It’s Friday in the Wall Street Daily nation. And longtime readers know what that means…

We’re taking a break from our typically long-winded commentary (keep the hallelujahs to yourself) and instead cherry-picking a few graphics to convey some of the week’s most important economic and investing news.

Or more simply, we’re going for less talking and more graphics.

This week, we’re also mixing in some 1980s music references. So a virtual mixed media investment mash-up awaits you.

It involves another friendly reminder to steer clear of Wall Street’s hyped-up IPOs, as well as the only asset worth buying on weekends. Yes, weekends.

Seeing that it’s Friday, you shouldn’t tarry any longer…

Snap, Crackle, Drop

File this in the “We Told You So” folder.

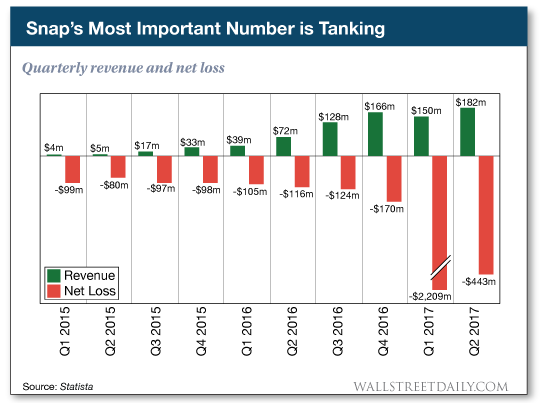

Even though the newest social media company to come public posted a 153% increase in sales, Snap’s (NYSE:SNAP) profitability is heading in the opposite direction. Fast.

During the second quarter, Snap’s losses almost quadrupled to $443 million.

If share prices ultimately follow earnings — and they do, as evidenced by Snap’s 13% post-earnings report sell-off — there’s not a single reason to own the stock.

I take that back. If you like living on a prayer, Bon Jovi style, there’s a chance Snap eventually gets acquired, as I shared on CNBC recently.

And there’s legitimately a chance that happens. Before the company ever came public, Facebook (NASDAQ:FB) reportedly offered $3 billion to buy it. And more recently, Alphabet (NASDAQ:GOOGL) is rumored to have offered $30 billion.

In case you’re wondering, Snap is currently trading at about a $15 billion valuation. Management’s refusal to double shareholders’ money and call it a day would trouble me if I owned the stock.

Such stubbornness could ultimately result in lower shares prices and much lower takeover offers.

Bottom line: Snap should have never had a “Buy” rating from Wall Street. It certainly didn’t get one from this guy. I’m convinced there’s more downside ahead.

Look Out Weekend, Here Bitcoin Comes

When the closing bell rings on Friday, most investors are trained to think the gains are gone until Monday morning. Think again!

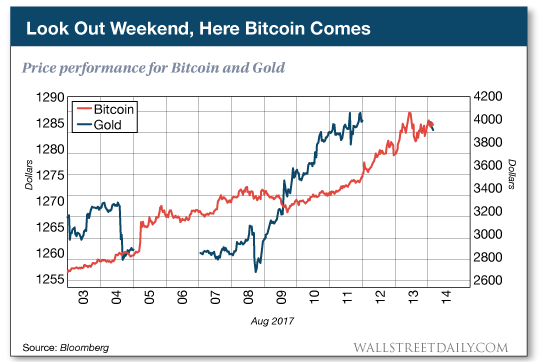

Over the last two weekends, bitcoin surged to record highs.

The cryptocurrency has more than quadrupled since the beginning of the year.

Meanwhile, the more traditional alternative currency, gold, has barely budged, climbing only 12% year to date.

Is it too late to get in on the cryptocurrency profits? Not hardly!

As you know, I’m presently hyper-bullish on cryptocurrencies. Especially a few that are trading for pennies on the dollar.

You see, in addition to bitcoin, there are over 1,000 cryptocurrencies, all of which represent fresh opportunities for quadruple-digit gains.