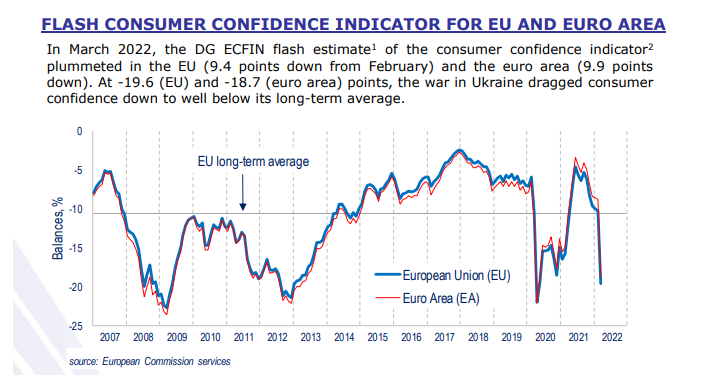

Confidence shaken – EU consumer confidence has tumbled due to the war in Ukraine, while clearly inflation is the big kitchen table worry. PMIs this morning point to surging input cost inflation and this being passed onto consumers. The German private sector saw the steepest rise in overall input costs on record for the series (since Jan 1998). Incidentally, the PMIs show activity is holding up pretty well, in part it seems because for now they can pass the costs on, and demand is not a problem. However, the business confidence reading from the French PMI fell to its lowest since January 2021. In Germany, businesses’ expectations worsened considerably, falling to their lowest since June 2020. German manufacturer confidence turned negative, suggesting more firms expect a fall in output in the year ahead, for the first time since May 2020. Confidence has been shaken by the war in Ukraine, a natural reaction, but also very much by the subsequent expected rise in inflation, which was already high, and supply disruption, which was already bad. Meanwhile, fertilizer prices have exceeded their 2008 high and US farmers are asking to plant on protected land to make up for lost grain and oils from Ukraine. Runaway inflation is bad for confidence and bad for business.

European stock markets are attempting to rally this morning, after Wednesday’s declines. US stocks dropped more than 1% amid rising oil prices and some more tough talking from the Kremlin over Ukraine. Yields have stalled with the US 10-Year around 2.34% this morning.

Oil continues to advance, with Brent front month at $122, WTI above $115 in what’s still a volatile market marked by low liquidity and tight physical supplies. Outages at the Caspian Pipeline Consortium may last for weeks and could remove about 1m bpd from the market, whilst EIA data showed a surprise 2.5m barrel draw on US inventories, which are 12% below their average for this time of year. Trafigure says oil could hit $150 or even $200, a belief shared by top trader Pierre Andurand. Meanwhile, Russia said unfriendly nations would need to make payments for gas in roubles, a move that has sparked a sharp bounce back for the Russian currency and a spike in European gas prices.

Russia’s stock market resumed partially today under heavy restrictions, including bans on foreigners selling stock and short selling. The MOEX rallied over 8% in early trade, but that is what happens if lots of people can’t sell. In London, this morning shares in Polymetal (LON:POLYP) rose 10%, and Petropavlovsk (LON:POG) rallied 16%.

Selling in the US market yesterday was broad-based with only Energy and Utilities finding bid. Apple (NASDAQ:AAPL) held up tech all by itself, rallying 0.8% against the trend for growth names, which gave back some of the recent rally. I’m not convinced by this recent show of strength we’ve seen in growth; it runs counter to rising rates, persistently high inflation and slowing growth. A lot of the action will be driven by oil prices.

Nickel trading remains chaotic, with the LME cancelling trades yesterday and the market again hitting limit up at +15% today.