In H122, Checkit (LON:CKT) made further progress in its strategy to become a pure SaaS business, with 16% h-o-h growth in annual recurring revenue (ARR) and 13% group revenue growth year-on-year on a normalised basis. Management reiterated that it continues to invest in sales, marketing and product development to take advantage of the opportunity in the deskless worker software market. We maintain our forecasts pending H122 results.

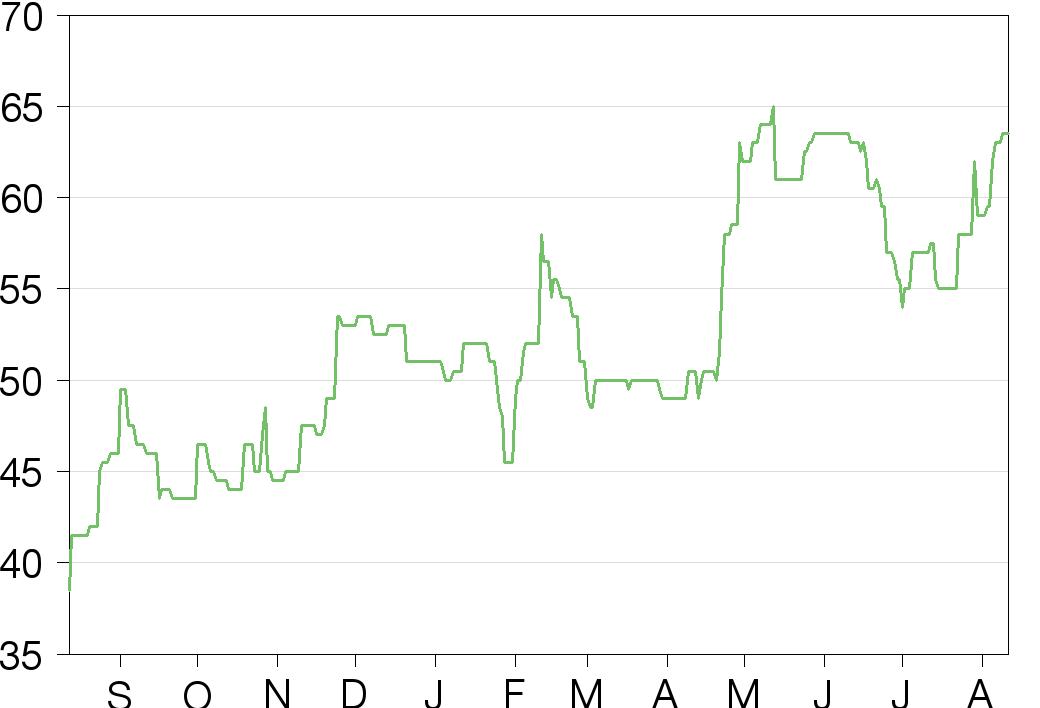

Share price performance

Business description

Checkit optimises the performance of people, processes and physical assets with connected digital solutions. It is headquartered in Cambridge, UK and has its operations centre in Fleet, UK.

ARR growth of 16% h-o-h to £6.6m

Checkit disclosed revenue of £3.6m for Q222: group revenue grew 9% y-o-y on a normalised basis and 24% on a reported basis. H122 revenue grew 13% on a normalised basis, with 10% growth for Checkit Connect (core business +12%, Checkit US -2%) and 19% growth for Checkit BEMS. ARR at the end of H122 was £6.6m, up 16% h-o-h. Cash at the end of H122 was £8.5m.

Recurring revenue continues to grow

Recurring revenue made up 44% of Q222 revenue and 39% of H122 (Checkit BEMS undertook a one-off project that boosted non-recurring revenues in Q122). While Checkit US saw a decline in revenue in H122, in constant currency the business grew. Checkit US H122 recurring revenue grew 13% y-o-y as a result of new subscriptions. The core Checkit Connect business saw 32% y-o-y growth in recurring revenue in H122 as new subscriptions went live; at the same time, non-recurring revenue declined 35% y-o-y, reflecting the shift to a subscription model. The company noted that Checkit BEMS is likely to see lower revenue in H222, with the focus of the BEMS business increasingly on smart building technology through the Checkit Connect platform. When its transformation is complete, management expects to merge the BEMS business with Checkit Connect. We maintain our forecasts pending Checkit’s H122 results on 16 September.

Valuation: Sum-of-parts suggests upside

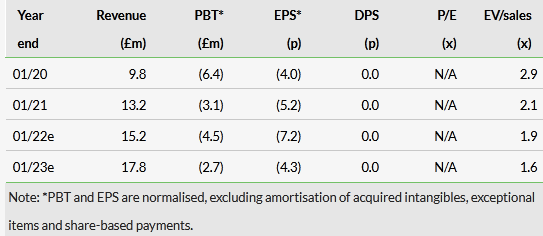

On an EV/sales multiple of 1.9x for FY22e and 1.6x for FY23e, Checkit trades at a significant discount to the UK software sector (5.7x current year sales). On a sum-of-the-parts basis attributing EV/sales multiples that better reflect the performance and prospects for each division, we estimate the stock is significantly undervalued. For example, using a 4x FY22e multiple for Checkit Connect and 1x for Checkit BEMS would result in a valuation of 83p per share.

Click on the PDF below to read the full report