Gold was able to rise a little bit after bulls managed to prevent bears from breaking 1790.00. At the moment, it’s too early to say that the decline is over and the asset is expecting nothing but growth ahead because bulls haven't broken 1825.00 yet. Negative market sentiment forces investors to escape risks related to the stock market slump and the increasing number of new coronavirus cases, which may slow down the current economic recovery all over the world.

The number of investors, who are buying Gold, is reported to be increasing rapidly. However, it’s understandable since precious metal has always been considered a “safe haven” asset and tends to be extremely popular when financial markets and the global economy experience uncertainty. Given the current situation, which is the ongoing coronavirus pandemic and low rates, it’s not surprising that investors are getting more and more interested in Gold.

Another signal in favour of a further uptrend in Gold is the data on the open interest on Gold futures, which has been growing for several consecutive trading sessions. In this case, one shouldn’t exclude a further bullish trend after a long correction that we had been witnessing since the end of 2020.

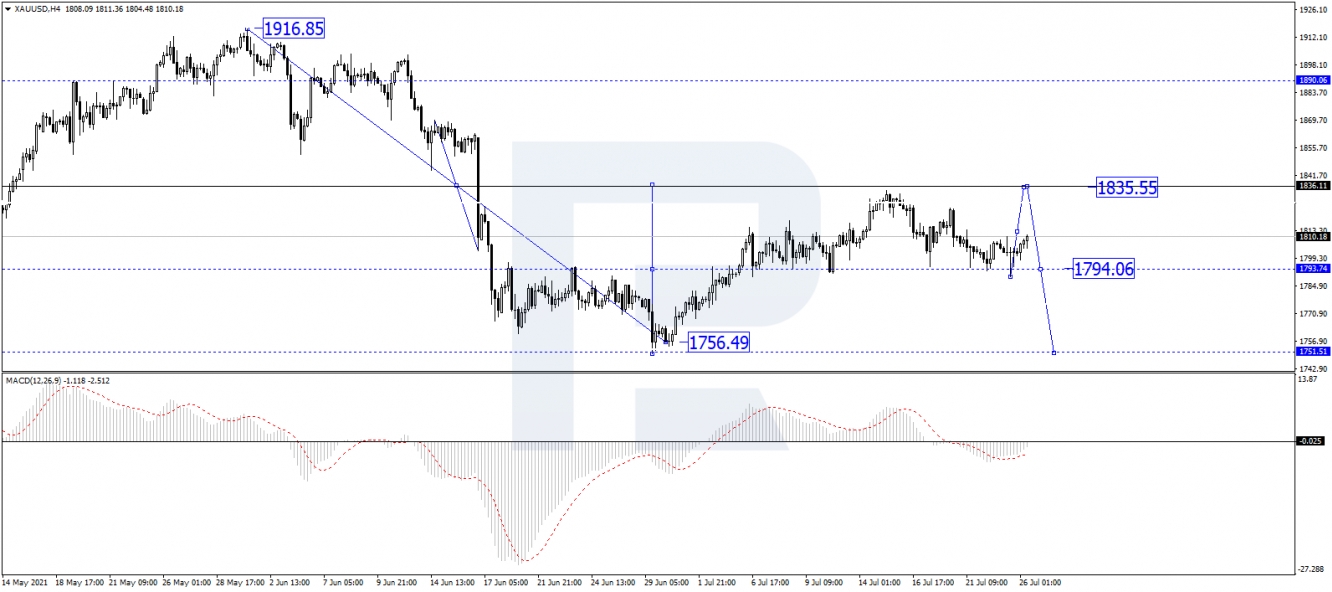

As we can see in the H4 chart, after completing the descending wave at 1790.60, XAU/USD is correcting towards 1813.55. Possibly, the metal may continue the correction up to 1835.55, After that, the instrument may start a new decline to break 1785.00 and then continue falling with the target at 1751.51. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is moving below 0, thus confirming a further downtrend on the price chart.

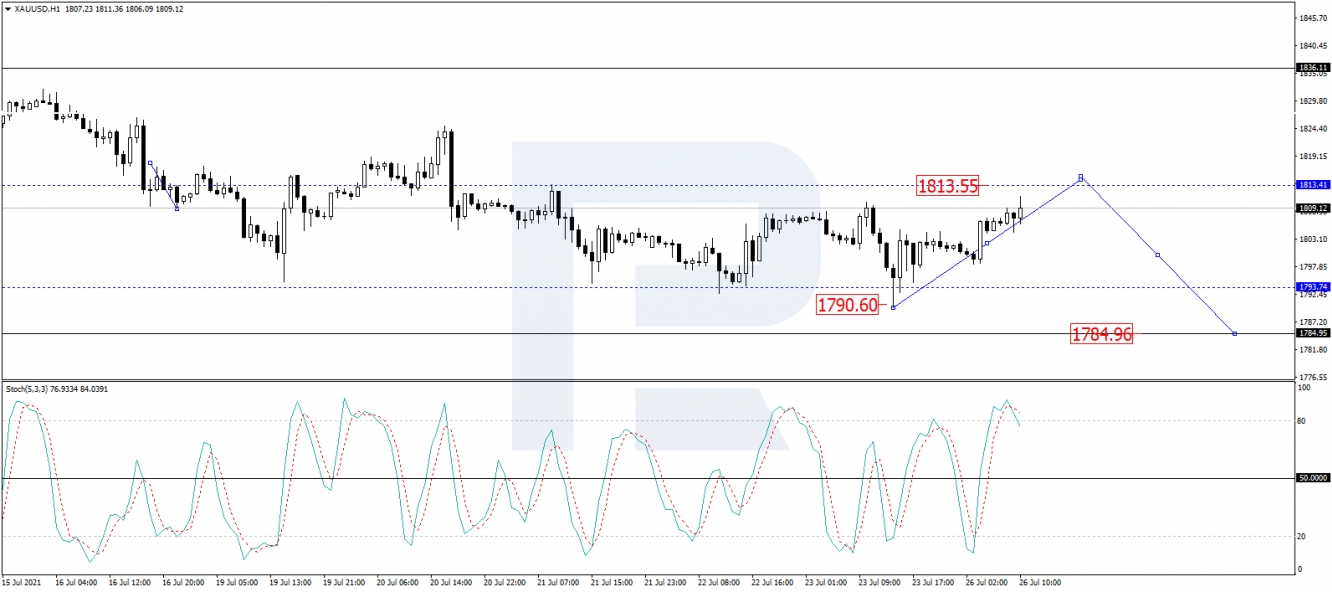

In the H1 chart, Gold is correcting towards 1813.60 and may later fall to break 1790.00. Later, the metal may continue falling within the downtrend with the target at 1785.00. From the technical point of view, this scenario is confirmed by the Stochastic Oscillator: after rebounding from 80, its signal is expected to fall to break 50 and then continue moving downwards to reach 20.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Price is Rising

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.