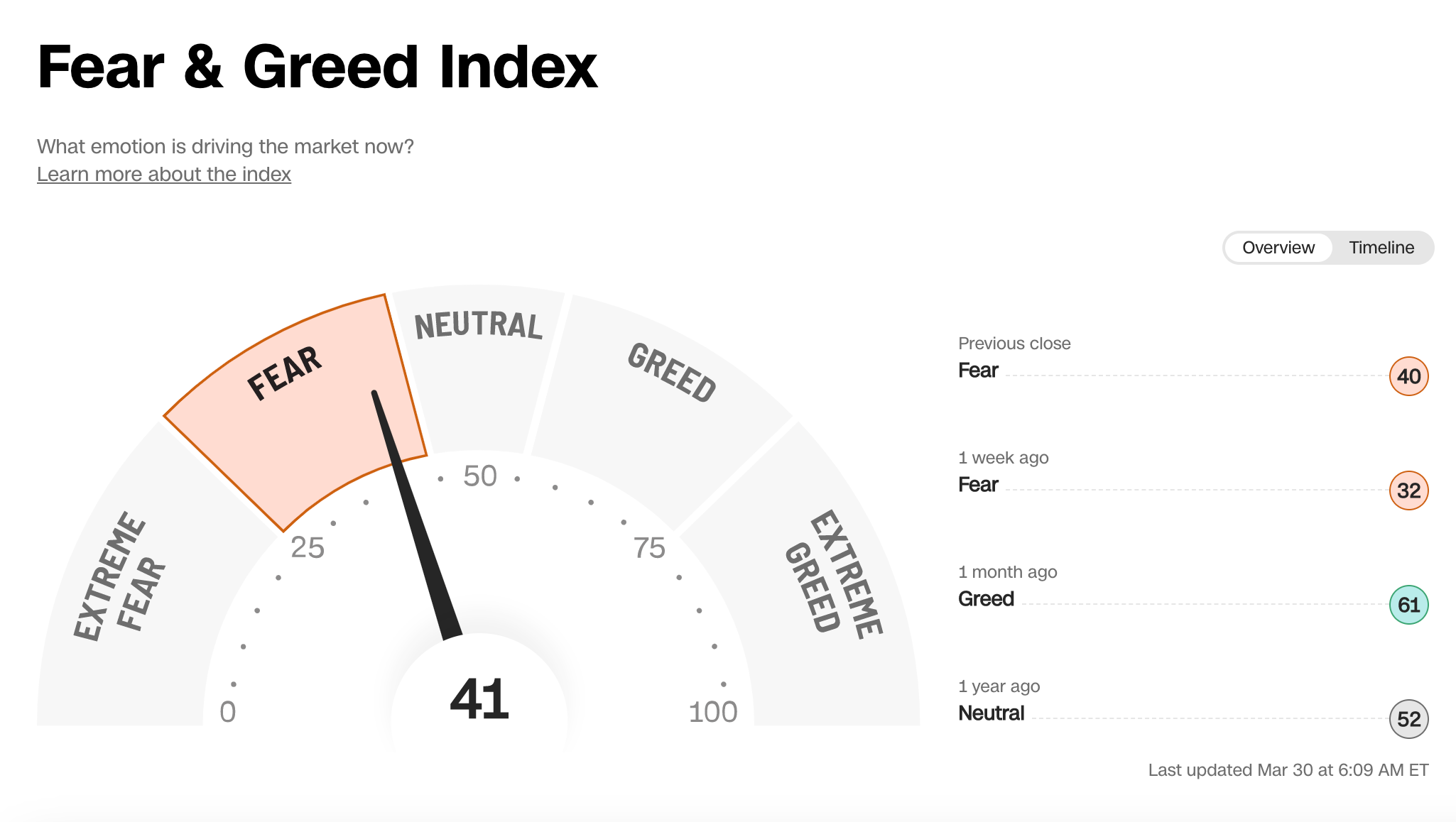

The investors' sentiment is Fear, as indicated in the graph below:

Sentiment indicator - Fear & Greed Index

The market sentiment is 41, in “Fear” mode, the same as last week, but it is slowly improving towards the Neutral mode.

How much further the central bank will raise interest rates this year?

This is the question that US lawmakers asked Jerome Powell, the Federal Reserve president, during a private meeting on Wednesday.

Mr Powell said that the Fed is planning to increase the interest rate one more time this year.

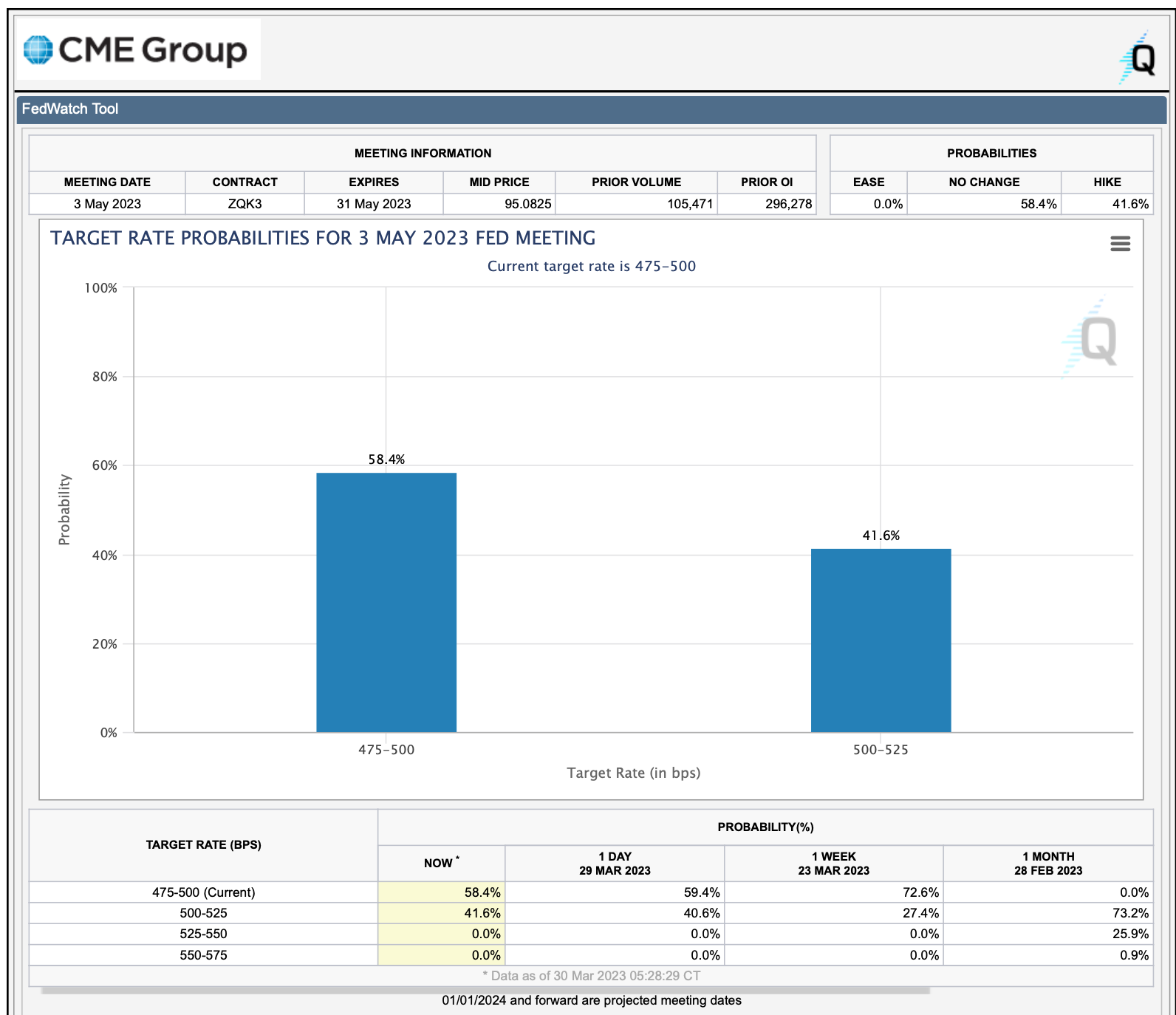

The next Fed meeting will be held on 3 May and based on the current situation the majority of the economists, 58,4%, are expecting no rate increase.

The remaining, 41,6% of the economists are forecasting a rate increase of 25 basis points.

What to watch today

U.S. Gross Domestic Product (GDP) will be released today at 13:30 GMT.

It is expected to remain at 2.7%.

At the same time will also be published the weekly US initial jobless claims, which are forecasted to be 196,000, 5,000 units up from last week's data.

Financial markets could be volatile.

Follow me

If you find my analysis useful, and you want to receive updates when I publish them in real-time, click on the FOLLOW button on my profile!

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

How much further the Fed will raise interest rates this year?

Published 30/03/2023, 12:31

Updated 28/07/2023, 11:55

How much further the Fed will raise interest rates this year?

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.