We’ve heard a lot in the news about the re-emergence of inflationary worries, but investors appear to have made a collective decision not to take fright. They sending the markets higher, apparently in the unconscious belief that equity gains can outpace inflation.

The NASDAQ and S&P both started this week on an up note, and both indexes have shown solid year-to-date gains – ~11% on the NASDAQ, and 13% on the S&P. This is clearly outpacing the roughly 6% annualized inflationary trend.

Chiming in on the situation from Credit Suisse, chief US equity strategist Jonathan Golub lists several reasons for keeping a bullish attitude on stocks. Key among his list are the steady increase in economic activity and the high levels in both share price growth and reported EPS.

“While the pace of improvement is sure to moderate, growth is projected to remain well above trend through the end of 2022,” Golub noted.

Bearing this in mind, we’ve used the Investing Insights platform during our search for exciting growth names, according to the analyst community. Locking in on three stocks that fit the bill, each analyst-backed ticker stands to notch more gains on top of their impressive year-to-date climbs. Even better, these tickers score a ‘Perfect 10’ smart score.

Everi Holdings (EVRI)

We’ll start in the casino gaming niche, an industry that usually has no difficulty generating revenues. Everi Holdings (NYSE:EVRI), based in Nevada, is a major developer and manufacturer of games and other equipment for brick-and-mortar casinos. The company is well-known for its slot machines, and also produces a variety of fintech solutions for the casino, including software and devices for cash management, surveillance, and ATM and payment kiosks.

The economic reopening has been good for Everi, which has seen a 79% share price increase so far this year. The gains began in the second half of last year; after seeing revenues bottom out in 2Q20, Everi has posted sequential gains for three consecutive quarters.

The most recent quarterly report, for 1Q21, showed a top line of $139.1 million, the best since 4Q19 and second-highest result of the past two years. The company’s quarterly net income of $20.5 million was a record, and gave an EPS of 21 cents, beating the 4-cent estimates by a wide margin.

In recent months, Everi has announced several major installations, giving investors reason to believe that the company will continue to post growing revenues and earnings. The announcements include an agreement to install casino games and fintech systems at the Caesar’s Palace casino in Las Vegas, and a game installation, made public earlier this month, at the San Manuel Casino in Southern (NYSE:SO) California.

The company’s solid performance has attracted the attention of B. Riley analyst David Bain. The 5-star analyst rates EVRI a Buy along with a $15 price target. This figure implies a one-year upside of 54% from current levels.

“EVRI’s fintech creates unique, significant stock upside potential. EVRI is the leader in casino fintech with ~60% market share. Casino supplier peers lack fintech, which we believe has the potential to expand multi-fold through a shift toward cashless casinos with casino-branded digital wallets enabling migration off the casino floor—and even outside its four walls,” Bain opined.

The analyst added, “EVRI’s May 20th installation announcement of its jackpot management system at Caesar’s Palace not only further validates EVRI’s casino fintech technology lead but could foreshadow a larger fintech relationship over the intermediate term, in our view.”

In line with his bullish thesis, Bain rates EVRI a Buy along with a $38 price target. This figure indicates that shares could surge ~54% in the next twelve months.

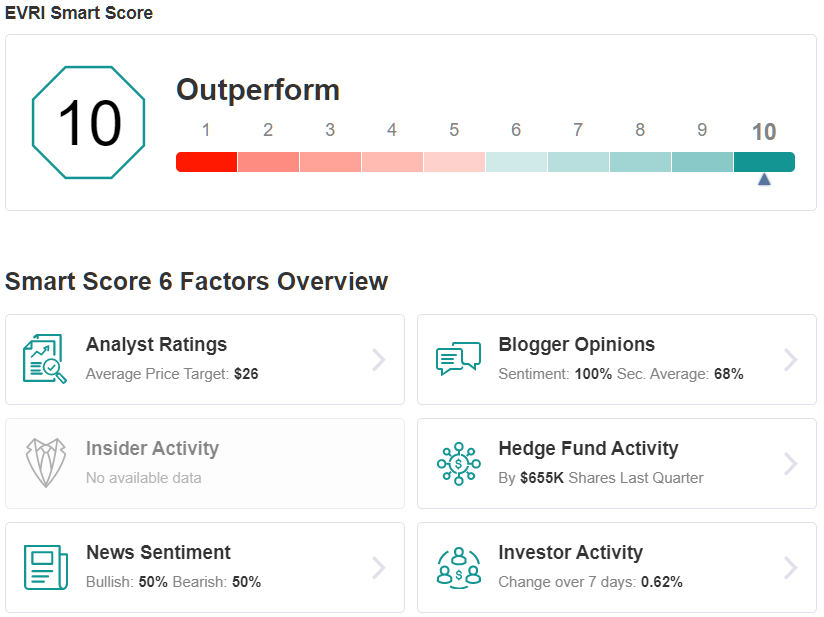

Everi has a unanimous Strong Buy analyst consensus rating, showing that Bain’s view is no outlier. That consensus is based on 7 recent reviews of the stock. The shares are currently priced at $24.69, and recent gains have pushed the share value up towards the average price target of $26.38. (See EVRI stock analysis)

J2 Global Communications (JCOM)

And now, we’ll shift gears into the communications industry. LA-based J2 Global (NASDAQ:JCOM) is an internet company, offering content, messaging, storage service through the cloud and on a variety of internet sites. The company’s brands include BabyCenter, Everyday Health, What to Expect, and Mashable. J2’s services are offered through two business divisions, the Business Cloud and Digital Media. By the numbers, J2 boats more than 1,100 advertisers across its 40+ brands, and has 50 offices around the world. The company’s services claim more than 4.4 million subscribers and over $1.6 billion in annual revenue. In short, internet communications is big business.

That scale has helped to push J2’s share price up in the last 12 months. Since this time last year, the stock has gained an impressive 87%.

J2’s first quarter results, released last month, show that the gains are on sound footing. Quarterly revenues rose 19.8% year-over-year, to reach $398.2 million. It was the fifth quarter in a row to show a yoy gain. Earnings showed an even more impressive increase. In 1Q20, the EPS came in at a 13-cent loss; for 1Q21, the earnings per share hit $1.67, the second-highest result of the last two years.

Numbers like these will always impress the Wall Street analysts, and Shyam Patil of Susquehanna duly noted them in his coverage of the stock.

“JCOM reported another monster quarter and raised its 2021 guidance. We see a relatively straight-forward pathway for the stock to [rise] from here on its way to our $250 price target. At the same time with the valuation at merely 10x 2021 EBITDA, we don’t think there’s much downside risk. Simply put, we see continued execution on M&A and the core business as catalysts to drive the stock higher,” Patil noted.

Patil’s $250 price target – suggesting a one-year upside of ~83% – comes along with a Buy rating on the stock.

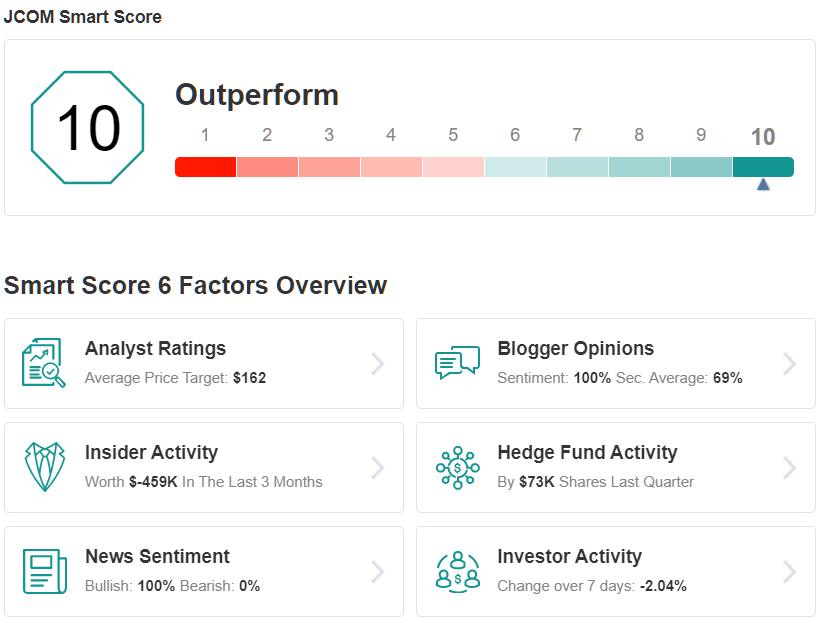

Overall, the eight recent reviews on JCOM include 6 to Buy and 2 to Hold, for a Strong Buy consensus rating. The stock’s average price target is $162.88, implying an upside of ~19% from the current trading price of $136.42. (See JCOM stock analysis)

Anterix, Inc. (ATEX)

We’ll stick with the digital communications world for the last stock, but give it a different take. Anterix (NASDAQ:ATEX) is a broadband provider, specializing in the commercialization of broadband assets and making 900 MHz private broadband available to utility providers. Anterix is the largest holder of 900 MHz band licenses and has coverage throughout the US, including Alaska, Hawaii, and Puerto Rico. The company uses its strong position in broadband access to make secure, private LTE networks available to its customers.

Secure network access is always desirable, and Anterix has been announcing a spate of business agreements in recent weeks. In two separate announcements, released on May 27, Anterix made public agreements with both Nokia (NYSE:NOK) and Motorola (NYSE:MSI) to facilitate the deployment of Private LTE networks for electric utilities, as part of the power industries efforts to modernize and secure the electric grid.

In addition, Anterix announced on June 15 an agreement with Ericsson (BS:ERICAs), a collaboration in the deployment of private network models that will expand 4G and 5G access across North America using FCC-certified cellular radio technology. Again, this initiative is targeted to electric utility companies as the end users.

A rapidly expanding business is always good for the share price, and Anterix has seen its shares rise 67% so far this year.

With this in the background, the comments by Craig-Hallum’s 5-star analyst George Sutton make a great deal of sense. Sutton notes the urgency of network security in the utility industry, especially in light of recent well-publicized cyber attacks.

“We believe the current environment will likely cause more utilities to prioritize their spectrum/network decisions as the industry looks to harden itself against potential threats, a reversal from last year where utilities were busy with pandemic-related challenges. Along with utilities acting independently to shore up service in their respective service territories, we also see growing potential for a ‘network of networks’ that would enable greater interoperability so that utilities can rely on neighbors as well,” Sutton wrote.

Turning to Anterix, specifically, Sutton added, “We believe that Anterix would have used roughly half of its current spectrum inventory by FY24 and that the remaining spectrum assets should be sufficient to allow for revenue to double again over the following five years, creating material value above our target valuation.”

All of this adds up to a Buy rating on the stock, and Sutton’s $100 price target implies an upside of 59% for the coming 12 months.

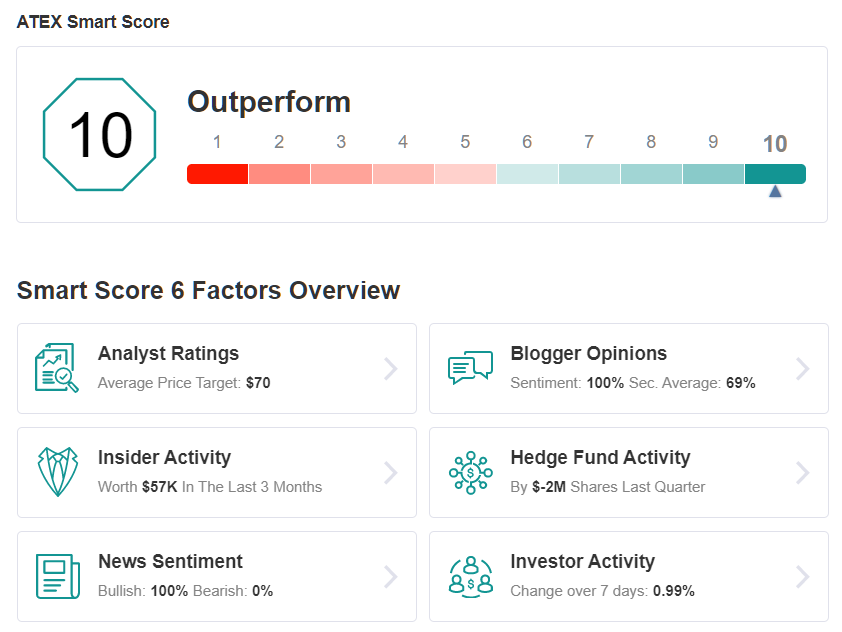

When it comes to other analyst activity, it has been relatively quiet on Wall Street. There are only three reviews, and they include a Hold as well as 2 Buys, for a Moderate Buy consensus view. The share are priced at $62.79 and the $70.33 average price target suggests a 12% upside from that level. (See ATEX stock analysis)

To find more ideas for stocks trading at attractive valuations, visit Investing Insights.