As far as stock market debuts go, there are few cases of a brighter debut than that of edtech giants, Duolingo (NASDAQ:DUOL). The roaring success of the language-learning company’s IPO has not only shown that education technology is here to stay in the wake of the Covid-19 pandemic, but it’s also provided one of the early success stories for Robinhood’s IPO Access platform - geared towards welcoming more retail investor participation for initial public offerings.

Shares in Duolingo closed up 36% on its market debut in late July on the Nasdaq, with shares in DUOL closing at $139.01 on its opening day, giving the company a market capitalisation of almost $5 billion.

The company had priced 3.7 million shares at $102 apiece prior to its listing - far higher than its initial $85 to $95 target range. Subsequently, the stock raised $521 million at an implied $3.7 billion valuation - up substantially from last year’s company valuation of $2.4 billion based on PitchBook data.

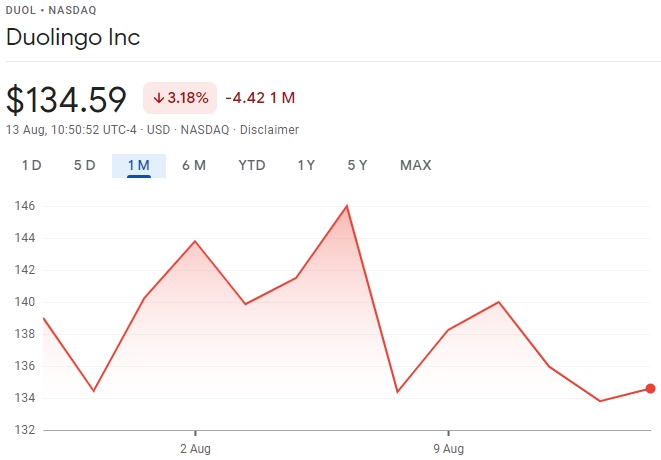

In the weeks that have followed Duolingo’s listing, we can see that the price of shares have ranged between around $132 and $146 - showing that the company’s roaring debut wasn’t a flash in the pan, and that the language platform is still sitting way above the top of its initial target range.

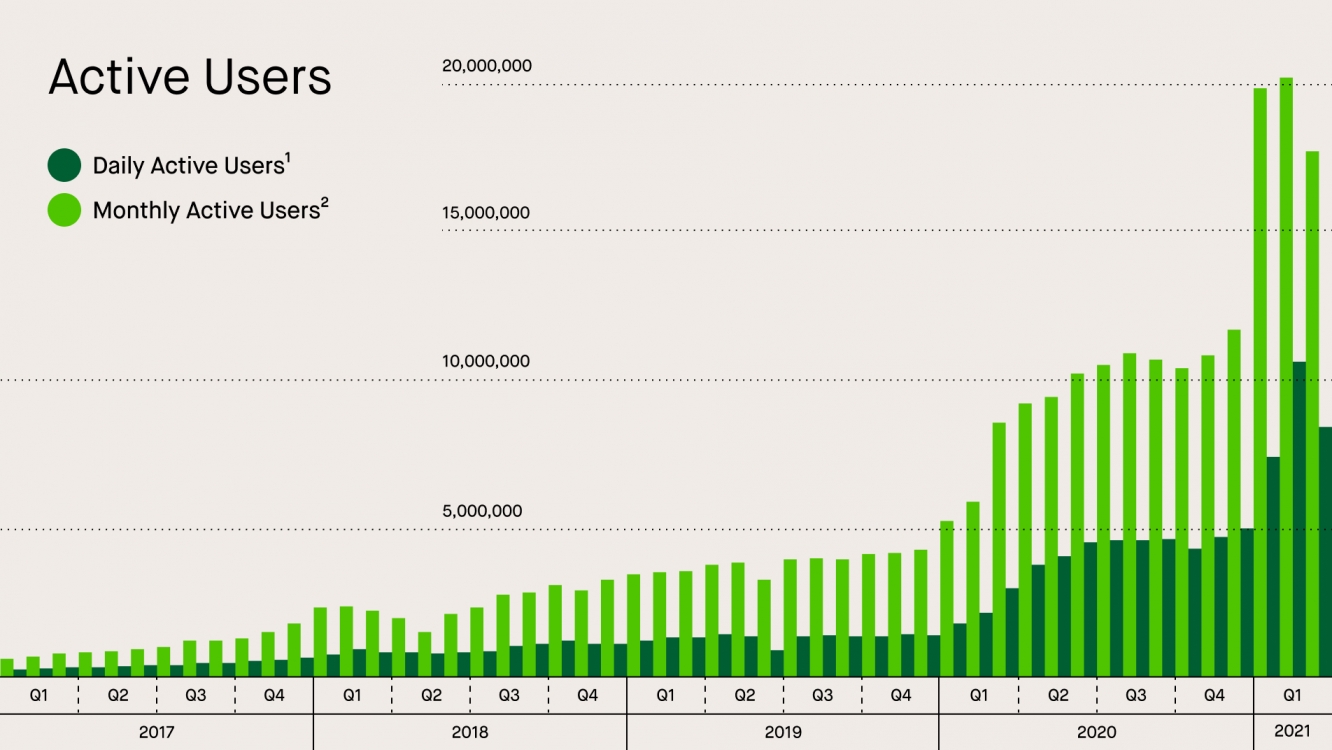

In its IPO prospectus, Duolingo disclosed annualized revenue growth of 129% last year to $161.7 million, while the company brought in $55.4 million in revenue for the first quarter of 2021 - a 97% leap from the year before. However, net losses also widened more-than six-fold to $13.5 million, as stated in the filing.

Such astonishing levels of growth show that the edtech revolution is still in full swing one year on from the start of the pandemic, however, it also provides a rich insight into how the world of investing has changed in such a short period of time.

The New Era of IPO Participation

Initial public offerings have traditionally been notoriously difficult for retail investors to buy into. There are many reasons for this, and it’s typically down to the sheer resourcefulness and deep pockets of institutional investors.

Fundamentally, big buyers are easier to find when it comes to selling shares in IPOs. For instance, selling a million shares to one institutional investor is a far more straightforward process than finding 1,000 individuals to purchase shares between them.

In fact, in the case of some IPOs, even large institutions struggle to get the shares they want. "Especially with a smaller IPO, nobody really gets 100% of their fill. In fact, no one gets more than 10% of their interest in the allocation," explained Kathleen Shelton Smith, principal at Renaissance Capital.

“Historically, institutional investors get around 90% of all shares, with only around 10% left for retail trades,” said Maxim Manturov, head of investment research at Freedom Finance Europe. “This is where allocation comes from: when the demand is high, the broker will have to reduce order amounts so as to at least partially fill all of them. The allocation ratio, meanwhile, depends on the investor trading activity and volume.”

However, fintechs have been steadily evolving in order to better accommodate retail investor participation within IPOs. This is a significant development in the investing landscape because initial public offerings can often represent opportunities for greater stock growth over time - allowing buyers to get in before the company launches on the stock market.

There has been a growing number of online brokerages that have offered IPO participation for individuals in recent years, but Duolingo’s IPO was among the first to be listed on Robinhood’s revolutionary new portal, IPO Access.

In IPO Access, users are free to buy into the initial public offerings of participating companies, all without the necessity of a minimum account balance. This has opened up the opportunity for more retail investors to buy shares in the companies they love at the earliest opportunity.

Data suggests that 12,602 retail investors used the Robinhood (NASDAQ:HOOD) platform to buy shares in Duolingo before the company arrived on the Nasdaq - a move that’s likely to have been seen as shrewd business considering the performance of the stock upon its flotation.

Setting the Standard for the Future of Investing

12,602 retail investors may not seem like a large enough number to spark a financial revolution, each participant represents the grabbing of an opportunity that may not have been available just 12 months ago.

Furthermore, some 301,573 investors utilised IPO Access to buy shares in Robinhood’s own IPO - representing some 1.3% of the app’s total user base.

(Image: SEC)

Robinhood has seen an active and growing user base since the start of the Covid-19 pandemic, and this coupled with innovations like IPO Access is likely to open the door for greater retail IPO participation over the coming months and years.

Duolingo’s IPO has been a resounding success for the edtech industry, but for the 12,602 retail investors that opted to take part in the successful listing, it provides an insight into the future of the initial public offering marketplace.

As fintech continue to level the playing field of investment participation, we’re likely to see far more newcomers to the IPO investing space. Successes like that of Duolingo are vital for industry validation and encouraging more widespread adoption.

Piece by piece, the successful flotation of Duolingo and future like-minded companies will help to bring IPOs into the retail investing landscape - carrying benefits that can be felt across Wall Street.