by Jason Martin

Even as the U.S. Congress and White House rush to put the final rubber stamp on tax reform before the end of the year, and even with a potential government shutdown looming on December 22 (House Republicans introduced a temporary stop-gap spending bill on Monday to fund the government to push back what was initially a December 8 deadline; the measure is expected to be passed by the end of the week), there remain other issues on President Donald Trump’s plate that, though still hovering in the background, could well affect the future path of the American economy and, consequently, stocks.

1. NAFTA Still Unresolved

The North America Free Trade Agreement (NAFTA), adopted in 1994, was intended to create a North American market where goods could move across borders between the U.S., Canada and Mexico tariff-free. As part of his presidential campaign, Trump threatened to withdraw from the accord unless it was made “fairer” for the U.S., claiming that it had dented American manufacturing and caused a $60 billion trade deficit with Mexico.

One of the major sticking points in negotiations has been the U.S. insistence on the rules of origin for the auto industry. The U.S. wants to raise the minimum threshold for sourcing auto production to be 85% from NAFTA members and 50% of the total from the U.S. itself, compared to the current agreement for 62.5% to be sourced from the member countries.

U.S. automakers are actually lobbying against the plan. In a November 27 meeting with Vice President Mike Pence, executives from Ford (NYSE:F), General Motors (NYSE:GM) and Fiat Chrysler (NYSE:FCAU) asked for the idea to be scrapped, arguing that it would add thousands of dollars to car costs in the U.S.

Regardless, ending NAFTA without a deal would imply the return of the World Trade Organization rules on free trade, hiking tariffs between the three countries. There is further speculation that Trump’s “America First” agenda would lead to a hike in tariffs even beyond WTO guidelines, which could be mirrored by retaliatory tariffs from Canada and Mexico.

A November 27 report from the Bank of Montreal calculated that a failure to renegotiate terms would lead to a 0.2 net reduction in real U.S. gross domestic product over the next five years, while Canada would see a 1% decline.

The report further indicated that the U.S. industries to be hardest hit by the lack of a deal would be automotive, as prevailing agreements currently straddle all three economies, followed by textiles with Canada and Mexico accounting for 15% of U.S. manufacturers’ sales.

After negotiations in November failed to resolve any issues, so-called inter-sessional talks are scheduled for the week of December 11 in Washington. Those results would be reported to chief negotiators before a January 23-28 meeting in Montreal, Canada.

2. $1 Trillion in Infrastructure Policies on Tap

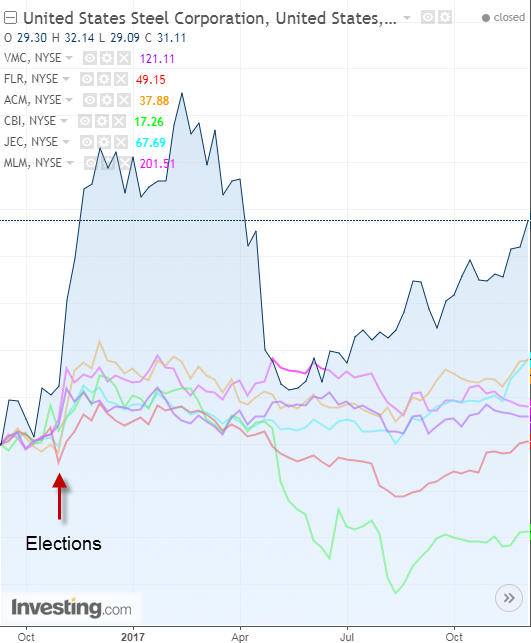

Infrastructure policies have been a part of Trump’s plans since day one of his presidency and his election caused an immediate furor in construction and materials firms, including United States Steel (NYSE:X), Vulcan Materials (NYSE:VMC), Fluor (NYSE:FLR), AECOM (NYSE:ACM), Chicago Bridge & Iron (NYSE:CBI), Jacobs Engineering (NYSE:JEC), and Martin Marietta Materials (NYSE:MLM)—on the back of increased proposals and funds for the sector.

As can be seen in the graph above, the aforementioned companies all received a boost in the run-up to the elections through the end of 2016. U.S. Steel saw the most dramatic rally though enthusiasm appeared to taper off as time moved on and policy promises had yet to materialize. Fluor and Chicago Bridge & Iron have also been unable to hold post-election peaks.

From a wider perspective, only the gains of 42%, 36% and 33% in U.S. Steel, AECOM and Jacobs Engineering beat the 23.35% return in the S&P 500 since the election, while all the other firms underperformed by more than half.

It was back in April of this year that President Trump renewed his promise for a “very big infrastructure plan,” tagged at being around no less than $1 trillion. As political battles have raged over other issues, none of those big tag policies have actually materialized. Trump did note on November 20 that he planned to unveil the massive plan after Congress pushes through tax reform. “We’ll be submitting plans on infrastructure… soon after taxes,” Trump declared from the White House.

To the President’s credit, he has moved forward with the Keystone pipeline and also streamlined regulations to speed up the permitting process for builders.

One of the major sticking points for the passage of infrastructure policy is interwoven with tax reform and the budget. Many Republicans are wary of the pricing for the $1 trillion dollar package. Originally, Trump hoped to achieve about $200 billion in federal seed money to incentivize private investment in the projects.

However, it is currently unclear not only whether politicians will give the green light on the government spending, but whether the tax bill already passed by the House, which eliminated the deduction for firms using tax-exempt private activity bonds, will form part of the final law. These are often used in public-private relationships to help build roads, highways, hospitals, airports, housing and other crucial projects. The elimination of the tax deduction, if included in the final compromise, may well disincentivize private company participation.

China’s own infrastructure policy, known as the Belt and Road Initiative (BRI), may serve to provide clues for the possible outcome of Trump’s planned investments, although the “America First” ideology is diametrically opposed to the BRI’s attempt to promote development and “economic cooperation” along five corridors out of China: land routes through Central Asia to Europe; to the Middle East, and Southeast Asia; and sea routes connecting Chinese ports to Europe and to the South Pacific.

The Belt and Road Initiative will benefit China, as well as other countries across the globe. In the first three quarters of this year, trade between China and economies along the route amounted to $786 billion, an increase of 15% year-on-year, according to a China Daily interview with Joao Mendes De Faria, president of the multinational mining firm Vale China.

Mendes calculated that Chinese businesses had increased their investment in the economies along the BRI by 29.7% to $9.6 billion, while those participating economies had upped their investment in China by 34.4% to $4.24 billion. He further noted that Chinese businesses had helped build 75 economic and trade cooperation zones in 24 markets along the Belt and Road, generating more than 209,000 jobs.

Pointing to number of BRI and Public-Private Partnerships as the major factors supporting the Chinese economy, Mendes emphasized that the infrastructure project “has greatly fueled economic growth”.

Markets are still awaiting the details of Trump’s massive plan, not to mention how it will be funded, but it appears clear that $1 trillion in infrastructure spending, if approved, would give a big boost to not only the American economy but to stocks that would reap the benefits.

3. Immigration Beyond the Wall

While most thoughts regarding Trump’s immigration policy naturally turn to his promise to build a wall between the borders of the U.S. and Mexico to stop illegal immigration (yet another topic intertwined with tax reform and spending policies as estimates range from Trump’s own $12 billion projection to price tags as high as $70 billion without including maintenance), many of the President’s first attempts at wider measures, such as the travel ban, have faced judicial resistance.

Just this last Monday, the Trump administration did win a small victory as the Supreme Court allowed a third version of its travel ban to go into effect while legal challenges continued. Despite two dissents from Justices Ruth Bader Ginsburg and Sonia Sotomayor who preferred to deny the request for the ban to go into effect, the Supreme Court approved the move, urging appeals courts to move more swiftly to decide on its lawfulness.

This allowance for the third ban means that the U.S. will be allowed to fully enforce restrictions on entry into the country from eight nations: Iran, Libya, Syria, Yemen, Somalia, Chad and North Korea. In essence, citizens of those countries will be denied entry to the U.S. although details vary on the restrictions. Many will be unable to emigrate permanently to the U.S. while others will be barred from working, studying or even vacationing in the United States.

To avoid drawn out legal battles on other immigration topics, the Trump Administration has concentrated this year on tightening current legislation. In the fight against what Trump considers to be unneeded competition for Americans from legal foreign workers, a Wall Street Journal article recently highlighted that the administration is more closely scrutinizing applications for the high-skilled visa program known as H-1B. According to the financial paper, more than one in four applicants between January and August received “requests for further evidence” compared to a year earlier under the Obama Administration when those requests were fewer than one in five.

The article suggests that the tactic was being used to purposely slow the process, thus reducing legal immigration via an increase in bureaucracy, rather than embarking on new legislative measures that could face political opposition.

According to the report, other methods to slow down the process have included ignoring past approvals for the same person—forcing renewals to take longer—requiring more applicant interviews which bog down the system, along with the suspension of premium processing which provided the opportunity to fast-track an application for a fee.

Further changes to regulations could also include the elimination of the right for the spouses of H-1B holders to work in the U.S. or allowing foreign graduates in science and technology from U.S. universities to work for an additional two-years.

H-1B visas are used to a large degree by tech companies who argue that these workers are needed to fill critical jobs, while opponents claim that they simply displace American workers, generally at cheaper compensation levels.

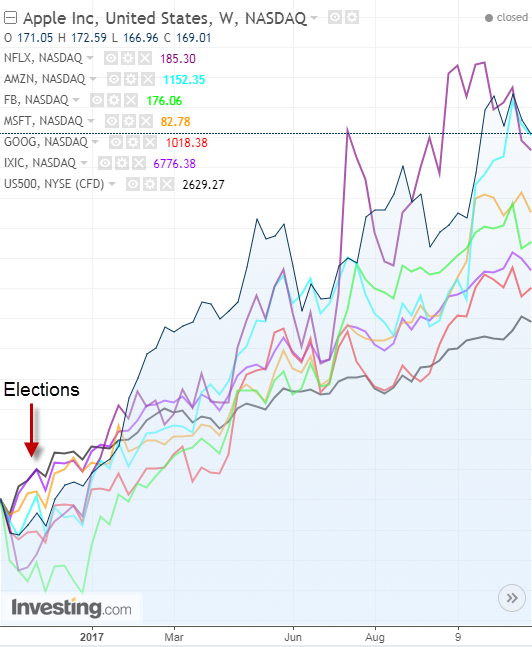

Tech firms initially took a hit following the presidential elections as market participants postulated that Trump policies would hinder their business. Obviously, those worries were not solely based on immigration, but also on overseas operations and other issues such as attacks from Trump when Apple (NASDAQ:AAPL) refused to unlock the iPhone of one of the San Bernadino shooters.

Still, what appeared post-election to be the start of a full-on feud between the President and Silicon Valley seems to have faded into the background. In fact, since the election, tech shares have led the Wall Street rally.

Unlike the materials and construction companies mentioned earlier whose returns have shown a mixed reading as they wait for policy follow-through, the graph above shows how top tech firms have skyrocketed. Apple has returned 53% since the elections, Netflix (NASDAQ:NFLX) 48%, Amazon (NASDAQ:AMZN) around 44%, Facebook (NASDAQ:FB) 38%, Microsoft (NASDAQ:MSFT) 34% and Alphabet (NASDAQ:GOOGL) 26%, compared to gains of 34.2% for the NASDAQ Composite and “just” 23.35% for the S&P 500.

Still ahead will be the outcome of Trump policies on tech stocks, whether he further clamps down on the firms' ability to access top tech talent outside of U.S. borders and whether he makes good on threats to force manufacturing back to the States.

With tax reform almost behind him and Congress expected to tackle spending before the end of the year, 2018 could see the door open for action on NAFTA, infrastructure and immigration with its consequences—whether bullish or bearish—for stocks.