Gold futures set to expire in February 2025 are under pressure, defying a surge in expectations for another Federal Reserve rate cut next week. While this move by the Fed is anticipated to mark the final cut in the current cycle, the spotlight is shifting to incoming President Donald Trump’s expected expansionary and inflationary policies, which could shape the long-term trajectory of interest rates.

Fed's Rate Path and Trump’s Economic Influence

After slashing rates by 75 basis points in 2024, the Fed is expected to ease at a slower pace in 2025. However, Trump’s administration is projected to maintain a hawkish stance in the long run, keeping rates elevated.

Higher rates typically weigh on gold prices by increasing the opportunity cost of holding non-yielding assets. While gold hit record highs earlier this year amid aggressive Fed cuts, its momentum has waned as markets adjust to Trump’s anticipated fiscal policies.

Adding to this uncertainty, U.S. inflation remains sticky, as evidenced by this week’s data. Despite a stronger dollar, gold futures have held steady, signaling a market grappling with conflicting signals about rate policy and economic growth.

Technical Analysis: Key Levels to Watch

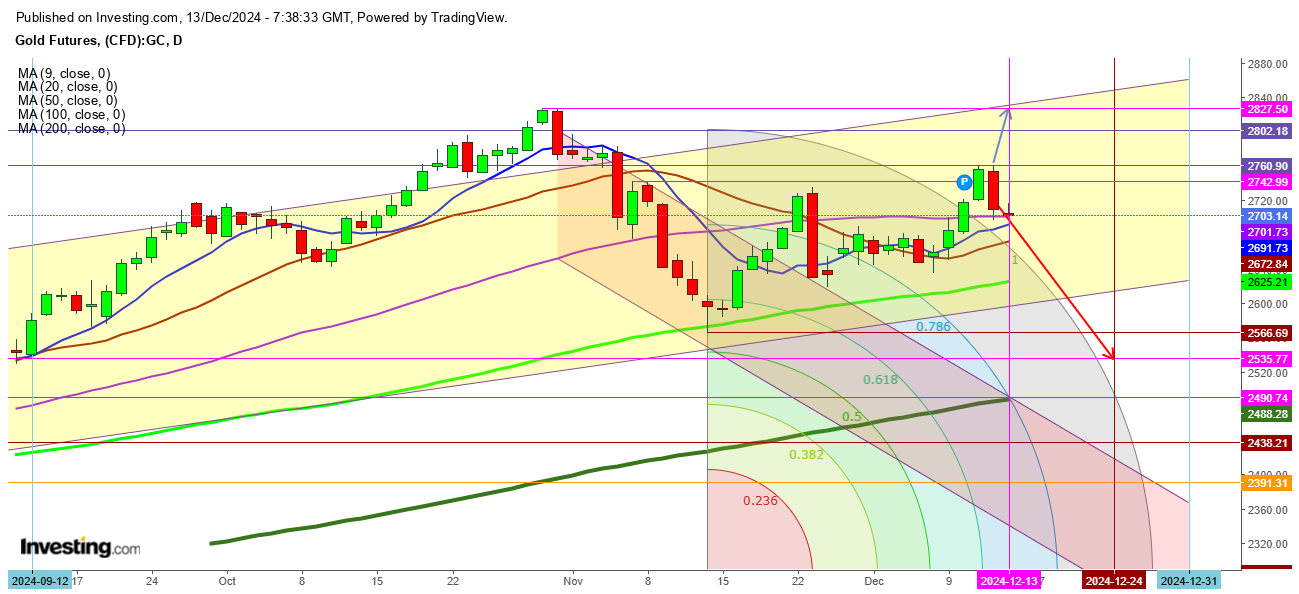

Gold futures continue to behave as predicted in my previous analysis, showing a steep decline on Thursday that extended into Friday’s session. Selling pressure remains elevated, with the formation of an exhaustive candle adding to bearish sentiment.

On the daily chart, gold futures are attempting to hold above the 50-day moving average (DMA) at $2,701. A breakdown below this level could pave the way for a deeper slide toward the next support at the 20 DMA, currently at $2,673. Such a move might even trigger a gap-down opening in the coming week, amplifying the downside risk.

Conversely, a temporary bounce driven by expectations of next week’s Fed rate cut could offer a fleeting opportunity for short-sellers. However, any upside appears capped at the significant resistance level of $2,742.

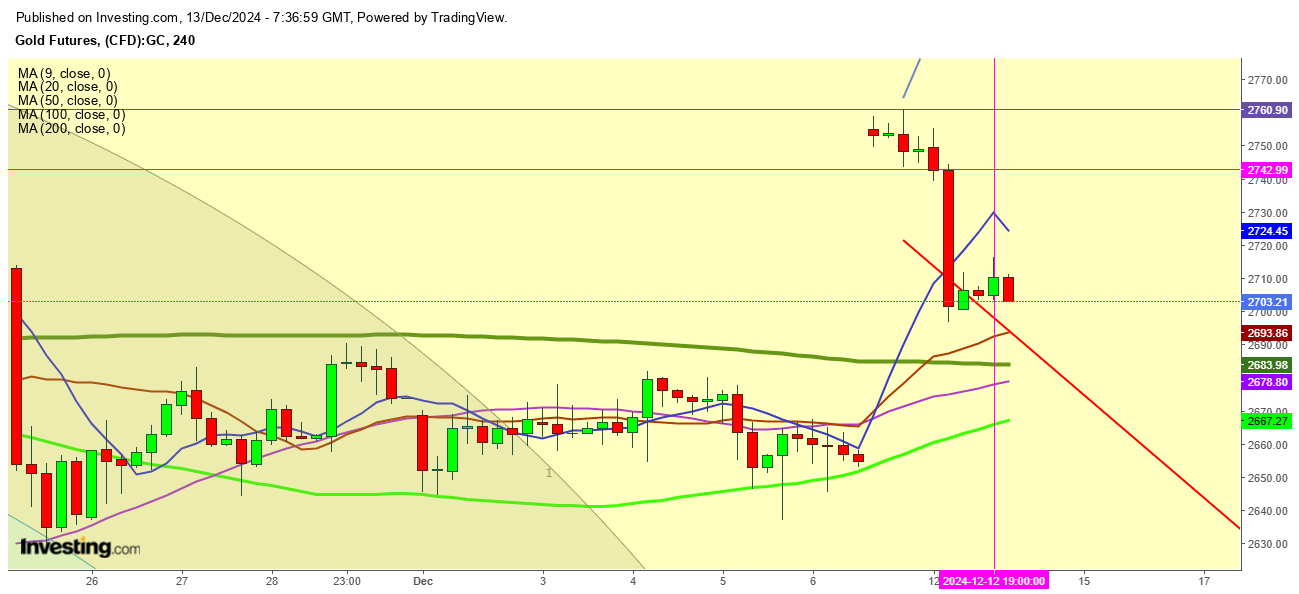

On the 4-hour chart, immediate support at $2,701 remains critical. The 9 DMA’s downward tilt suggests a sharp decline if prices breach the 200 DMA at $2,684. This reinforces the bearish outlook for gold in the near term.

Gold’s recent performance reflects growing unease over the interplay between Fed policy and Trump’s economic agenda. The yellow metal’s demand has softened, and the technical setup suggests the potential for another sharp decline, mirroring Thursday’s last-hour slide.

Traders should approach gold with caution as market conditions remain volatile. While a rate cut next week could spark short-lived optimism, the broader outlook points to limited upside and increasing downside risks.

Disclaimer: This analysis is based on technical observations and is not a recommendation to trade. Readers should make investment decisions at their own risk. The author does not hold any positions in gold.