As my colleague Kathleen Brooks noted yesterday in her in-depth preview, today is a major day for the British pound (see “Bank of England: Binge Watching the Bank's Next Move”). In addition to the monetary policy meeting itself, the Bank of England will also release the minutes from its previous meeting and most importantly of all, its Quarterly Inflation Report, which outlines the policymakers’ longer-term views on the economy and monetary policy. It’s no exaggeration to say that the information revealed during “Super Thursday” later today could impact trade in sterling not just for the day or week, but for months to come.

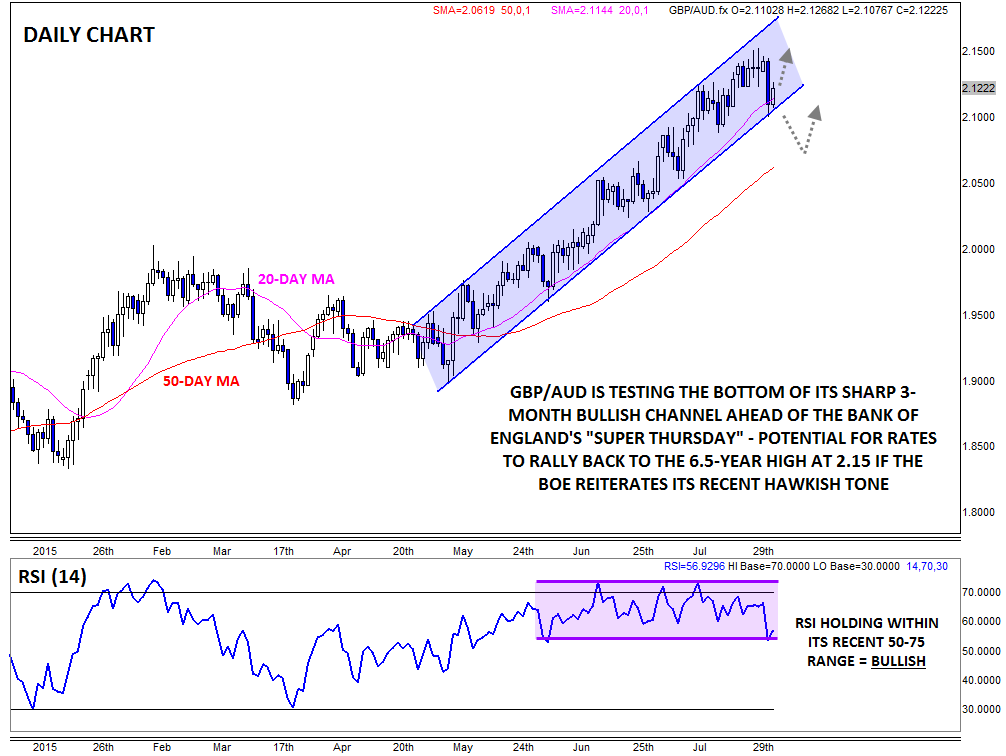

While many traders prefer to focus on the more widely-traded GBPUSD and EURGBP pairs, GBPAUD has shown one of the clearest trends in the market over the last few months. After bottoming below 1.90 back in early May, the unit moved all the way up to trade above 2.15 earlier this week, a 2500-pip rally in less than three months.

Of course, Tuesday’s shift back to neutral from the RBA was a momentary setback for the pair, but bulls managed to defend support at the bottom of the channel and the 20-day MA around 2.10. Digging a bit deeper, the RSI indicator also held within its recent sideways range from 50-75, suggesting that while Tuesday’s drop was steep, it was not out of character for the established uptrend yet.

Indeed, as long as GBPAUD holds above 2.10, a continuation higher is favored, especially if the Bank of England reiterates its recent hawkish tone. If that is the case, GBPAUD may recover to retest its 6.5-year high around 2.15 later this week or early next week. On the other hand, a more dovish BOE could break the channel and take rates down to test the 50-day MA around 2.0600 next.