Figures suggest that Asia is leading the way in fintech investments, paving the way for a future of unprecedented borderless convenience across the continent.

Across 2021, India dominated in fintech investments across the Asia-Pacific region, raising some $5.94 billion over 236 deals throughout the year, according to the 'APAC Fintech Funding Report' published by S&P Global (NYSE:SPGI) Market Intelligence.

The past year has also seen fintech investments in nations like Singapore grow 47% year-on-year to reach $3.94 billion in 2021, with emerging technologies like blockchain and crypto amounting to nearly half of the funds raised - amounting to $1.48 over 82 deals alone.

The APAC Fintech Funding Report has also suggested that venture capital investments across the Asia-Pacific region have grown to a record $15.69 billion in 2021 - which is almost three-times its 2020 total of $5.87 billion.

(Image: Consultancy.eu)

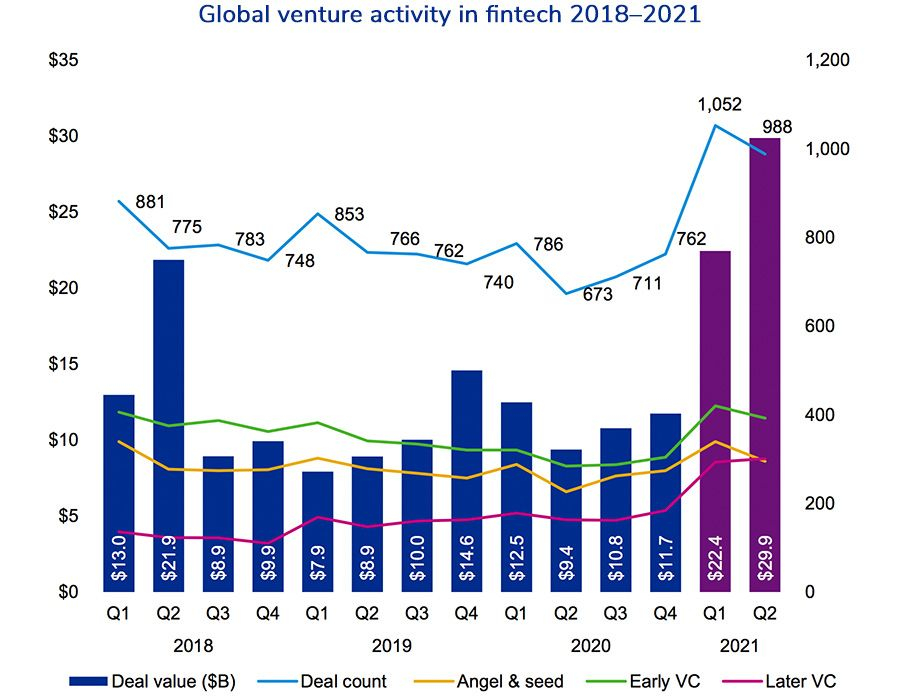

The growth of Fintech investments in Asia follows a similar trend around the world. As the chart above shows, global venture activity in fintech reached new highs throughout the early stages of 2021 - with more than 2,000 deals occurring over the first half of the year alone.

Early venture capital recaptured levels that hadn’t been seen since 2018, whilst later VC accelerated to new highs.

In India, payment intermediaries that enable online and offline merchants to accept different payment methods were among the top three fundraisers in 2021, with each firm securing multiple funding rounds throughout the year.

For instance, Pine Labs Pvt Ltd raised $700 million over two fundraisers, whilst Razorpay Software Pvt Ltd gained $535 million across three investment rounds. Resilient Innovations Pvt Ltd, which operates as NharatPe, completed two equity rounds amounting to $477 million.

The 2021 fundraising totals represents a 74% leap from pre-pandemic levels from 2019. "While large rounds of at least $100 million accounted for nearly 54 per cent of total transaction value in 2021, a spike in deal volume also contributed to the surge in aggregate amount raised," the report noted.

Across 2021, fintechs in the Asia-Pacific region completed 754 deals in 2021, which is up some 81% from 2020 and 2019 respectively.

The regional enthusiasm for fintech funding is likely to lead to faster innovations across Asia’s financial landscape. This may bring developments in blockchain technology, open banking and borderless transactions over the course of the coming months and years.

Revolut’s Path to Global Dominance

We’re already seeing rapid fintech growth in Asia and especially India, which has invested nearly $6 billion in the industry. India’s burgeoning relationship with fintech has paved the way for Revolut to grow into the region. Having arrived in India in April 2021, the leading challenger bank intends to take on companies from banks to new-age fintechs by offering its suite of services to Indian markets.

The fintech giants gained $800 million in funding from a Tiger Global and SoftBank-led fundraiser in July 2021, paving the way for a valuation of $33 billion. Of the $800m raised, Revolut put aside $45 million as an initial investment in India, and the startup intends to recruit 300 workers by the end of the year to serve Indian and Asia-Pacific markets.

The expansion into India is set to be spearheaded by Paroma Chatterjee, who has been drafted in as CEO for Revolut in India. In a recent interview with Moneycontrol, Chatterjee said:

“The way we have planned out the roadmap is to initially launch with cross-border remittances because that’s where we bring in the differentiation, as well as domestic remittances. We will have a borderless remittance solution plus payments in the form of cards that will be issued through the app.”

“Post that we will get into trading and investments, which is the next fastest-growing segment in India as well as globally. The differentiation we can bring in there is to allow Indians to invest in foreign stocks. Then, we will evolve into offering credit for the retail as well as business-to-business segment. Once we have managed to make a meaningful presence in these verticals, then it will be a logical step to take a leap into forming a full-fledged digital bank,” Chatterjee added.

Cross border payments are big business in Asia due to the volume of remittances that families receive from around the world. As Chatterjee explains, Revolut has already identified the potential of delivering a low-cost infrastructure for remittances, but the future is likely to bring more options and versatility in the services available for cross-border transactions.

As an example, developing fintechs like Connectum has the power to deliver multi-currency processing solutions for individual users and enterprises alike, all within a dedicated 3D-Secure AI-driven anti-fraud system to ensure that money can safely travel beyond borders without the fear of it falling into the wrong hands.

Over the coming months, we’re likely to see more advances being made across Asia as these big-money fundraising rounds begin to come to fruition. For a region that has much to gain from borderless banking, the growth of fintech services throughout the continent is set to pave the way for greater prosperity among citizens - and building a healthier economy throughout the continent in the process.