by Chaim Siegel of Elazar Advisors, LLC

Gold has a problem. Inflation has been dropping while interest rates are rising. It’s a double-whammy of bad for gold. Gold needs a good CPI number on Friday, otherwise it’s looking at more downside.

First, The Chart

Above is the gold futures chart. The key level that it absolutely needs to hold is 1213. That is just too close for us to have any confidence in it holding. Gold must hold that level.

We drew a couple of arrows showing why we think this 1213 is such a critical level. Breakouts, breakdowns, supports held and resistances rejected major moves for gold in the last few years at this major level.

If it were to close below 1213 we wouldn't see a nearby support until 1188. The next stop thereafter would be the uptrend at about 1170.

CPI Critical Tomorrow

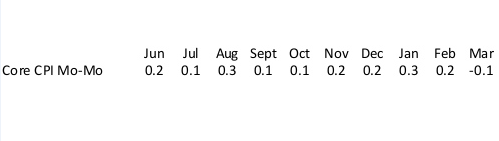

CPI had been strolling along fine at .2s and .3s until last month when it went negative.

Deflation is not great for gold. Gold is a commodity that goes up thanks to people wanting to pay more for things, including gold. Inflation helps gold. CPI needs to start trotting back into positive territory for gold to stop from dropping further.

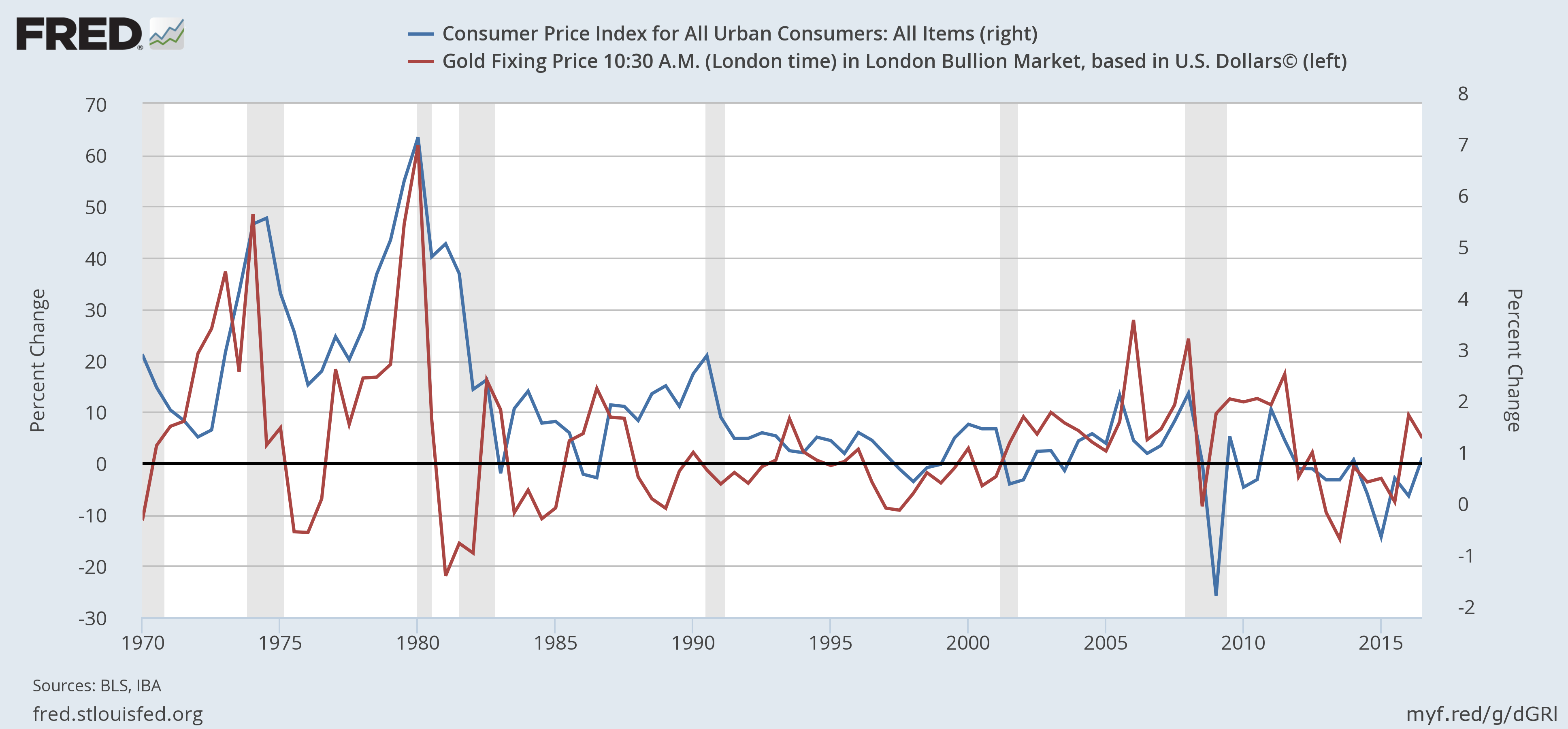

Here’s CPI versus gold:

Source: St Louis Fed

Above are the semi-annual percent changes in CPI versus gold. It’s not perfect but it is pretty good. As CPI moved up and down, gold generally moved up and down along with it.

So, CPI going negative is not good for gold.

And Rates Moving Up Are Not Good For Gold

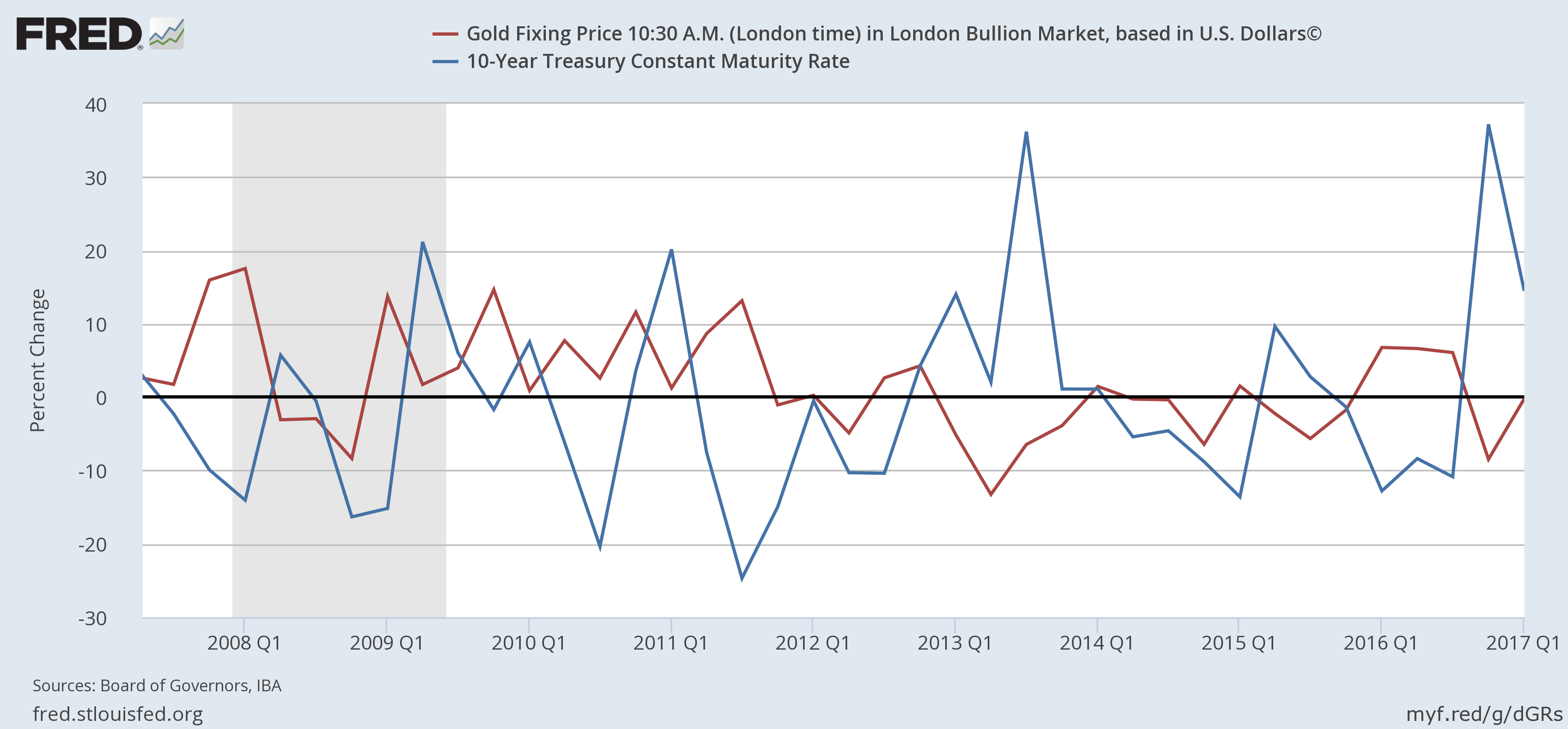

Source: St Louis Fed

On this chart we see a lot of opposites. When rates are up (in blue), gold (in red) is down. When rates are down, gold is up. Currently (see right side, just above) rates are moving up.

The Fed is also still dead-set on raising rates in June. CME has it as an 85% chance for a rate hike in June.

This is a smack in the face of negative inflation. Higher rates are not good for gold. And it’s doubly not good for gold in the face of negative inflation numbers.

Comey: Bad Action

Uh Oh. The world just had a scare after President Trump fired FBI director James Comey. This was going to set off an avalanche of risk. It was going to destabilize politics as we know it.

Yet what did gold do? Nothing. That is great news (for gold anyway) and bad action.

That is a bearish trading signal, meaning if good news can’t get gold up, bad news can more easily take it down.

You better get a good CPI number on Friday, otherwise you can see risk building in gold.

Still, Lots of Gold Bulls

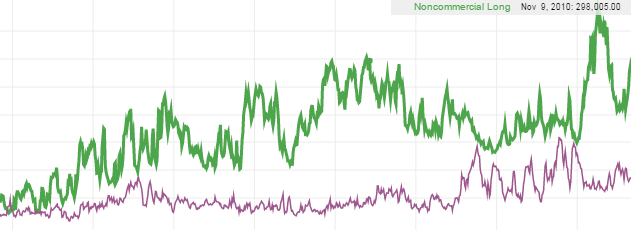

Source: Quandl

The chart above shows the most recent Commitment of Traders for gold. People still love gold.

Being bullish is not a problem. The problem is when the amount of bulls increase and all that buying can’t get gold to move higher. Bullishness increasing when gold moves down is not a good thing.

What you want to see is if gold goes down it removes bullishness. That way you can get a bottom when bullishness bottoms.

But when gold goes down and bullishness moves up, who’s left to buy? All the bulls are already in. You have more people who will react to bad news by wanting to sell than you have people on the sidelines waiting to react to good news who are waiting to buy.

When that bullishness finally caves, you have a wash-out driving gold lower. Until then you have more downside risk.

Conclusion

CPI better be up big for gold to work. If CPI is negative again, expect more downside. And higher rates plus lots of bulls don’t help matters for gold either.

Disclaimer: Securities reported by Elazar Advisors, LLC are guided by our daily, weekly and monthly methodologies. We have a daily overlay which changes more frequently which is reported to our premium members and could differ from the above report.

Portions of this report may have been issued in advance to subscribers or clients. All investments have many risks and can lose principal in the short and long term. This article is for information purposes only. By reading this you agree, understand and accept that you take upon yourself all responsibility for all of your investment decisions and to do your own work and hold Elazar Advisors, LLC and their related parties harmless. Any trading strategy can lose money and any investor should understand the risks.