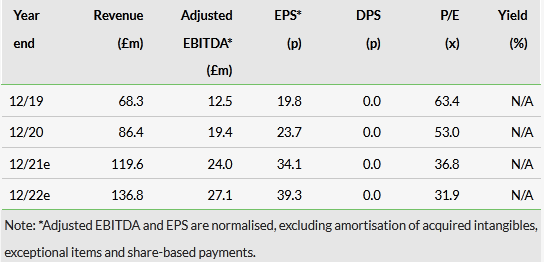

Ergomed's (LON:ERGO) H121 trading update highlights that operational momentum continues to be strong following its stellar performance in FY20. The order book continues to grow at an impressive rate, up 18% from end-2020 with a strong 1.62x book-to-bill ratio for the period. We maintain our FY21 revenue forecast, in line with company guidance, which assumes no additional FX headwinds, but note that this could mean our FY22 revenue forecast is conservative. With acquisition synergies being realised faster than expected, we adjust our near-term margin assumptions, somewhat increasing our FY21/22e adjusted EBITDA forecasts. Our valuation increases to £706m or 1,445p/share from £683m or 1,400p/share.

Share price performance

Burgeoning order book underpins momentum

Total H121 revenues increased by 38.8% to £56.0m (+48.1% CER) with underlying service fees up 28.6% to £47.6m (+37.2% CER). FX headwinds did curtail growth, reflecting the increasing US$ contribution (now c 50% of the mix after the MedSource acquisition in December 2020), which was c 9% lower versus GBP relative to H120. In the AGM statement in June 2021, Ergomed guided that FY21 EBITDA is expected to be ‘materially ahead’ of consensus (£21.9m at the time). We increase our adjusted FY21 EBITDA by 10.6% from £21.7m to £24.0m by adjusting near-term margins. Full H121 results are due in September 2021. The order book stood at £227.8m, up 18.0% from end-2020 and 50.5% y-o-y, providing high visibility of revenue into 2022.

Plenty of firepower for bolt-on acquisitions

Management has repeated on several occasions that it will continue to expand via both organic top-line growth and additional bolt-on acquisitions. The latter is evident from the two acquisitions it completed in 2020 (details in our last outlook report). Looking forward, with net cash of £24.6m on hand (at 30 June 2021) and £30m in unused credit facilities, Ergomed has plenty of firepower to continue pursuing its active M&A strategy, which could bolster the growth outlook.

Valuation: £706m or 1,445p/share

Adjusting our near-term margin assumptions, updating for net cash and rolling our DCF model forward increases our valuation to £706m or 1,445p/share, implying an EV/EBITDA multiple of 28.4x based on our FY21 forecast. Ergomed trades at a premium EV/EBITDA of 24.5x compared to the peer average of 21.9x, but at a discount to Medpace on 28.5x. In our recent outlook note, we provided bull and bear scenarios from flexing our DCF assumptions (long-term sales growth and profit margins). Implementing these near-term adjustments results in a bull case of 2,005p/share and a bear case of 1,032p/share.

Click on the PDF below to read the full report