Finding the right stock is the essence of investing. While that skill has a reputation for being more art than science, a savvy investor knows otherwise. Follow the data, read the trends, and understand the fundamentals; these are the tried and true methods for investing success.

The Investing Insights data tool makes the science – and its results – available to all investors. Using the full range of stock information, the Investing Insights collates everything and distills the mass of raw material into a single number, a score that’s easy to read and indicates how a stock is likely to move in the near future. It’s a valuable aid in finding investing opportunities.

We’ve used the Investing Insights to pick out three high-yield dividend stocks with a ‘perfect 10’ score – indicating likely overperformance in the coming year – for your perusal.

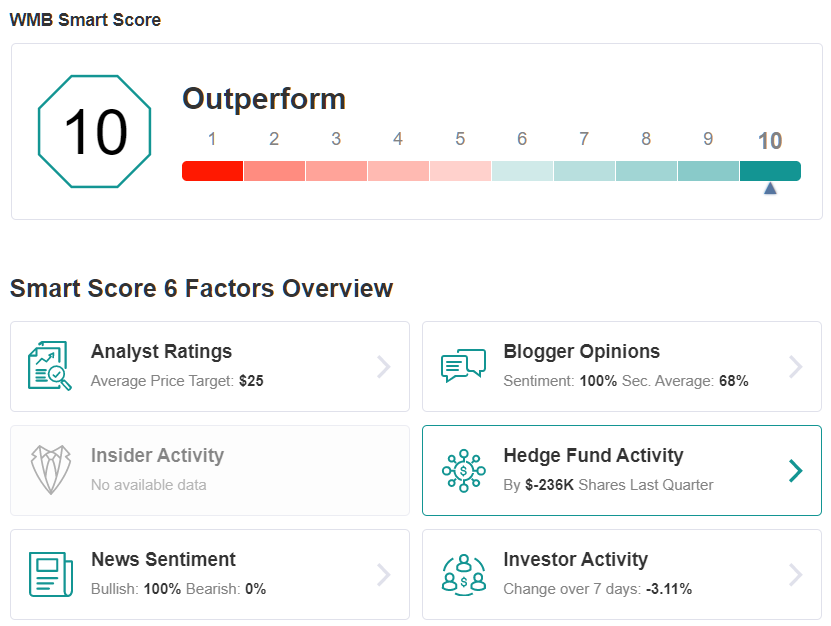

Williams Companies (WMB)

The first stock we’ll look at is Williams Companies Inc (NYSE:WMB), a natural gas processing firm based in Oklahoma. Williams controls pipelines for natural gas, natural gas liquids, and oil gathering, in a network stretching from the Pacific Northwest, through the Rockies to the Gulf Coast, and across the South to the Mid-Atlantic. Williams’ core business is the processing and transport of natural gas, with crude oil and energy generation as secondary operations. The company’s footprint is huge – it handles almost one-third of all natural gas use in the US, both residential and commercial.

Williams will report its 4Q20 results late this month – but a look at the Q3 results is informative. The company reported $1.93 billion at the top line, down 3.5% year-over-year but up 8.4% quarter-over-quarter, and the highest quarterly revenue so far released for 2020. Net earnings came in at 25 cents per share, flat from Q2 but up 38% year-over-year. The report was widely held as meeting or exceeding expectations, and the stock gained 7% in the two weeks after it was released.

In a move that may indicate a solid Q4 earnings on the way, the company declared its next dividend, to be paid out on March 29. The 41-cent per common share payment is up 2.5% from the previous quarter, and annualizes to $1.64. At that rate, the dividend yields 7.1%. Williams has a 4-year history of dividend growth and maintenance, and typically raises the payment in the first quarter of the year.

Covering the stock for RBC, 5-star analyst TJ Schultz wrote: “We believe Williams can hit the low-end of its 2020 EBITDA guidance. While we expect near-term growth in the NE to moderate, we think WMB should benefit from less than previously expected associated gas from the Permian. Given our long-term view, we estimate Williams can remain comfortably within investment grade credit metrics through our forecast period and keep the dividend intact.”

To this end, Schultz rates WMB an Outperform (i.e. Buy), and his $26 price target suggests an upside of 13% in the next 12 months.

With 8 recent reviews on record, including 7 Buys and just 1 Hold, WMB has earned its Strong Buy analyst consensus rating. While the stock has gained in recent months, reaching $23, the average price target of $25.71 implies it still has room for ~12% growth this year. (See WMB stock analysis)

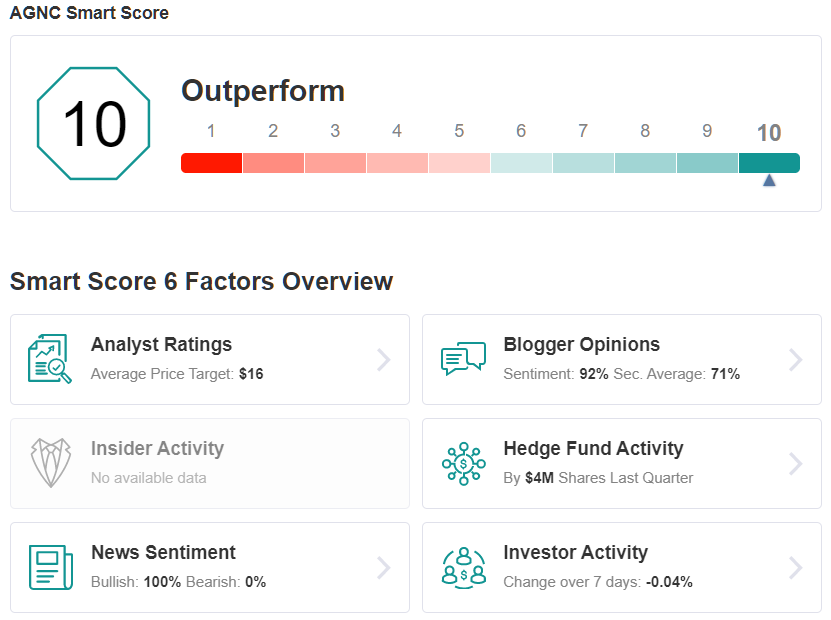

AGNC Investment (AGNC)

Next up is AGNC Investment Corp (NASDAQ:AGNC), a real estate investment trust. It’s no surprise to find a REIT as a dividend champ – these companies are required by tax codes to return a high percentage of profits directly to shareholders, and frequently use dividends as the vehicle for compliance. AGNC, based in Maryland, focuses on MBSs (mortgage-backed securities) with backing and guarantees from the US government. These securities make up some two-thirds of the company’s total portfolio, or $65.1 billion out of the $97.9 billion total.

AGNC’s most recent quarterly returns, for 4Q20, showed $459 million in net revenue, and a net income per share of $1.37. While down yoy, the EPS was the strongest recorded for 2020. For the full year, AGNC reported $1.68 billion in total revenues, and $1.56 per share paid out in dividends.

The current dividend, 12 cents per common share paid out monthly, will annualize to $1.44; the difference from last year’s higher annualization rate is due to a dividend cut implemented in April in response to the coronavirus crisis. At the current rate, the dividend gives investors a robust yield of 8.8%, and is easily affordable for the company given current income.

Among AGNC’s bulls is Maxim (NASDAQ:MXIM) analyst Michael Diana who wrote: “AGNC has retained a competitive yield on book value relative to other mortgage REITs (mREITS), even as it has out-earned its dividend and repurchased shares. While turmoil in the mortgage markets at the end of March resulted in losses and lower book values for all mortgage REITs, AGNC was able to meet all of its margin calls and, importantly, take relatively fewer realized losses and therefore retain more earnings power post-turmoil.”

Based on all of the above, Diana rates AGNC a Buy, along with an $18 price target. This figure implies a ~10% upside potential from current levels.

Wall Street is on the same page. Over the last couple of months, AGNC has received 7 Buys and a single Hold — all add up to a Strong Buy consensus rating. However, the $16.69 average price target suggests shares will remain range bound for the foreseeable future. (See AGNC stock analysis)

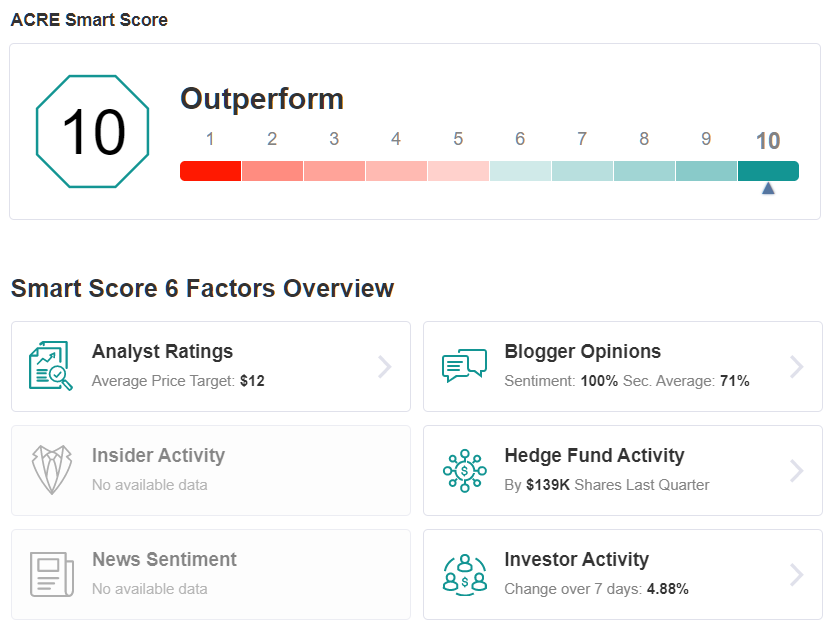

Ares Commercial Real Estate (ACRE)

Last but not least is Ares Commercial Real Estate (NYSE:ACRE), a company focused on the commercial real estate mortgage sector. Ares boasts a diversified portfolio – featuring office space, apartments, hotels, and mixed-use properties – mainly across the Southeast and West. The company has over $2 billion invested in 49 separate loans, 95% of which are senior mortgage loans.

At the end of October, the company released 3Q20 earnings (the last reported quarter), showing $22.4 million in total revenue, for a 13% year-over-year gain. The 45-cents earnings per common share was up 40% since the prior year. Furthermore, Ares closed a $667 million commercial real estate collateralized loan obligation, with firmed up funding on 23 senior loans.

On the dividend front, Ares declared in December its 4Q20 dividend. The payment, at 33 cents per common share, was paid out on January 15 – and is fully covered by current income levels. At current rates, the dividend annualizes to $1.32 and gives an impressive yield of 10.50%.

Among the bulls is Hayes, who wrote: “We believe shares of ACRE are unfairly discounted relative to other commercial mREITs given strong Ares sponsorship, a very healthy balance sheet, and limited exposure to at-risk assets.” In his view, this leaves the company “well positioned to face the headwinds from COVID-19.”

In line with these comments, Hayes rates ACRE a Buy, and his $13.50 price target implies a 10% upside from current levels.

Only one other analyst has posted a recent ACRE review, also rating the stock a Buy, which makes the analyst consensus here a Moderate Buy. Shares are priced at $12.28, and their $12.75 average price target suggests room for modest ~4% growth. (See ACRE stock analysis)

To find more ideas for stocks trading at attractive valuations, visit Investing Insights.