Early in another October week, the oil market continues rallying and reaching new highs. Brent has already broken $86 and this growth is not over yet – the possibility of the oil prices collapse is very low.

The “wild” and stable demand for the oil remains the key trigger for this rally. The global economy requires energy while experiencing a supply shortage. This is what makes oil prices go up.

The latest data from Baker Hughes showed that the Total Rig Count in the US dropped for the first time in seven weeks: the indicator lost 2 units, down to 443.

OPEC+ is going to have another meeting next week, which means that investors will hear plenty of different comments about oil production and demand parameters in the coming days.

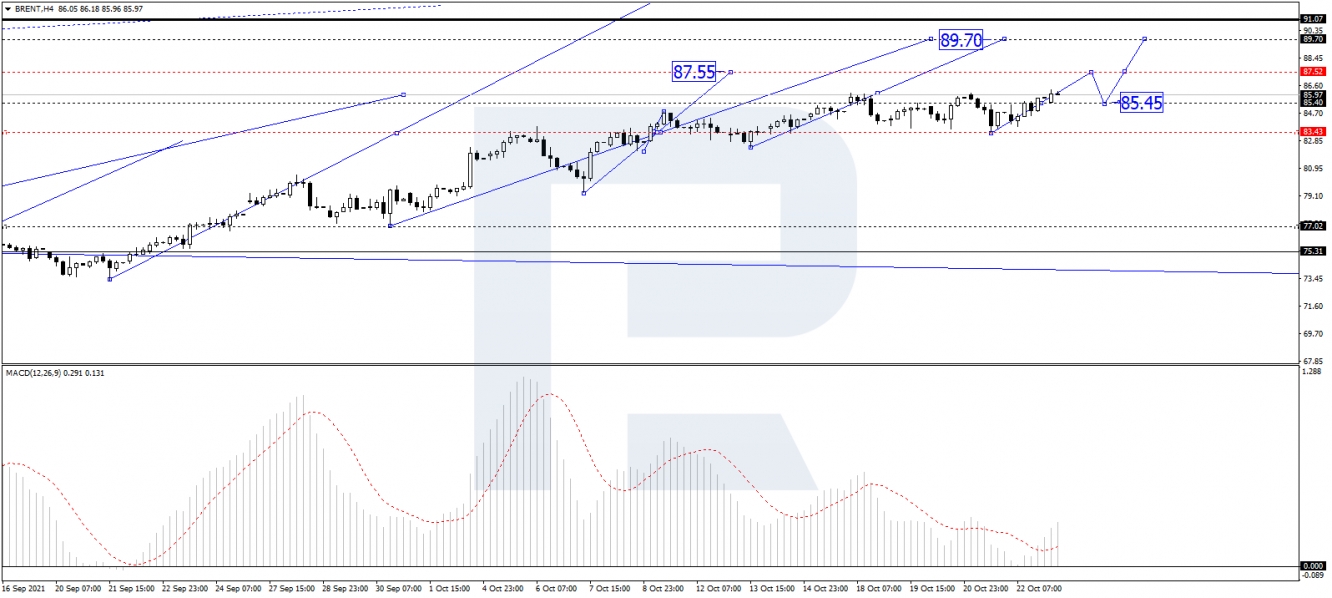

In the H4 chart, after completing the correction at 84.43 and rebounding from this level, Brent is growing to reach the upside border of the consolidation range at 86.00. Today, the asset may break 86.20 and consolidate there. Later, the market may break this range to the upside and form one more ascending towards 88.00 or even reach the target at 90.00. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is moving above 0 within the histogram area and may continue growing towards new highs.

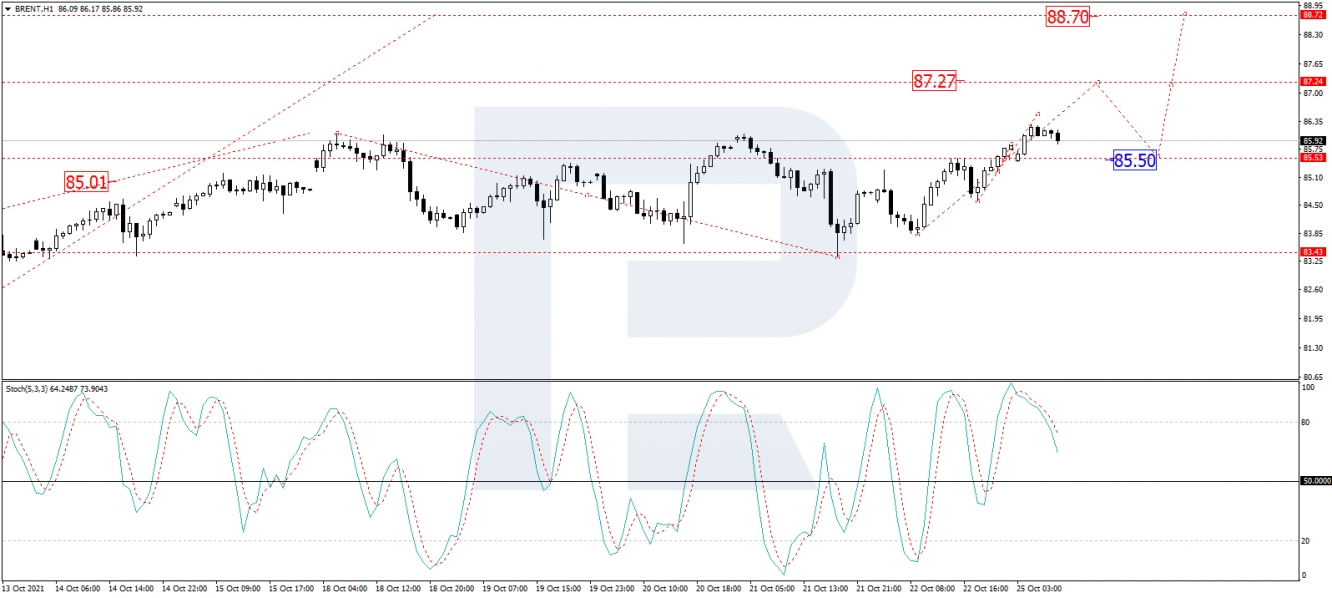

As we can see in the H1 chart, after forming a new consolidation range around 85.50 and breaking it to the upside, Brent is expected to trade upwards with the target at 87.27. After that, the asset may start a new correction towards 86.00 and then resume growing to reach 90.00. From the technical point of view, this idea is confirmed by the Stochastic Oscillator: its signal line is moving below 80 and may fall a little bit to reach 50. After that, the line may rebound from the latter level and start another growth towards new highs.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.