Quote of the day: “The Fed’s application of its framework has left it behind the curve in controlling inflation. This, in turn, has made a hard landing virtually inevitable" - former NY Fed President Dudley.

The yield on the 2yr Treasury bond briefly rose above the yield for 10yr paper....that’s the big inversion everyone has been waiting for. So now it’s happened, can we look at the curve steepening again? That might be good for risk, although it could imply higher terminal rate...it can probably steepen a bit from these levels but I wouldn’t be too confident. Anyway, an inverted yield curve of this sort is usually a pretty good recession indicator for the US; in 50 years it’s never missed. Typically, it takes about 18 months to come good. Last time, in August 2019, I guess it got lucky as Covid came around the corner...what could be different this time? The Fed’s Harker is technically right to point out it’s correlated with recessions, rather than a causal factor...but that somewhat misses the point. It’s an indicator and it’s a good one. The 5s30s curve inverted earlier this week for the first time since 2006.

We saw Eurozone money markets all over the place yesterday, starting to price for more tightening this year by the ECB and then reversing...ECB’s Holzmann says lifting interest rates to zero by 2022 is critical for ECB policy. Chief economist Lane says the inflation is imported shock, will fade away...will they never learn? German inflation today is expected to rise from 5.1% in Feb to 6.3% in March...but the early stats from the industrial region of North Rhine Westphalia shot to 7.6% from 5.3% so we could see the national reading higher than forecast. Spain’s CPI inflation jumped to 9.8% in March! European bonds are on the move again off the back of these readings this morning with shorter dated paper selling off fast. German 2yr yields rose about 9bps to 0.04%, with the 10yr Bund moving close to 0.7% again after briefly rising above this level yesterday.

FX

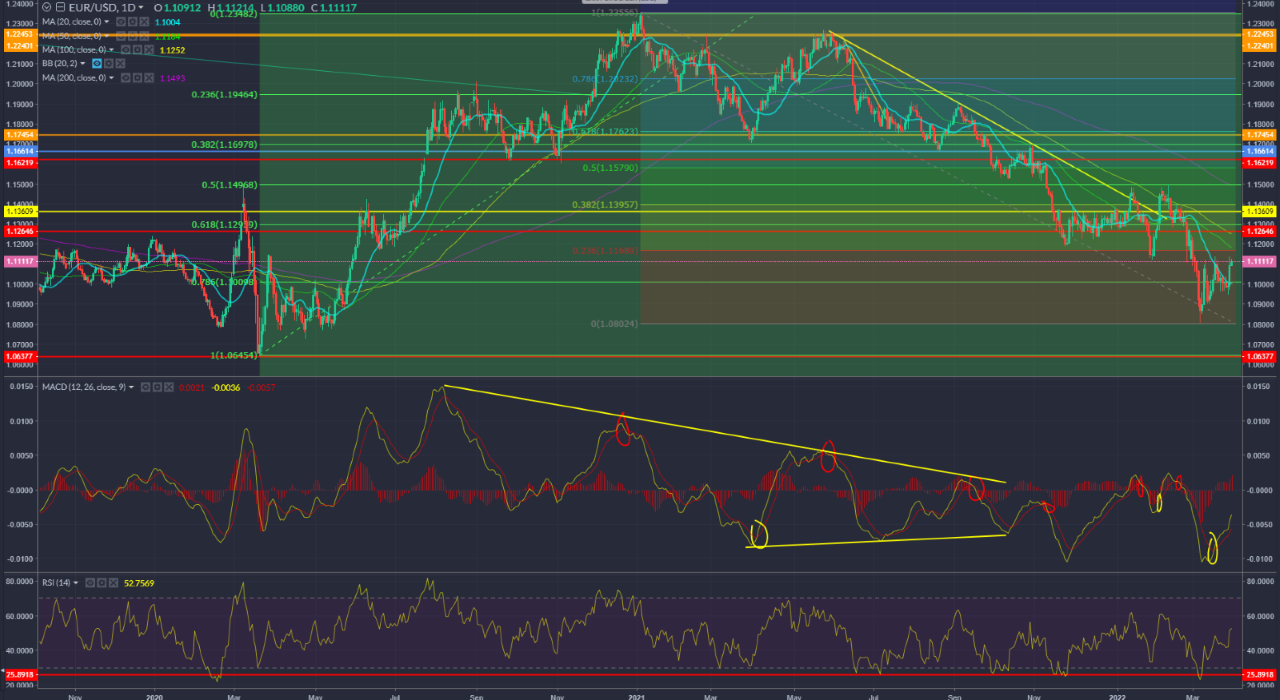

The euro caught some bid as yields moved around...hopes for Ukraine peace deal perhaps given the euro has been a good proxy for the impact of the war. Largely EUR/USD has held gains with the cross above 1.11 this morning, holding close to the mid-March swing high, eyeing near-term resistance at the 23.6% retracement of the Jan-Mar decline at 1.1170. MACD still supportive.

USD/JPY keeps lower as it maintains its descent from 1.25, where the rapid move higher seems to have hit exhaustion point. Looking to see now if the 200-hour SMA at 1.21 holds. GBP/USD is a tad firmer this morning but still facing pressure with the 20-day SMA acting as near-term resistance. BoJ jawboning and pledges to buy more JGBs to defend yields has helped cool the rally but it might just be a pullback setting up for another rip. Eisuke Sakakibara, who was Japan's Vice Minister of Finance for International Affairs in the 1990s, says the BoJ will only need to intervene if it hits 1.30. Former currency chief Naoyuki Shinohara is on the wires this morning saying a defence of the yen would be futile. Further yen weakness ahead?

Meanwhile, the ruble is back to pre-war territory...no default and the oil and gas keep flowing.

Equities

On that front, equity markets clearly got a lift from the headlines suggesting that Russia was scaling back military operations around Kyiv and Chernihiv...we await to see what really happens on the ground. Western intelligence is sceptical and could be repositioning of units during a natural lull, caused by stiff defence...making a virtue out of a necessity.

After a strong run over the last two sessions, European equities are softer in early trading this morning. Losses are under 1% at the open, after the CAC rose 3% and the DAX advanced 2.8% on Tuesday. The FTSE tried to stay flat with and oil & gas, basic resources the top sectors in European trade. BP (LON:BP) +1.7%, Shell (LON:RDSa) +2.4% doing a lot of the lifting the FTSE 100, whilst Anglo American (LON:AAL), Glencore (LON:GLEN), Fresnillo (LON:FRES) and Rio Tinto (LON:RIO) all in support. US futures are pointing to a lower open after Wall Street notched its fourth straight day of gains on Tuesday.

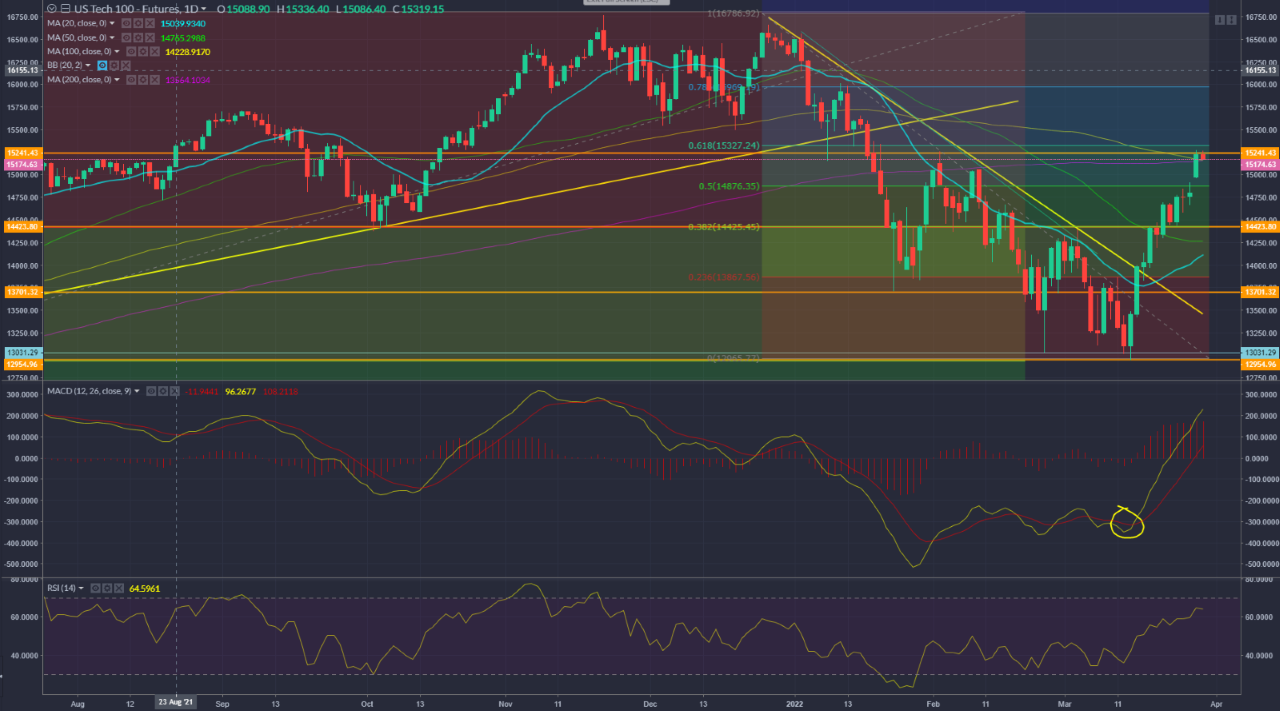

NQ futures sits around its 100-day and 200-day SMAs, plus 61.8 retracement above 15,300, where it just came up a bit shy yesterday...time for this rather vicious bear market rally to unwind?

Oil

OPEC gets underway today with the Joint Technical Committee (JTC) meeting, set to begin at 11 GMT. Ministerial and OPEC+ meetings are tomorrow and expected to produce no change in the policy of gradually increasing output by 400k bpd monthly...we know members are struggling to even hit that level. API data showed a larger than expected draw on inventories yesterday at –3m, the official EIA figures are forecast to show a headline draw of 2m barrels.

Oil prices remain volatile...lower on Russian headlines, up on Shanghai lockdown fears and then hit again by Russian statement saying its Caspian Pipeline Consortium could be out for two months.

Brent futures (June) just about holding onto the trend support...May is at $112. WTI has jumped $3 this morning to above $107.