On Tuesday in Sydney, the Reserve Bank of Australia held its cash rate steady at the record low 1.50%, as widely expected. Little was changed in the RBA’s new rate statement except that the central bank removed references to a strong Australian dollar being a source of pressure on the economy, as well as the assessment that inflation would likely remain low. With those omissions, the statement skewed slightly towards the hawkish side, but ultimately was not enough to keep the Australian dollar afloat in the face of a rebounding US dollar, even despite earlier Australian retail sales numbers and China services PMI data that both beat estimates.

Looking ahead this week, several key data releases will likely have a significant impact on AUD/USD. On Wednesday in Australia, Q3 GDP will be released (+0.7% expected). In the US, Wednesday brings the November ADP private employment report (around +190,000 jobs expected), a precursor to Friday’s official jobs data. Thursday features Australian trade balance data for October (+1.41B expected). Finally, Friday brings the highly anticipated November US jobs report, centering on the headline non-farm payrolls number (around +200,000 jobs expected), unemployment rate (4.1% expected), and average hourly earnings (+0.3% expected). Aside from these key data points, the US dollar will also be driven by any progress (or lack thereof) on US tax reform.

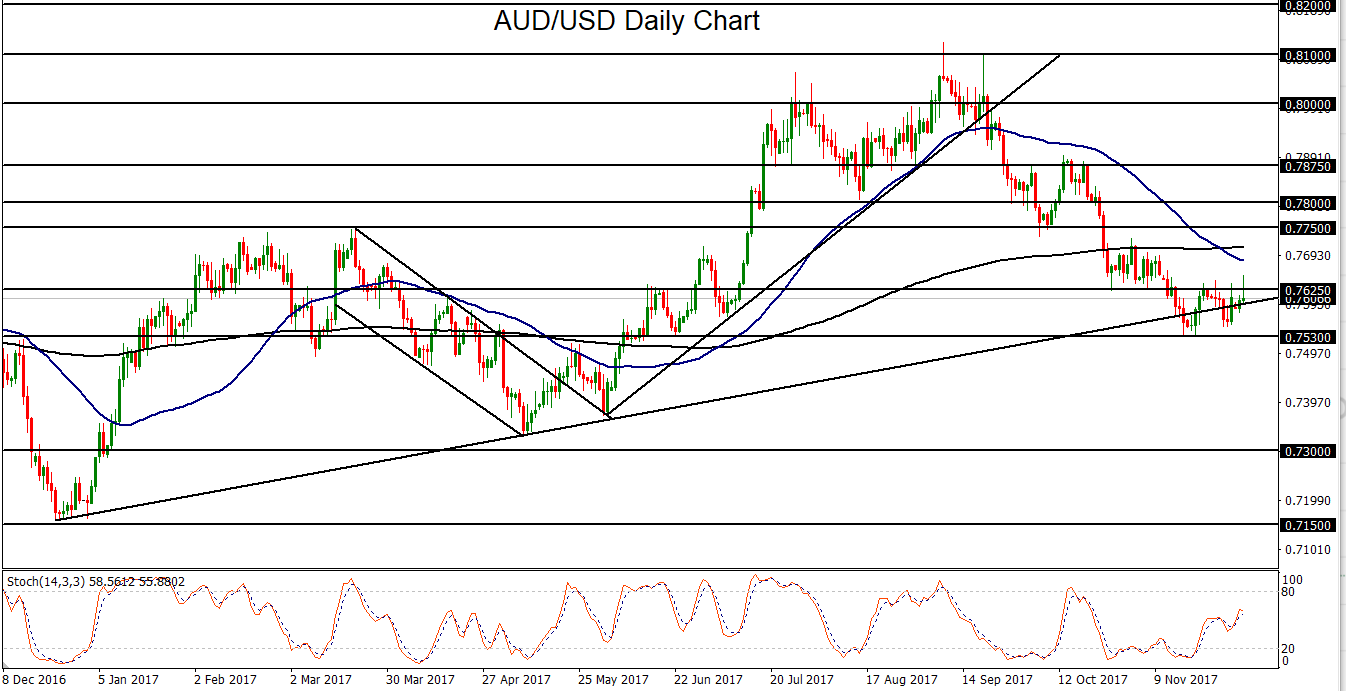

From a technical perspective, AUD/USD has been entrenched in a strong bearish trend since the early September high around the 0.8100 handle. On a longer-term basis, the currency pair still trades largely within a bullish trend as outlined by an uptrend line extending back to the lows one year ago in December of 2016. The past few weeks have seen AUD/USD fluctuate above and below this trend line without yet making a decisive breakdown. With any data-driven downside move for AUD/USD, or USD-positive developments in US tax reform that would pressure the currency pair lower, a key trigger level to watch for a potential breakdown lies around the 0.7530 November lows.

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.