Deutsche Börse (DE:DB1Gn) (DB1) is a leading European capital markets infrastructure provider with activities across pre-trading, trading and clearing, and post-trade segments. Its diversity provides resilience to fluctuations in market activity and encompasses a range of faster growing areas that can fuel the secular growth element of its strategy. M&A is seen as an important potential source of additional capability and growth.

A broad market infrastructure business

Deutsche Börse’s largest four segments by revenue and EBITDA are Eurex (financial derivatives), which contributed 31% of 9M21 EBITDA; Clearstream (custody, settlement, collateral management and other post-trade activities), 23%; IFS (investment fund services), 13%; and Xetra (cash equities), 12%. The remaining 21% of EBITDA was generated by EEX (spot and derivative commodity markets), 360T (foreign exchange), Qontigo (indices, including Stoxx and Dax, and portfolio construction and risk analysis tools) and, acquired this year, ISS (institutional shareholder services, including ESG). Geographically, Europe as a whole accounts for c 87% of revenue, including 25% Germany and 20% UK with 13% arising in the Americas and Asia (FY20 figures). Finally, revenue is split c 53/47% (H121) between transactional and recurring.

Strategy combines secular and M&A growth

In November 2020, DB1 set out its Compass 2023 medium-term plan targeting continued secular growth and an increased contribution from M&A. The focus is on expanding in activities with exposure to asset classes that have structural growth prospects. Drivers of organic growth include the continuing shift from OTC to on-exchange trading, the increasing importance of ESG, growth in passive investing and digitisation of the financial sector. Financial targets in the plan include 10% compound annual revenue growth for 2019–23 with 5% each from secular growth and M&A. The aim is to achieve 10% CAGR in EBITDA and EPS as well. So far, the group is on track with better than expected secular growth. It has acquired ISS, which boosts its ESG exposure and expects to close the acquisition of two-thirds of Crypto Finance in Q421. DB1 has also benefited from its portfolio of minority investments, which provide exposure to activities related to the group’s value chain.

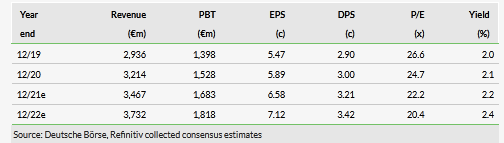

Valuation: Prospective P/Es below peer average

Deutsche Börse trades on prospective multiples that are below the average for large exchange peers. Execution of the strategic plan is not risk free, but existing diversification, strong market positions and areas of growth potential are positives.

Consensus estimates

Share price graph

Bull

- A well-established leading position in European derivatives.

- A number of business areas with high growth prospects.

- Diversification across trading, pre- and post-trading activities.

Bear

- Subject to capital market cyclicality.

- Delivery of secular growth element of strategy carries risk.

- Some pricing and execution risk attached to M&A.

Link to PDF here: