by Clement Thibault

Take a quick look at the S&P 500, the US's leading stock index. As of today, it stands at 2461 points, a mere 29 points away from its intraday, all-time high of 2490. We are 1.2% away from the benchmark's highest level in history.

Now look at the VIX, sometimes referred to as the fear index. This summer the index has seen unprecedented lows, with the VIX hovering around 10 for much of July and August. Even though it's recently moved as high as 12, we're still witnessing one of the most muted VIX streaks in history.

Looking at these two leading indicators without any knowledge of geopolitical context, you'd assume all was well with the world. Stock market all-time highs and volatility lows should indicate the US economy is in the sweet spot of healthy growth while peace and prosperity reign – and no clouds on the horizon.

Unfortunately, as anyone who's paying attention knows, that's not the case at all. While some believe economic growth is occurring (witness last quarter's GDP), global peace and political quiet are not on display. Putting aside internal US affairs—including hurricane destruction and recovery, the delayed debt ceiling debate, ongoing immigration uncertainty and the diminishing possibility of tax reform—the stock market appears to be completely overlooking a potential international conflict point: North Korea.

North Korean Saber Rattling; US Rhetoric

Over the past few months, North Korea has been taunting South Korea, Japan and the US by repeatedly testing intercontinental ballistic missiles (ICBMs). On August 29, Pyongyang sent a missile over Japan; additional recent North Korean missiles have appeared capable of hitting Hawaii and Alaska, while another seemed to have the power to potentially hit California.

Barely a week ago, the rogue nation tested what it claimed was a hydrogen bomb, its biggest and most powerful test to date. While a relatively small, economically impoverished country, North Korea's Chairman, Kim Jong-Un, believes nuclear power could level the field—and boost the prominence of his country—with a single, successful hit creating a devastating blow.

Even without nuclear power, North Korea could unleash its conventional military power on South Korea, forcing the US to intervene. The North Koreans and their leader seem determined to continue along this threatening path.

In response to the North Korean tests and provocations, US President Donald Trump—not known for tempered behavior himself—said:

"[North Korea] will be met with fire and fury like the world has never seen".

According to Trump's aides, the President's words were ad-libbed, improvised in the heat of the moment. In response, Kim Jong-Un threatened to create "an enveloping fire" around Guam, a US protectorate.

Though a full scale war appears unlikely, the rhetoric is worrying. But apparently not so much for the S&P 500.

Impending Trade War?

An actual war would obviously be disastrous for both nations as well as nearby Asian neighbors. Were that to occur, the economy and stock market would be the least of our worries. However, there's a potential economic war brewing as well. Trump fired the first 'shot' early Sunday morning, September 3rd, via Twitter:

Of course, any country doing business with North Korea includes, Russia, South Korea and, well, the US's largest trading partner – China. Not only is China "doing business" with North Korea, it single-handedly sustains the isolated country, accounting for 4/5 of North Korea's total trade volume.

Trade volume between the U.S and China is estimated at nearly $650 billion a year in goods and services. Almost everything is bought and sold between the two countries, creating an important co-dependence that obviously leads to a more stable relationship, making them less prone to go to war. In short, the U.S simply can't cut off North Korea from China without crippling itself by severing its own ties from the Asian giant.

Naturally, the impact of a trade war would be reflected in the stock market, both on a macro level but also on a smaller, per-company scale. For example, Apple (NASDAQ:AAPL) would struggle to manufacture its iPhone 8 without the Chinese factories which handle the smartphone's production and assembly. Apple without an iPhone is not the Apple currently valuated at $837 billion dollars, nor would its valuation remain anywhere close to that if it couldn't deliver on its flagship product.

Similarly, almost all chip manufacturing, which includes makers such as Qualcomm (NASDAQ:QCOM), Nvidia (NASDAQ:NVDA), and Intel (NASDAQ:INTC), would be effected.

Among non-tech companies, casinos would be hardest hit, with Wynn Resorts (NASDAQ:WYNN), Las Vegas Sands (NYSE:LVS) and MGM Resorts International (NYSE:MGM) taking major revenue and asset hits, since all three are heavily invested in Macao.

UN Sanctions Add Another Layer Of Complications

As well, the US is pushing for a UN Security Council resolution vote later today, imposing additional sanctions on North Korea, in advance of any additional missile launches. Such sanctions would include an embargo on oil, a halt to textile exports which are a critical component of the country's economy and a financial and travel ban on the country's leader Kim Jong-Un. This morning Pyongyang warned that the US will pay "due price" if harsh sanctions are enacted via the UN.

'Rational Markets' Surprised Before

How might markets handle all this? We often trust the collective knowledge of the market a little too much, and assume the aggregated decisions of traders and investors are a reliable indicator of future event risk.

This has been proven false on several occasions, especially within in the past year or so. The surprise Brexit referendum result and the unexpected outcome of last November's US elections are two prime, and very recent, examples. Though both the UK's FTSE and S&P 500 Futures moved down on the immediate news, both corrected quickly afterward. And shortly after the US news was fully 'digested,' a new SPX bull emerged, bringing us to the all-time highs we're seeing now.

Defense Stocks An Early Warning?

Clearly, the market as a whole prefers to play it cool. Whereas one would assume the US's benchmark indices would plunge in advance of the potential—and very serious—risks, they've blithely meandered higher. Investors in defense industry stocks however, have responded very differently to the ongoing North Korean threat.

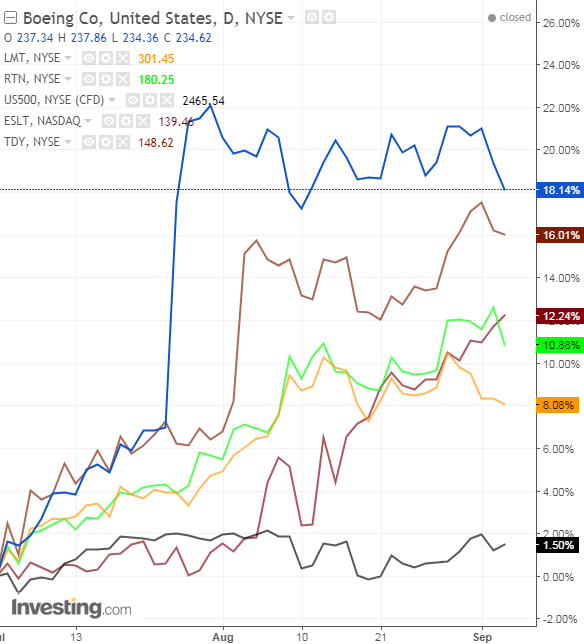

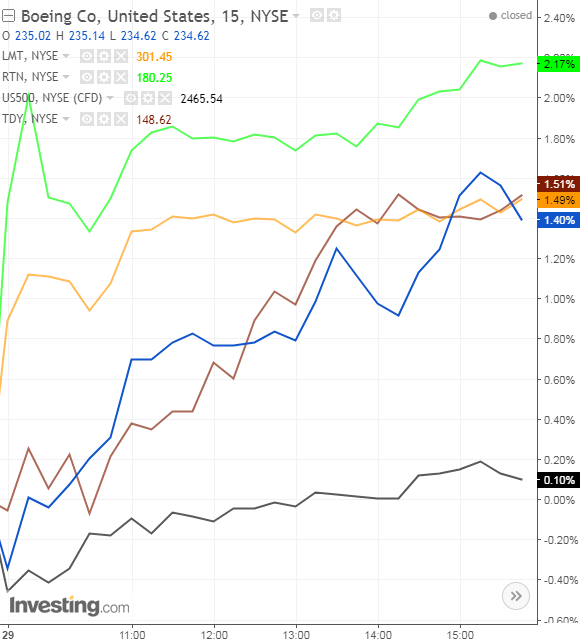

On July 4, the day of the first ICBM missile launch by North Korea, defense stocks responded sharply. Most major defense corporations finished the day up more than one-percent whereas the S&P 500 stagnated on the news, finishing the day barely 0.3% lower.

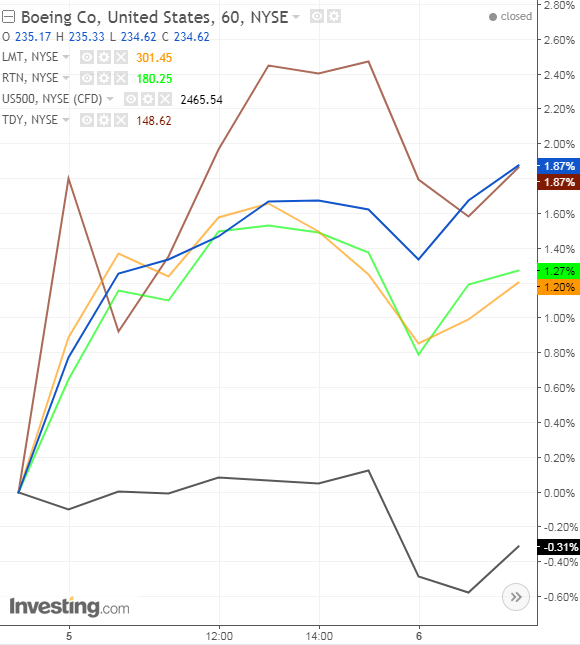

Almost all defense stocks jumped again on August 29, when North Korea launched a missile over the north of Japan. Again, the reaction is consistent with what we've seen so far – defense stocks up 1.4-2% on the news, while the S&P shrugged it off, finishing +0.1% on the day.

Since then, as the language has become more bellicose and threats bolder, defense stocks have continued to advance. Almost all major defense corporations are higher than where they were in early July (see chart, at top). Lockheed Martin (NYSE:LMT) is up 8%; Raytheon (NYSE:RTN) has gained 10%; Elbit Systems (NASDAQ:ESLT) moved 12% higher; Teledyne (NYSE:TDY) is up 16%, and Boeing (NYSE:BA) jumped 18%.

It appears the market can "reward" companies for a potential future event without punishing the remaining members of the index for the possible future event risks generated by the same event. This doesn't seem like coherent and consistent behavior. If the risk of military escalation is priced in for some companies, ie defense stocks, shouldn't it then be priced in to the downside for the rest of the market?

This isn't to say that actual war with North Korea or even a trade war will start tomorrow, or even ever occur. It's just a reminder that the future is, by default, uncertain.

Is it possible the S&P 500 will drop by a thousand points on the threats of a dictator? Of course not.

However, there is clearly some sort of escalation going on, as signaled by both North Korea's actions as well as shares of defense industry equities. Nevertheless, it appears that the US stock market as a whole continues to be irrational and inattentive to event risk surprises—much like it has in the recent past.