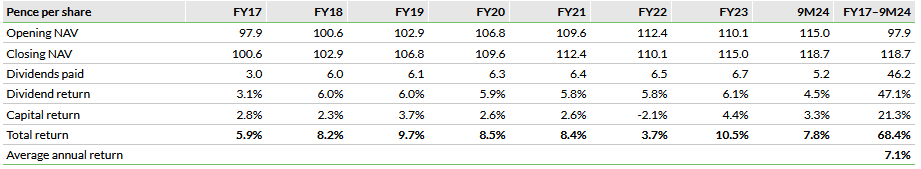

Care REIT (Care) (LON:CRT), formerly Impact Healthcare REIT, and its tenants continued to perform strongly in Q324. The quarterly EPRA net tangible assets (NTA) return of 2.1% took the year-to-date total to 7.8%, while rent cover increased to 2.3x. Care is well on track to meet its FY24 DPS target of 6.95p (+2.7%), fully covered by adjusted ‘cash’ earnings, with a yield of 8.3%. The company has also announced two new investments, including forward funding the development of a new, high-quality home, at an accretive blended yield in excess of 8% with strong valuation potential.

Note: *EPRA earnings exclude fair value movements on properties and interest rate derivatives. **P/NAV and yield are based on the current share price.

Strong financial and operational performance

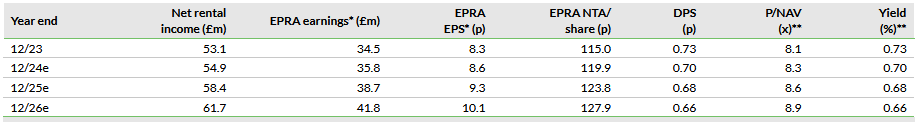

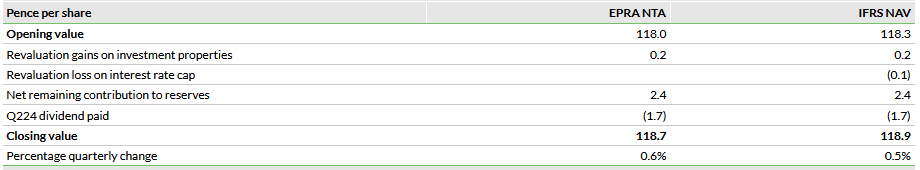

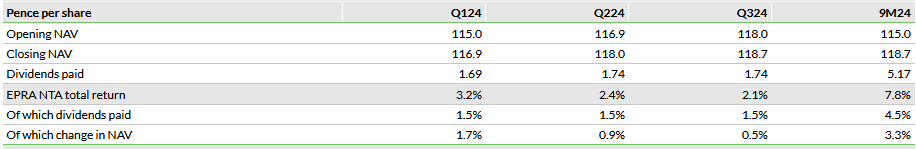

Q324 NTA total return of 2.1% (2.0% on an IFRS basis) comprised a 0.6% increase in NTA per share to 118.7p and dividends paid of 1.7375p. FY24 is well on track to be another strong year of returns (FY23: 10.5%), building on a consistently positive performance since listing in 2017, even through the COVID-19 pandemic. The drivers of performance, income and dividends as well as NAV growth, continue to be indexed to rent uplifts and accretive asset management, while 93% of borrowing costs are fixed or hedged. Tenant performance is benefiting from good levels of home occupancy and strong fee growth. The transfer of all seven of the turnaround homes to experienced, long-term operators will provide a significant uplift to cash rental income, the basis for dividend decisions.

Acquisitions are accretive and portfolio-enhancing

Care operates in a structurally supported market, where care demand is driven by the demographics of a growing elderly population. It addresses this market broadly, by acquiring homes at low capital values, generally well below replacement value, which can be let at affordable rents, while still generating an attractive yield. Asset management, to enhance the quality of the assets, provides additional opportunities to increase rents and create value, with Care successfully targeting a cash yield of at least 8% (with additional potential for capital gain). This sets a high benchmark for alternative capital allocation, which the two new investments meet. They are accretive to earnings and the new development in particular enhances the overall quality and sustainability of the portfolio. With a yield on investment at well above the portfolio average of 6.95% there is a strong potential for capital growth at completion, which we expect by the end of 2025.

Valuation: Income-driven, long-term returns

The FY24 DPS target represents an attractive yield of 8.3%, which we expect to again be fully covered by adjusted ‘cash’ earnings. Meanwhile, the shares trade at a c 30% discount to Q324 NAV per share.

Additional details on financial performance and returns

Rental growth continues to drive performance. Reviews completed in Q324 were at a blended uplift of 3.6%, adding c £0.2m to contracted rent roll, offset by the disposal of non-core assets. In July, Care exchanged contracts to sell five non-core properties for a combined £8.8m, in line with valuation. The sale of two of these completed in Q3 for £4.5m, following CQC re-registration, and we expect the sale of the remaining three properties, for £4.3m, to complete in Q125.

The portfolio value increased by 1% in the quarter as a result of the rental uplifts and a slight tightening in the EPRA topped up net initial yield to 6.95% from 6.98% in Q2.

Exhibit 1: Quarterly movement in NAV/NTA

Source: Care REIT data, Edison Investment Research

The positive valuation performance has driven positive total accounting returns in each quarter year to date, representing an aggregate nine-month EPRA NTA/accounting return of 7.8%. On an annualised basis, the FY24 return is close to matching the strong level of FY23.

Exhibit 2: Quarterly EPRA NTA total return

Source: Care REIT data, Edison Investment Research

The year-to-date EPRA NTA total return continues a strong track record since Care listed in March 2017, with an average of 7.1% pa. Even in 2022, the worst year for commercial real estate valuations in over a decade, Care’s robust cash flows enabled the company to report a dividend-driven total return of 3.7%. Since listing, progressive dividends have generated 70% of returns.

Exhibit 3: Consistently attractive EPRA NTA total returns

Source: Care REIT data, Edison Investment Research

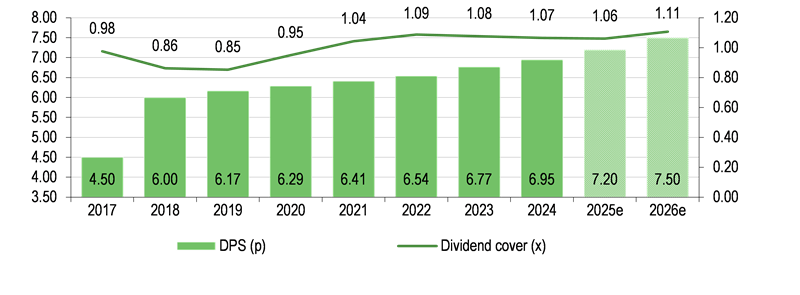

Dividend distributions are based on adjusted ‘cash’ earnings which excludes the positive impact of non-cash IFRS rent smoothing. Dividends have been fully covered by EPRA earnings, which includes rent smoothing, in each year since listing and, as cash rents have continued to increase, have been well covered on an adjusted ‘cash’ basis. We expect this to continue.

Exhibit 4: Progressive dividends and cash cover

Source: Care REIT data, Edison Investment Research. Note: For 2024, Care REIT targets 6.95p in aggregate earnings and has already paid three quarterly dividends of 1.7375p each.

Acquisitions are accretive and enhance the portfolio

The two homes invested in since Q324 are both let to Prestige. Prestige is an existing tenant of the group and already operates five of the group’s homes.

At Bedale, in North Yorkshire, Prestige is developing a new, high-quality, 72-bed home that will be a fully electric property and is expected to have an EPC rating of A. Prestige has contracted to lease and operate the home at completion on a 35-year indexed lease. Care will forward fund the development, which at completion will be delivered by Prestige at a maximum cost of £8.7m or an attractive £121k per bed.

Care will also acquire from Prestige, in a sale and leaseback transaction, Middleton Manor, near Darlington. The home has 83 beds, all with en-suite bathrooms, and an EPC rating of B. The lease term is 35 years. Of the up to £5.9m consideration, £2.1m is deferred, contingent on the future performance of the home. If made, the deferred payment will be reflected in additional rental income.

Care says that on a blended basis the properties are being acquired at a yield in excess of 8% which it expects to be both income and capital accretive. Although Care has not broken down the yield by asset, given its 8% hurdle rate on new investments, we do think there is a material yield difference between the two, which compares with the current portfolio EPRA topped up initial yield of 6.95%. Valuing the Bedale development in line with the portfolio average indicates capital upside of well above 10% on completion.

The consideration for Middleton Manor and initial outlay for Bedale can be substantially funded from existing cash resources, including the £8.8m proceeds from the sale of non-core assets, as well as available revolving credit facilities. Even if fully debt funded, there is a healthy yield spread over the marginal cost new variable borrowings, and rents will increase with indexation. Care’s marginal borrowing cost is currently 6.75% pa (SONIA plus a margin of 2%) but based on market expectations this should decline. The five year SONIA swap rate is c 4%.

Care highlights the similarities between the announced transactions and those previously undertaken with Prestige. In 2019, Care acquired Yew Tree Care Centre in Redcar for £2.8m and subsequently contracted to forward fund the development of Merlin Manor, a new £6.1m 94-bed care home in Hartlepool, both let to Prestige. Merlin Manor was Care’s first forward-funded development, enabling it to bring new, high-quality and affordable care accommodation to the market while also generating attractive financial returns. The IRR on the Merlin Manor investment life-to-date is above 20%. Working closely with Prestige, a substantial asset management initiative at Yew Tree was recently completed. At a cost of £2.5m, monetised in line with Care’s minimum cash target return on investment of at least 8%, a new 25-bed dementia unit has increased the overall number of beds to 101.

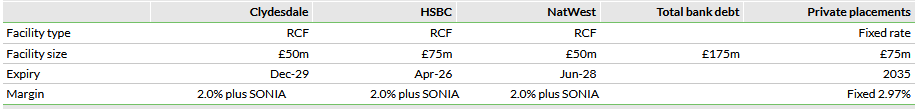

Moderate gearing and mostly fixed borrowing costs

Drawn debt was £189m at end-Q324, out of committed facilities of £250m, with 93% of the costs fixed or hedged, at an average 4.6%. There is no debt maturity until 2026 (a £75m revolving credit facility), although a £50m interest rate cap (at 4%) expires in January 2025, for which Care is reviewing options, which are likely to include increasing the share of longer-term fixed rate funding. Meanwhile, with interest rates forecast to fall further, we do not expect any significant impact on earnings, which will in any case continue to benefit from rental uplifts.

Exhibit 5: Summary of debt portfolio

Source: Care REIT

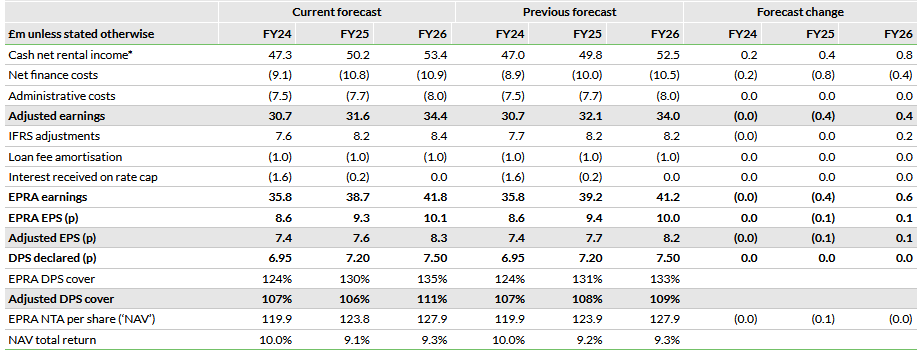

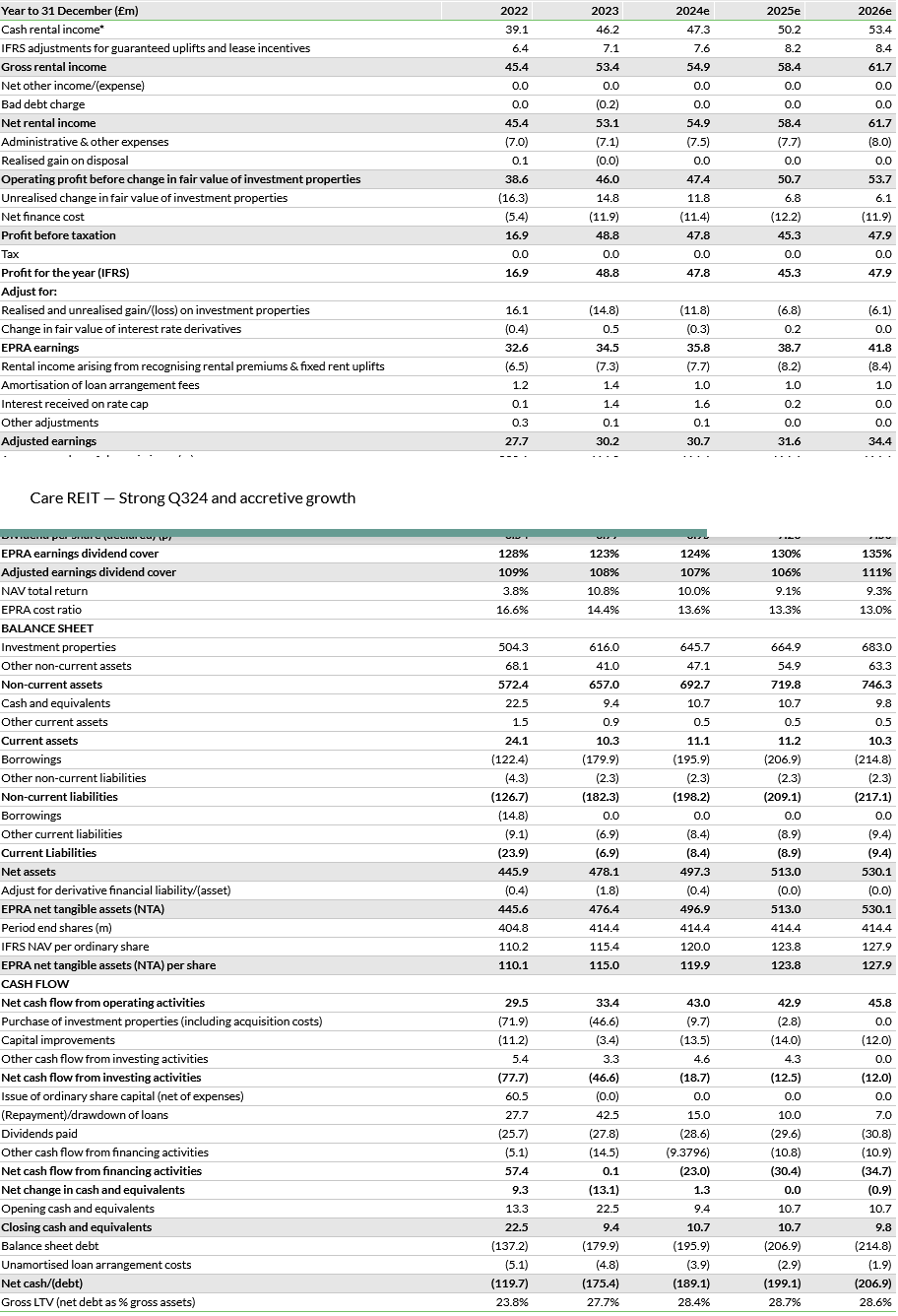

Forecasts and valuation

The Q324 update is consistent with our full-year forecasts and the announced transactions have a modest positive impact on FY26 as the newly completed development contributes for a full year.

Most importantly, we expect further growth in full cash-covered DPS and in EPRA NTA per share. EPRA NTA growth reflects the positive impact of rental growth on property valuations with an unchanged yield. With interest rates expected to decline further, in combination with high average tenant profitability and affordable rents, there appears material scope for the portfolio yield to tighten from the current 6.95% and for property values to increase by more than we forecast.

Exhibit 6: Forecast summary

Source: Edison Investment Research

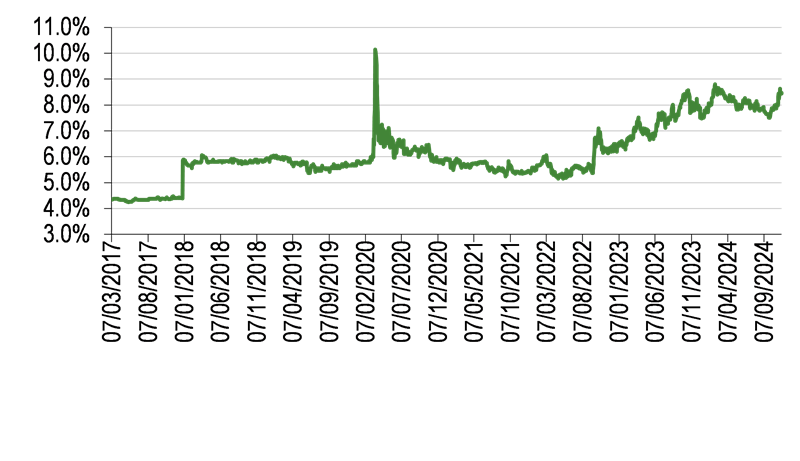

Valuation continues to trail financial returns

For FY24, Care is targeting a DPS of 6.95p (+2.7%), fully covered by adjusted ‘cash’ earnings. This represents an attractive yield of more than 8%. Meanwhile, the shares trade at a c 30% discount to Q324 EPRA NTA per share of 118.7p. Given the prospects for continuing growth in fully covered dividends, the relatively high yield on assets combined with the likelihood of further interest rate declines and the potential for capital gains, this appears a very undemanding valuation.

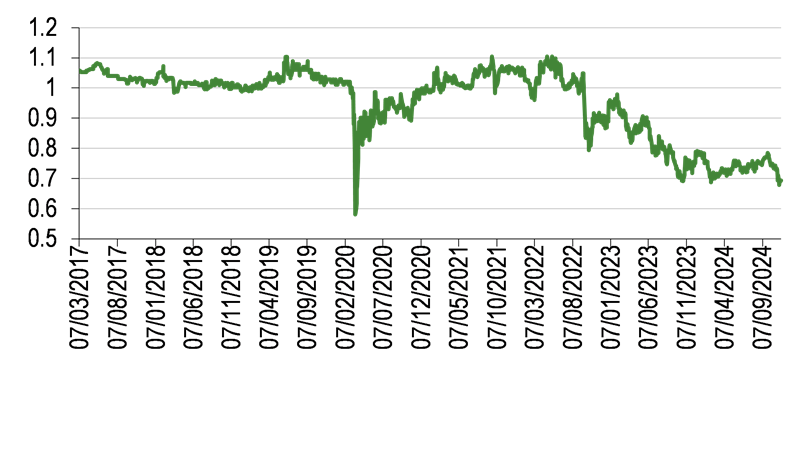

Exhibit 7: Dividend yield since listing

Source: Company DPS data, LSEG Data & Analytics prices

Exhibit 8: P/NAV since listing (x)

Source: Company NAV data, LSEG Data & Analytics prices

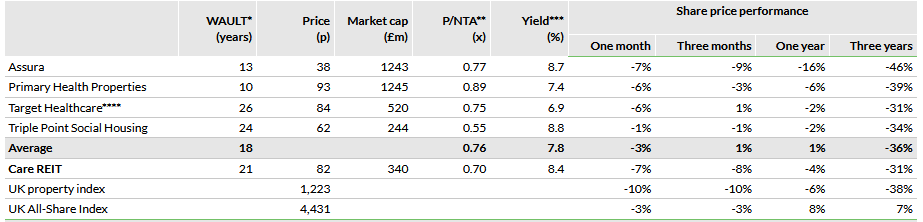

Exhibit 9 shows a summary of the performance and valuation of a group of real estate investment trusts (REITs) that we consider to be Care’s closest peers within the broad and diverse commercial property sector. The group is invested in the primary healthcare, supported housing and care home sectors, all targeting stable, long-term income growth derived from long lease exposures. For consistency, NAV and DPS data are presented on a trailing basis and do not fully reflect DPS targets. Over the past three years, in terms of share price performance, the group has slightly outperformed the broader property sector but has materially underperformed the UK equity market.

Exhibit 9: Peer group comparison

Source: Historical company data, LSEG Data & Analytics. Note: *Weighted average unexpired lease term. **Based on last published EPRA NTA/NAV per share. ***Based on trailing 12-month DPS declared (except for target).

Based on the H223 target yield, annualised. LSEG Data & Analytics price data at 20 November 2024.

Exhibit 10: Financial summary

Source: Care REIT historical data, Edison Investment Research forecasts